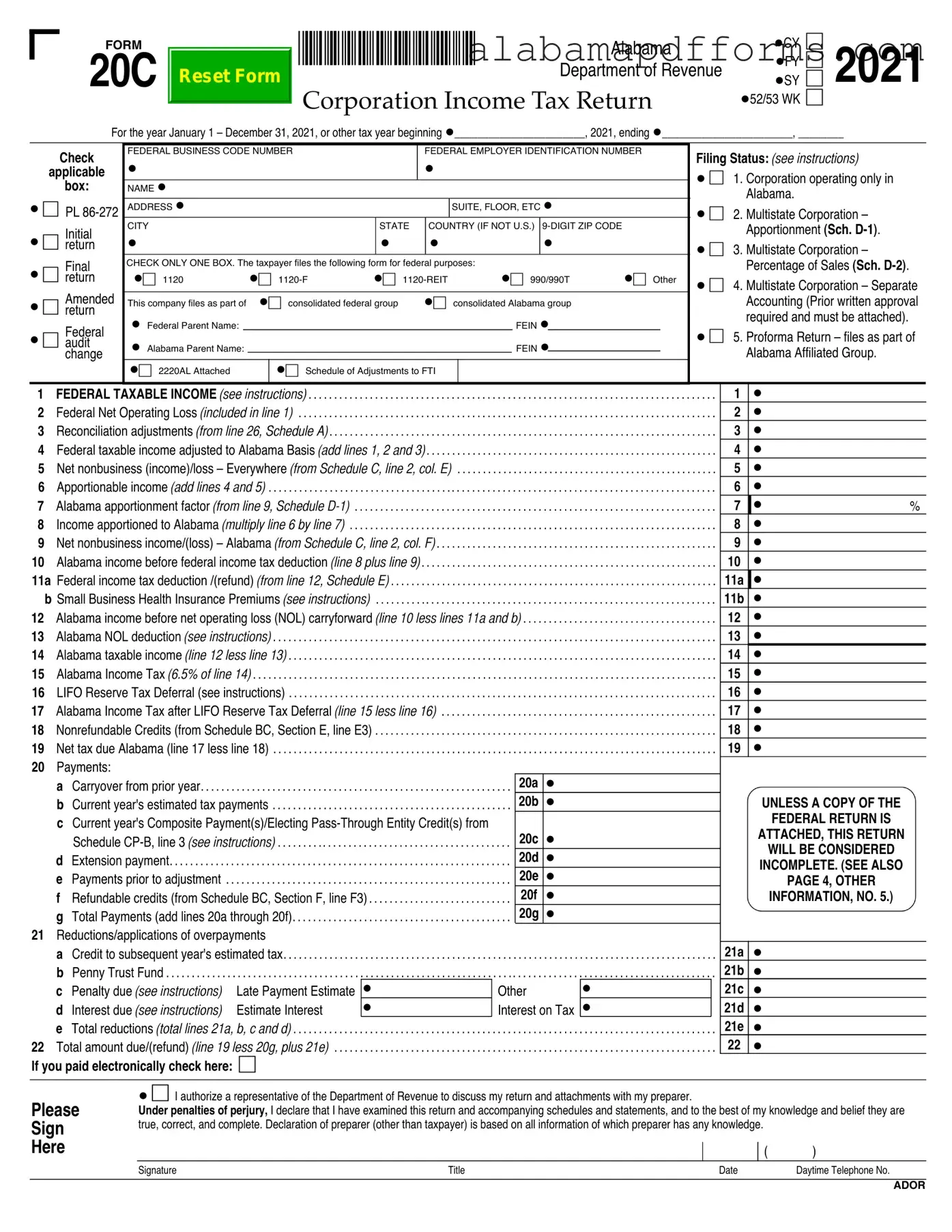

The Alabama 20C form is similar to the IRS Form 1120, which is the U.S. Corporation Income Tax Return. Both forms are used by corporations to report their income, deductions, and tax liability to the respective tax authorities. The IRS Form 1120 requires detailed information about a corporation's financial activities, similar to how the Alabama 20C captures income and deductions specific to Alabama. Both forms also require the calculation of taxable income and the application of tax rates to determine the amount owed or refunded.

Another document that shares similarities with the Alabama 20C is the IRS Form 1120-S, used by S corporations. Like the 20C, the Form 1120-S allows for the reporting of income, deductions, and credits, but it is specifically tailored for S corporations that pass income directly to shareholders. Both forms require detailed income reporting and adjustments to arrive at the taxable income, although the 1120-S includes specific provisions for pass-through taxation that do not apply to the 20C.

The Alabama 20C form is also comparable to the state-specific forms used in other states, such as the California Form 100. Each state has its own corporate income tax return that aligns with its tax laws. Similar to the Alabama 20C, California's Form 100 requires corporations to report their income, calculate their tax liability, and provide necessary schedules and attachments. Both forms aim to ensure that corporations comply with state tax regulations and accurately report their financial activities.

Additionally, the Alabama 20C form resembles the IRS Form 1065, which is used for partnerships. Both forms require the reporting of income and deductions, although the 1065 is designed for pass-through entities where income is reported on individual partners' tax returns. The structure of both forms includes schedules for detailing income sources and adjustments, ensuring that the tax authorities receive comprehensive financial information.

In the realm of corporate taxation, understanding liability is crucial, which is why documents like the Hold Harmless Agreement come into play. This agreement outlines the responsibilities of parties involved in business transactions, mitigating potential risks and liabilities that may arise during operations. Just as other state-specific tax forms provide clarity in reporting obligations, a Hold Harmless Agreement protects parties by clearly defining responsibilities and expectations, ensuring a smoother transaction process.

Finally, the Alabama 20C is similar to the IRS Form 990, which is filed by tax-exempt organizations. While the 20C focuses on corporate income taxation, both forms require detailed financial disclosures, including income, expenses, and changes in net assets. They both serve to inform the respective tax authorities about the financial health of the organization, albeit for different types of entities, ensuring compliance with tax obligations and transparency in financial reporting.