|

exclusively in Alabama, do not complete lines 2-8.) |

|

. . . . . |

. |

. . . . . . . . . . . . . |

. . . . 2 |

• |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

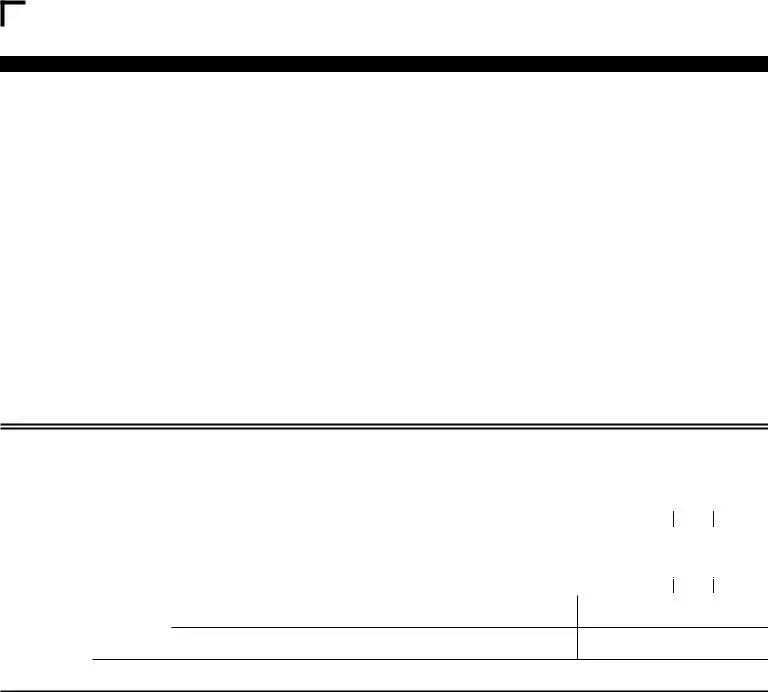

Apportionment of separately stated items |

|

|

|

|

|

|

|

|

x • |

% = 3c |

|

|

|

|

|

3 |

|

3a |

|

• |

|

|

3b |

|

• |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter in line 3a the amount from line 18, Schedule A |

|

|

|

|

Apportionment Factor |

|

|

|

|

|

|

|

|

|

|

|

(line 26, Schedule C) |

|

|

|

|

|

4 |

Separately stated items allocated to Alabama (line 1h, Column F, Schedule B) |

. . . . 4 |

• |

00 |

|

|

|

5 |

Total (add lines 2, 3c and 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . . . . |

. |

. . . . . . . . . . . . . |

. . . . 5 |

• |

00 |

|

|

|

6 |

. . . . . . . . . . . . . . .Adjusted total income (add line 19, Schedule A to line 1h, Column E, Schedule B) |

. . . . 6 |

• |

00 |

|

|

|

7 |

Federal income tax apportionment factor |

(line 5 divided by line 6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 7 |

• |

% |

8 |

Federal income tax apportioned to Alabama (multiply line 1 by the percent on line 7) |

|

|

|

|

|

|

|

|

|

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 8 |

• |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE E – Apportionment and Allocation of Income to Alabama |

|

|

|

|

|

|

|

% |

1 |

Net Alabama nonseparately stated income or (loss) from line 11, Schedule A |

. |

. . . . . |

. |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . 1 |

• |

00 |

2 |

Nonseparately stated (income) or loss treated as nonbusiness income (line 1d, Column E, Schedule B) |

|

|

|

|

|

|

|

|

|

|

|

– please enter income as a negative amount and losses as a positive amount |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . 2 |

• |

00 |

3 |

Apportionable income or (loss) (add line 1 and line 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . |

. |

. . . . . |

. |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . 3 |

• |

00 |

4 |

Apportionment ratio from line 26, Schedule C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. |

. . . . . |

. |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . 4 |

• |

% |

5 |

Income or (loss) apportioned to Alabama (multiply amount on line 3 by percent on line 4) |

|

|

|

|

|

|

|

|

. . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . 5 |

• |

00 |

6 |

Nonseparately stated income or (loss) allocated to Alabama as nonbusiness income (Column F, line 1d, Schedule B) |

|

|

|

|

. . . . 6 |

• |

00 |

7 |

Nonseparately Stated Income Allocated and Apportioned to Alabama (add lines 5 and 6). Also enter this amount on |

|

|

|

|

|

line 2, Schedule D; line 20, Schedule A; and line 1, Schedule K |

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 7 |

• |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE F – Alabama Accumulated Adjustments Account |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Beginning balance (prior year ending balance) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 1 |

• |

00 |

2 |

Net Alabama nonseparately stated income or (loss) (line 11, Schedule A) |

|

|

|

|

|

|

|

|

|

|

|

|

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 2 |

• |

00 |

3 |

Net separately stated items (line 18, Schedule A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . |

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 3 |

• |

00 |

4 |

Federal income tax deduction (line 1, Schedule D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 4 |

• |

00 |

5 |

Separately stated nonbusiness items (line 1h, Column E, Schedule B) |

|

|

|

|

|

|

|

|

|

|

|

|

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 5 |

• |

00 |

6 |

Other additions/(reductions) (Do not include tax exempt income and related expenses) |

|

|

|

|

|

|

|

|

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 6 |

• |

00 |

7 |

Less distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . |

. . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . |

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 7 |

• |

00 |

8 |

Ending balance (total appropriate lines) . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . |

. . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . |

. |

. . . . . |

|

. . . . . . . . . . . . . . |

. . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . 8 |

• |

00 |

SCHEDULE G – Tax Credits (CAUTION – SEE INSTRUCTIONS) |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Employer Education Tax Credit |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

• |

00 |

2 |

Coal Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . . . . . |

|

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

2 |

• |

00 |

3 |

. . . . . . . . . .TOTAL (add lines 1 and 2). Enter here and on line 22d, Schedule A |

. . . . . . |

|

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

• |

00 |

SCHEDULE H – The Following Information Must Be Entered For This Return To Be Considered Complete |

|

|

1 |

Indicate tax accounting method used: |

• |

|

Cash • |

Accrual |

• |

Other |

|

|

|

|

|

|

|

|