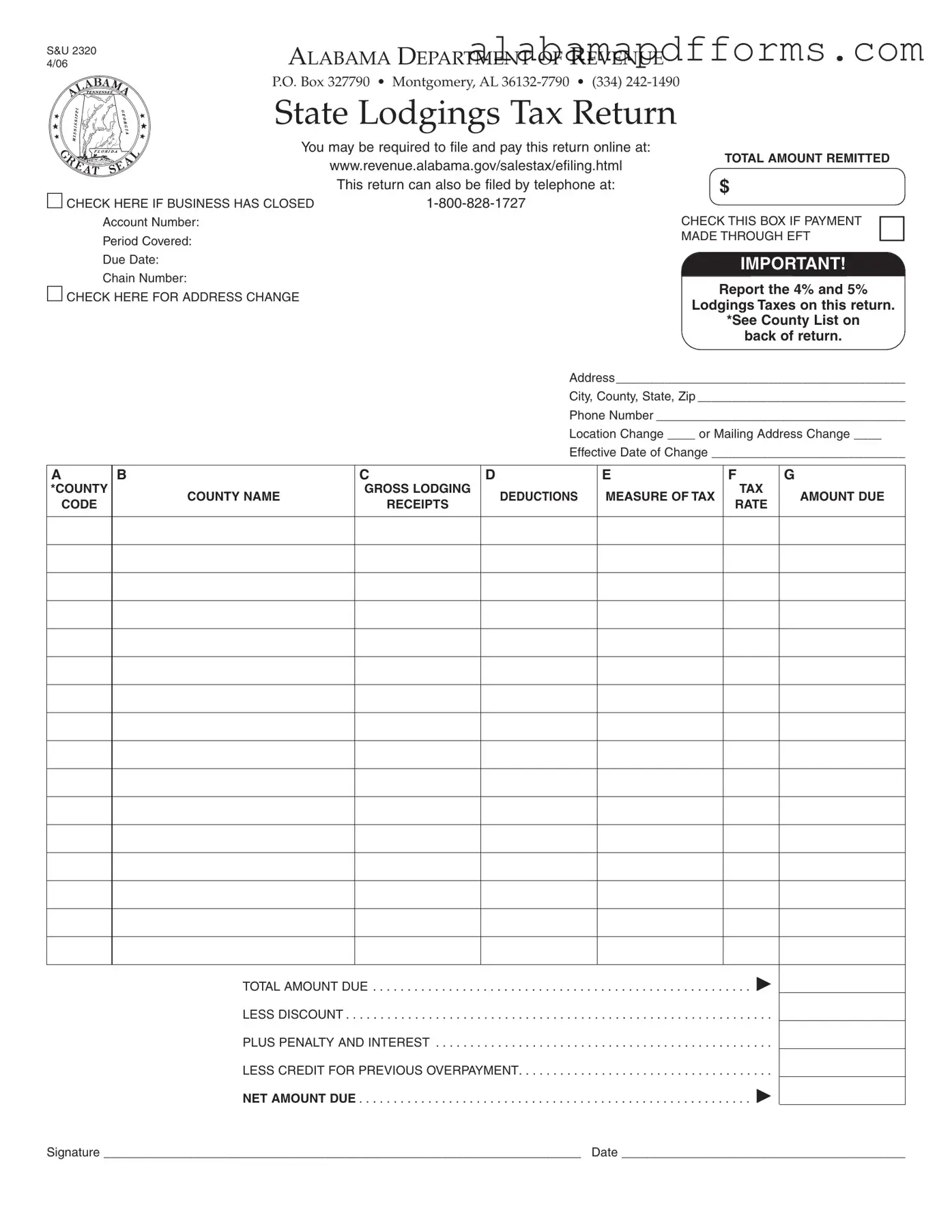

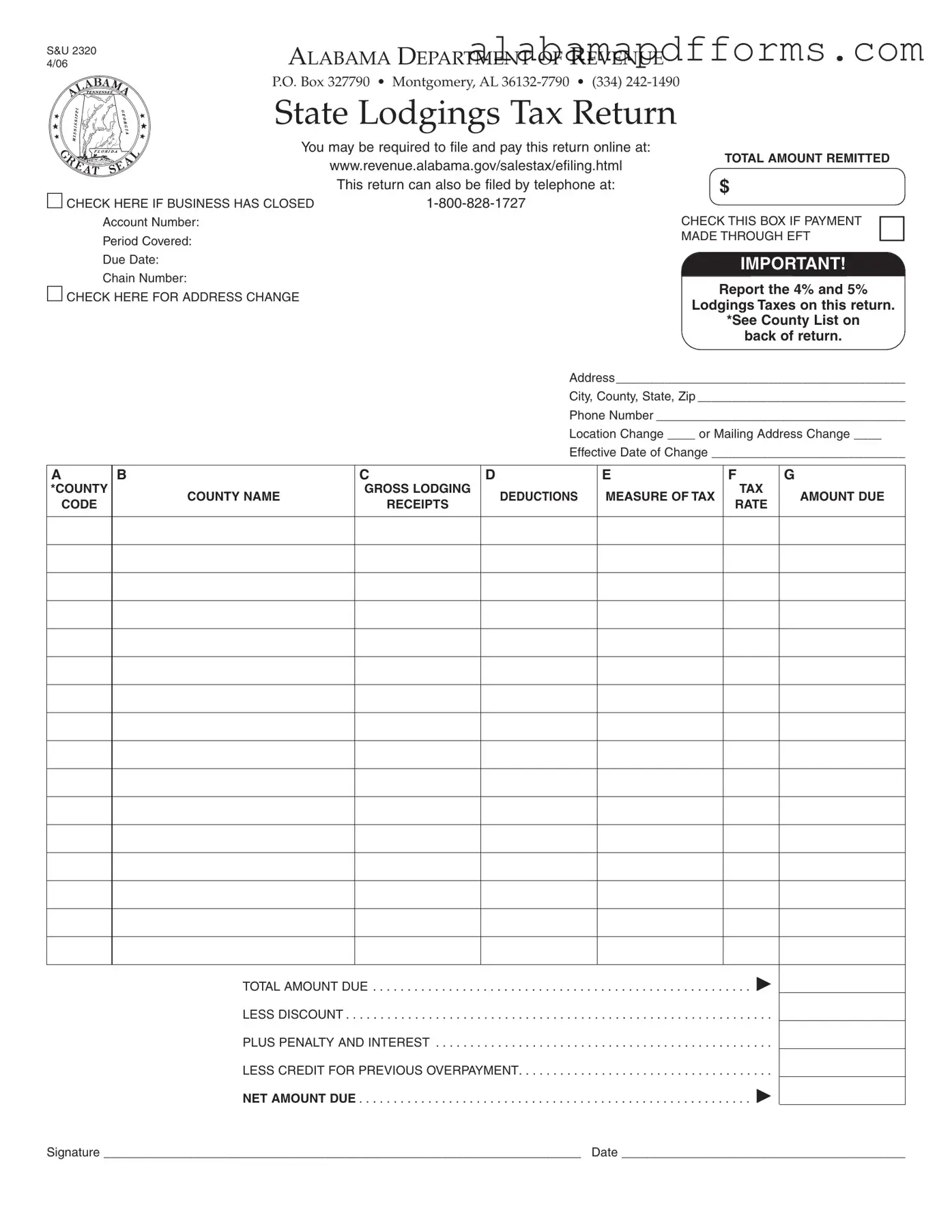

The Alabama 2320 form is similar to the Florida Department of Revenue's Transient Rental Tax Return. Both documents serve as tax returns specifically for lodging establishments. They require businesses to report their gross receipts from lodging services, calculate the applicable tax, and remit the total amount due. Each form also includes sections for deductions and credits, allowing businesses to accurately reflect their tax obligations based on their specific circumstances.

Another comparable document is the California State Board of Equalization's Transient Occupancy Tax Return. This form, like the Alabama 2320, is designed for lodging providers to report taxes on rental income. Both forms require detailed information about gross receipts and deductions, as well as the calculation of taxes owed. The California form also emphasizes compliance by providing instructions for electronic filing, similar to the Alabama form's online submission option.

The New York State Department of Taxation and Finance's Hotel Unit Fee Return shares similarities with the Alabama 2320 form. Each document is focused on lodging taxes and includes sections for reporting gross receipts and calculating the corresponding tax. Both forms require businesses to provide their account information and due dates, ensuring that tax payments are made in a timely manner to avoid penalties.

In addition, the Texas Comptroller of Public Accounts' Hotel Occupancy Tax Report is akin to the Alabama 2320 form. Both forms require lodging providers to report their earnings and calculate the taxes owed. They also include provisions for deductions and credits, allowing businesses to present a more accurate financial picture. Furthermore, both documents emphasize the importance of filing on time to avoid additional fees.

In addition to the various tax forms, it is essential for businesses engaged in activities that carry inherent risks to consider legal protections such as a Hold Harmless Agreement. This document can safeguard them by ensuring that participants acknowledge the risks involved and agree not to hold the business liable for any injuries or damages that may occur during their engagement. Understanding these legalities is key for responsible management in any enterprise.

The Illinois Department of Revenue's Hotel Operator's Occupation Tax Return is another document that resembles the Alabama 2320 form. Each form is used by lodging operators to report their earnings and calculate tax liabilities. They share common sections for gross receipts, deductions, and tax rates, ensuring that operators can accurately assess their tax obligations. Both forms also provide guidance on filing and payment options to facilitate compliance.

The Massachusetts Department of Revenue's Short-Term Rental Tax Return is similar to the Alabama 2320 form as well. Both forms cater to lodging providers and require detailed reporting of rental income and taxes owed. They include sections for deductions and credits, allowing businesses to adjust their tax liabilities accordingly. Additionally, both documents emphasize the importance of timely filing to avoid penalties.

Lastly, the Pennsylvania Department of Revenue's Hotel Occupancy Tax Return parallels the Alabama 2320 form. Each document is designed for lodging businesses to report their income and calculate the associated taxes. They include sections for gross receipts, deductions, and applicable tax rates, ensuring that businesses can accurately fulfill their tax responsibilities. Both forms also highlight the necessity of on-time submission to prevent additional charges.