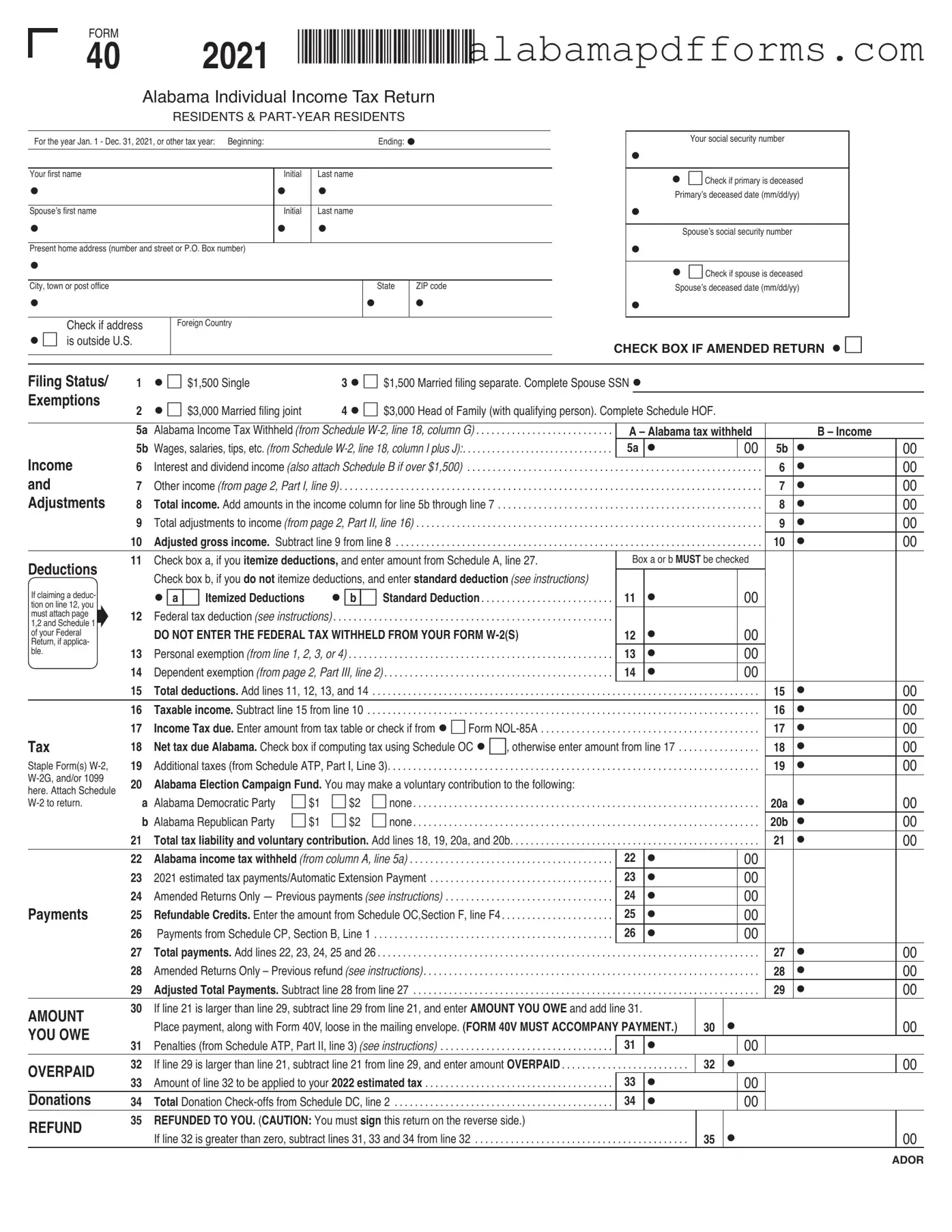

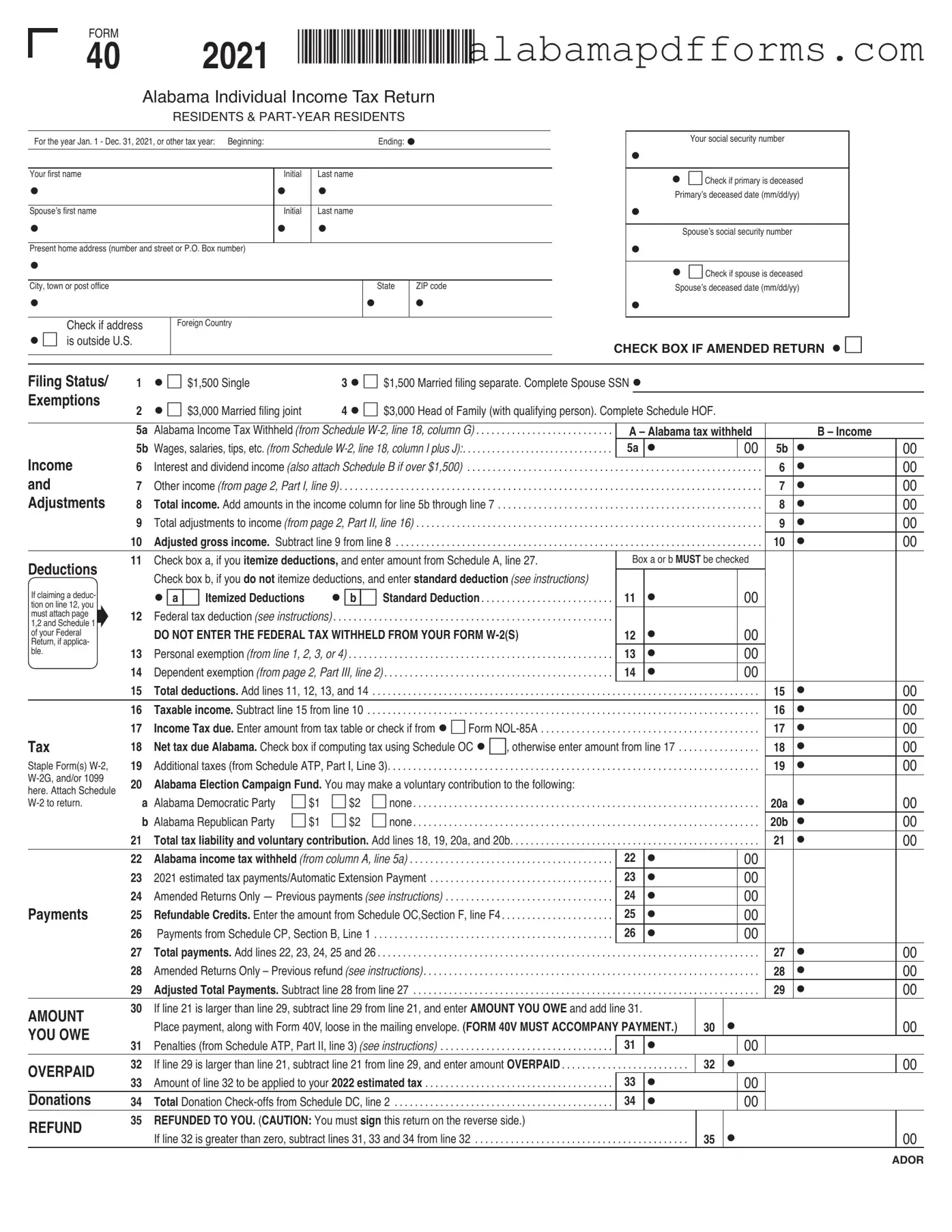

Filing Status/ |

1 |

|

$1,500 Single |

|

3 |

$1,500 Married filing separate. Complete Spouse SSN |

|

|

|

|

|

|

|

Exemptions |

2 |

|

$3,000 Married filing joint |

|

4 |

$3,000 Head of Family (with qualifying person). Complete Schedule HOF. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a |

Alabama Income Tax Withheld (from Schedule W-2, line 18, column G) |

. . . . . . . . . . . . . . . . . . . . . |

A – Alabama tax withheld |

|

B – Income |

|

5b |

Wages, salaries, tips, etc. (from Schedule W-2, line 18, column I plus J):. |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

5a |

|

|

|

00 |

5b |

|

00 |

Income |

6 |

Interest and dividend income (also attach Schedule B if over $1,500) |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. . . . . . |

. . |

. . . . . |

6 |

|

00 |

and |

7 |

Other income (from page 2, Part I, line 9) |

. . . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. . . . . . |

. . |

. . . . . |

7 |

|

00 |

Adjustments |

8 |

Total income. Add amounts in the income column for line 5b through line 7 . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. . . . . . |

. . |

. . . . . |

8 |

|

00 |

|

9 |

Total adjustments to income (from page 2, Part II, line 16) |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. . . . . . |

. . |

. . . . . |

9 |

|

00 |

|

10 |

Adjusted gross income. Subtract line 9 from line 8 |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. . . . . . |

. . |

. . . . . |

10 |

|

00 |

Deductions |

11 |

Check box a, if you itemize deductions, and enter amount from Schedule A, line 27. |

Box a or b MUST be checked |

|

|

|

|

Check box b, if you do not itemize deductions, and enter standard deduction (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If claiming a deduc- |

|

a |

Itemized Deductions |

|

b |

Standard Deduction |

|

11 |

|

|

|

00 |

|

|

|

tion on line 12, you |

|

|

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

must attach page |

12 |

Federal tax deduction (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

1,2 and Schedule 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

of your Federal |

|

DO NOT ENTER THE FEDERAL TAX WITHHELD FROM YOUR FORM W-2(S) |

12 |

|

|

|

|

|

|

Return, if applica- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

ble. |

13 |

Personal exemption (from line 1, 2, 3, or 4) |

|

|

|

13 |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

14 |

Dependent exemption (from page 2, Part III, line 2) |

. . . . . . . . . . . . . . . . . . . . . |

14 |

|

|

|

00 |

|

|

|

|

15 |

Total deductions. Add lines 11, 12, 13, and 14 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

15 |

|

00 |

|

16 |

Taxable income. Subtract line 15 from line 10 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

16 |

|

00 |

|

17 |

Income Tax due. Enter amount from tax table or check if from |

Form NOL-85A |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

17 |

|

00 |

Tax |

18 |

Net tax due Alabama. Check box if computing tax using Schedule OC |

, otherwise enter amount from line 17 . . . . |

. . . . . |

. . . |

. . . . |

18 |

|

00 |

Staple Form(s) W-2, |

19 |

Additional taxes (from Schedule ATP, Part I, Line 3) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

19 |

|

00 |

W-2G, and/or 1099 |

20 |

Alabama Election Campaign Fund. You may make a voluntary contribution to the following: |

|

|

|

|

|

|

|

|

|

here. Attach Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

W-2 to return. |

a |

Alabama Democratic Party |

$1 |

$2 |

none |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

20a |

|

|

b |

Alabama Republican Party |

$1 |

$2 |

none |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

20b |

|

00 |

|

21 |

Total tax liability and voluntary contribution. Add lines 18, 19, 20a, and 20b |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

21 |

|

00 |

|

22 |

Alabama income tax withheld (from column A, line 5a) |

. . . . . . . . . . . . . . . . . . . . . |

22 |

|

|

|

00 |

|

|

|

|

23 |

2021 estimated tax payments/Automatic Extension Payment |

. . . . . . . . . . . . . . . . . . . . . |

23 |

|

|

|

00 |

|

|

|

|

24 |

Amended Returns Only — Previous payments (see instructions) |

. . . . . . . . . . . . . . . . . . . . . |

24 |

|

|

|

00 |

|

|

|

Payments |

25 |

Refundable Credits. Enter the amount from Schedule OC,Section F, line F4. |

. . . . . . . . . . . . . . . . . . . . . |

25 |

|

|

|

00 |

|

|

|

|

26 |

Payments from Schedule CP, Section B, Line 1 . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . |

26 |

|

|

|

00 |

|

|

|

|

27 |

Total payments. Add lines 22, 23, 24, 25 and 26 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

27 |

|

00 |

|

28 |

Amended Returns Only – Previous refund (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

28 |

|

00 |

|

29 |

Adjusted Total Payments. Subtract line 28 from line 27 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . . . |

. . . . . |

. . . |

. . . . |

29 |

|

00 |

AMOUNT |

30 |

If line 21 is larger than line 29, subtract line 29 from line 21, and enter AMOUNT YOU OWE and add line 31. |

|

|

|

|

|

|

|

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.) |

30 |

|

|

|

|

00 |

YOU OWE |

|

|

|

|

|

31 |

Penalties (from Schedule ATP, Part II, line 3) (see instructions) |

|

|

31 |

|

|

|

00 |

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

OVERPAID |

32 |

If line 29 is larger than line 21, subtract line 21 from line 29, and enter amount OVERPAID |

. . . |

. . |

. . . . . . . . . |

32 |

|

|

|

|

00 |

|

33 |

. . . . . . . . . . . . . . . .Amount of line 32 to be applied to your 2022 estimated tax |

. . . . . . . . . . . . . . . . . . . . . |

33 |

|

|

|

00 |

|

|

|

Donations |

34 |

Total Donation Check-offs from Schedule DC, line 2 |

. . . . . . . . . . . . . . . . . . . . . |

34 |

|

|

|

00 |

|

|

|

REFUND |

35 |

REFUNDED TO YOU. (CAUTION: You must sign this return on the reverse side.) |

|

|

|

|

|

|

|

|

|

|

If line 32 is greater than zero, subtract lines 31, 33 and 34 from line 32 |

|

|

|

|

35 |

|

|

|

|

00 |

|

|

. . . |

. . |

. . . . . . . . . |

|

|

|

|