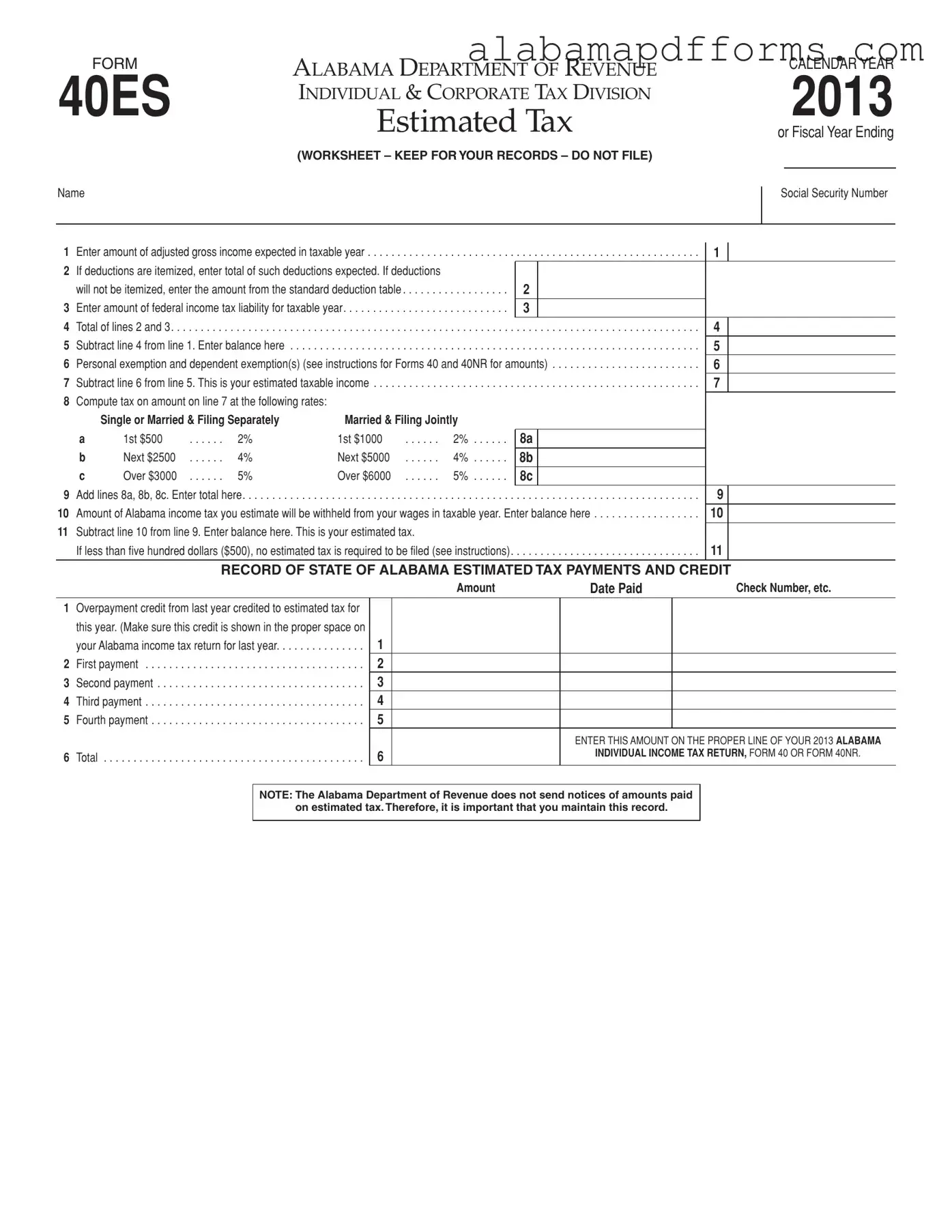

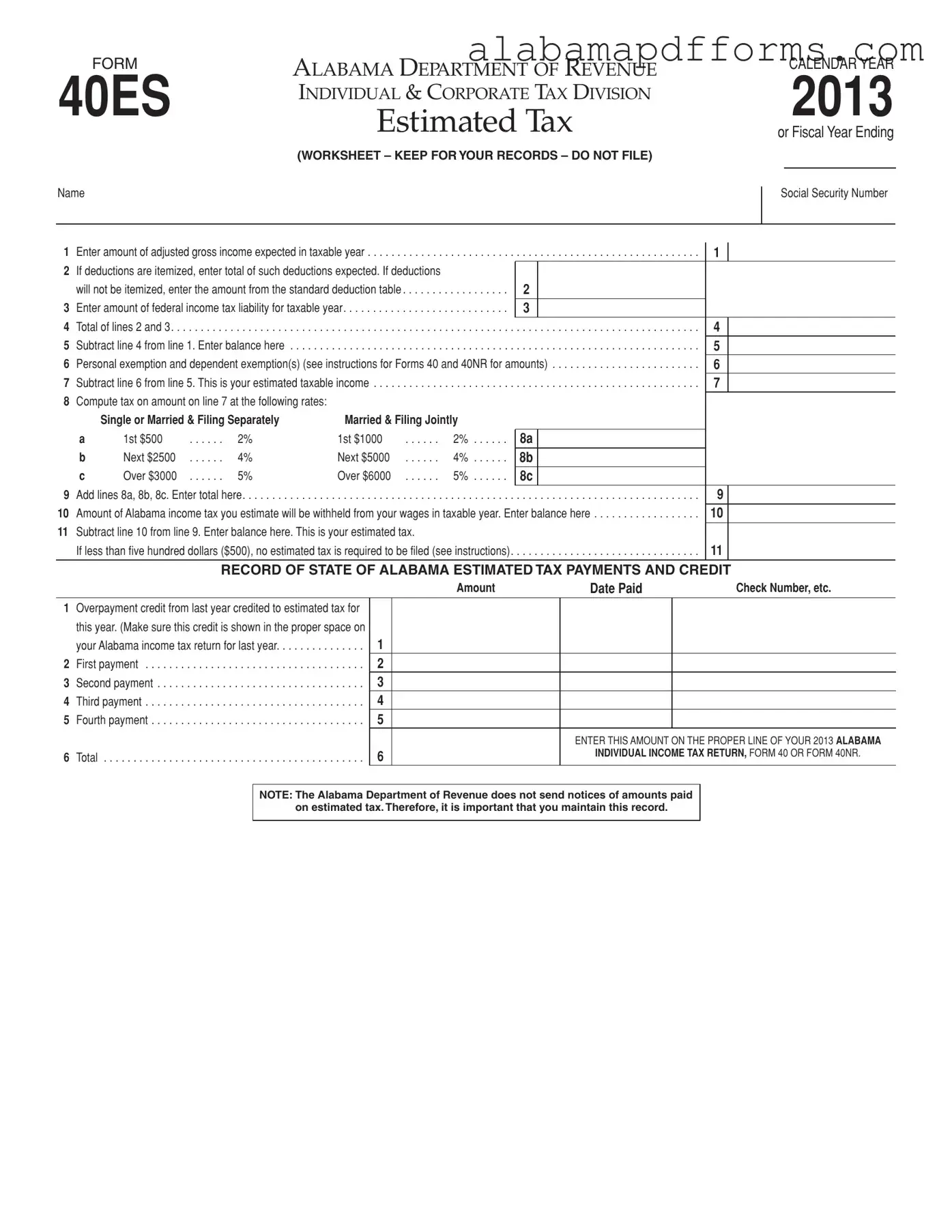

FORM |

ALABAMA DEPARTMENT OF REVENUE |

40ES |

ESTIMATED TAX |

|

INDIVIDUAL & CORPORATE TAX DIVISION |

|

(WORKSHEET – KEEP FOR YOUR RECORDS – DO NOT FILE) |

Name |

|

CALENDAR YEAR

2013

or Fiscal Year Ending

Social Security Number

1 Enter amount of adjusted gross income expected in taxable year |

1 |

2If deductions are itemized, enter total of such deductions expected. If deductions

|

will not be itemized, enter the amount from the standard deduction table |

2 |

|

|

|

3 |

Enter amount of federal income tax liability for taxable year |

3 |

|

|

|

4 |

Total of lines 2 and 3 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

4 |

|

5 |

Subtract line 4 from line 1. Enter balance here |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

5 |

|

6 |

Personal exemption and dependent exemption(s) (see instructions for Forms 40 and 40NR for amounts) |

6 |

|

7 |

Subtract line 6 from line 5. This is your estimated taxable income |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

7 |

|

8Compute tax on amount on line 7 at the following rates:

|

Single or Married & Filing Separately |

Married & Filing Jointly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

1st $500 |

. 2% |

1st $1000 |

2% |

8a |

|

|

|

|

b |

Next $2500 |

. 4% |

Next $5000 |

4% |

8b |

|

|

|

|

c |

Over $3000 |

. 5% |

Over $6000 |

5% |

8c |

|

|

|

|

9 Add lines 8a, 8b, 8c. Enter total here |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

9 |

|

|

|

|

|

|

|

10 Amount of Alabama income tax you estimate will be withheld from your wages in taxable year. Enter balance here |

|

10 |

|

11 Subtract line 10 from line 9. Enter balance here. This is your estimated tax. |

|

|

|

|

|

|

|

|

|

|

|

|

If less than five hundred dollars ($500), no estimated tax is required to be filed (see instructions). |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

11 |

|

|

|

|

|

|

|

|

|

|

RECORD OF STATE OF ALABAMA ESTIMATED TAX PAYMENTS AND CREDIT |

|

|

|

|

Amount |

|

Date Paid |

|

Check Number, etc. |

1Overpayment credit from last year credited to estimated tax for this year. (Make sure this credit is shown in the proper space on your Alabama income tax return for last year. . . . . . . . . . . . . . .

2 First payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Second payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Third payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Fourth payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ENTER THIS AMOUNT ON THE PROPER LINE OF YOUR 2013 ALABAMA

INDIVIDUAL INCOME TAX RETURN, FORM 40 OR FORM 40NR.

NOTE: The Alabama Department of Revenue does not send notices of amounts paid on estimated tax. Therefore, it is important that you maintain this record.

Who Must Pay Estimated Tax

If you owe additional tax for 2012, you may have to pay esti- mated tax for 2013.

You can use the following general rule as a guide during the year to see if you will have enough withholding, or if you should in- crease your withholding or make estimated tax payments.

General Rule. In most cases, you must pay estimated tax for 2013 if both of the following apply.

1.You expect to owe at least $500 in tax for 2013, after sub- tracting your withholding and credits.

2.You expect your withholding plus your credits to be less than the smaller of:

a.90% of the tax to be shown on your 2013 tax return, or

b.100% of the tax shown on the your 2012 tax return. Your 2012 tax return must cover all 12 months.

Special Rule for Higher Income Taxpayers

If your Alabama AGI for 2012 was more than $150,000 ($75,000 if your filing status for 2013 is Married Filing a Separate Return) substitute 110% for 100% in (2b) under General Rule, above.

When and Where to File Estimated Tax

Your estimated tax must be filed on or before April 15, 2013, or on such later dates as specified under “Farmers.” It should be mailed to the Alabama Department of Revenue, Individual Esti- mates, P.O. Box 327485, Montgomery, AL 36132-7485.

Payment of Estimated Tax

Your estimated tax may be paid in full or in equal installments on or before April 15, 2013, June 15, 2013, September 15, 2013 and January 15, 2014. If the 15th falls on a Saturday, Sunday, or State holiday, the due date will then be considered the following

business day. Checks or money orders should be made payable to the Alabama Department of Revenue.

Changes In Tax

Even though your situation on April 15 is such that you are not required to file estimated tax at that time, your expected tax may change so that you will be required to file estimated tax later. In such case, the time for filing is as follows: June 15, if the change occurs after April 1 and before June 2; September 15, if the change occurs after June 1 and before September 2; January 15, if the change occurs after September 1. If, after you have filed a voucher, you find that your estimated tax is substantially increased or de- creased as the result of a change in your tax, you should file an amended voucher on or before the next filing date – June 15, 2013, September 15, 2013, January 15, 2014.

Farmers

If at least 2/3 of your estimated gross income for the taxable year is derived from farming, you may pay estimated tax at any time on or before January 15, 2014 instead of April 15, 2013. If you wait until January 15, 2014, you must pay the entire balance of the estimated tax. However, if farmers file their final tax return on or before March 2, 2013, and pay the total tax at that time, they need not file estimated tax.

Fiscal Year

If you file your income tax return on a fiscal year basis, you will substitute for the dates specified in the above instructions the months corresponding thereto.

Penalties for Underpayment

Penalties are provided for underpaying the Alabama income tax by at least $500.00.

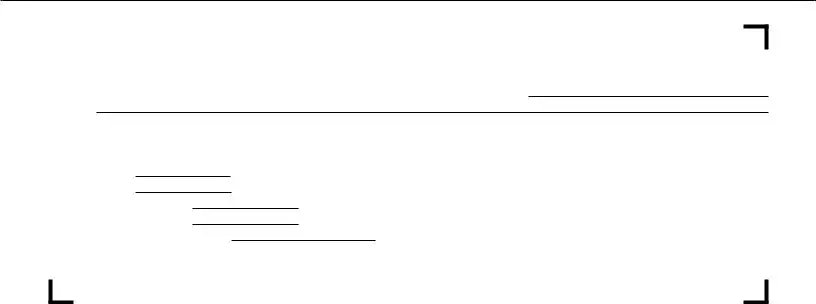

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➀ |

|

|

|

|

|

|

|

|

|

Estimated Income Tax Payment Voucher |

|

|

|

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

MAILING |

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL 36132-7485

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

After |

& Before |

Filing Date |

Voucher |

1-1-2013 |

4-2-2013 |

4-15-2013 |

1/4 of line 1 |

|

|

|

|

4-1-2013 |

6-2-2013 |

6-15-2013 |

1/3 of line 1 |

|

|

|

|

6-1-2013 |

9-2-2013 |

9-15-2013 |

1/2 of line 1 |

|

|

|

|

9-1-2013 |

1-1-2014 |

1-15-2014 |

All of line 1 |

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL 36132-7485

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➁ |

|

|

|

|

|

|

|

|

|

Estimated Income Tax Payment Voucher |

|

|

|

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

MAILING |

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL 36132-7485

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

After |

& Before |

Filing Date |

Voucher |

1-1-2013 |

4-2-2013 |

4-15-2013 |

1/4 of line 1 |

|

|

|

|

4-1-2013 |

6-2-2013 |

6-15-2013 |

1/3 of line 1 |

|

|

|

|

6-1-2013 |

9-2-2013 |

9-15-2013 |

1/2 of line 1 |

|

|

|

|

9-1-2013 |

1-1-2014 |

1-15-2014 |

All of line 1 |

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL 36132-7485

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➂ |

|

|

|

|

|

|

|

|

|

Estimated Income Tax Payment Voucher |

|

|

|

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

MAILING |

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL 36132-7485

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

After |

& Before |

Filing Date |

Voucher |

1-1-2013 |

4-2-2013 |

4-15-2013 |

1/4 of line 1 |

|

|

|

|

4-1-2013 |

6-2-2013 |

6-15-2013 |

1/3 of line 1 |

|

|

|

|

6-1-2013 |

9-2-2013 |

9-15-2013 |

1/2 of line 1 |

|

|

|

|

9-1-2013 |

1-1-2014 |

1-15-2014 |

All of line 1 |

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL 36132-7485

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➃ |

|

|

|

|

|

|

|

|

|

Estimated Income Tax Payment Voucher |

|

|

|

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

MAILING |

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL 36132-7485

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

After |

& Before |

Filing Date |

Voucher |

1-1-2013 |

4-2-2013 |

4-15-2013 |

1/4 of line 1 |

|

|

|

|

4-1-2013 |

6-2-2013 |

6-15-2013 |

1/3 of line 1 |

|

|

|

|

6-1-2013 |

9-2-2013 |

9-15-2013 |

1/2 of line 1 |

|

|

|

|

9-1-2013 |

1-1-2014 |

1-15-2014 |

All of line 1 |

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL 36132-7485