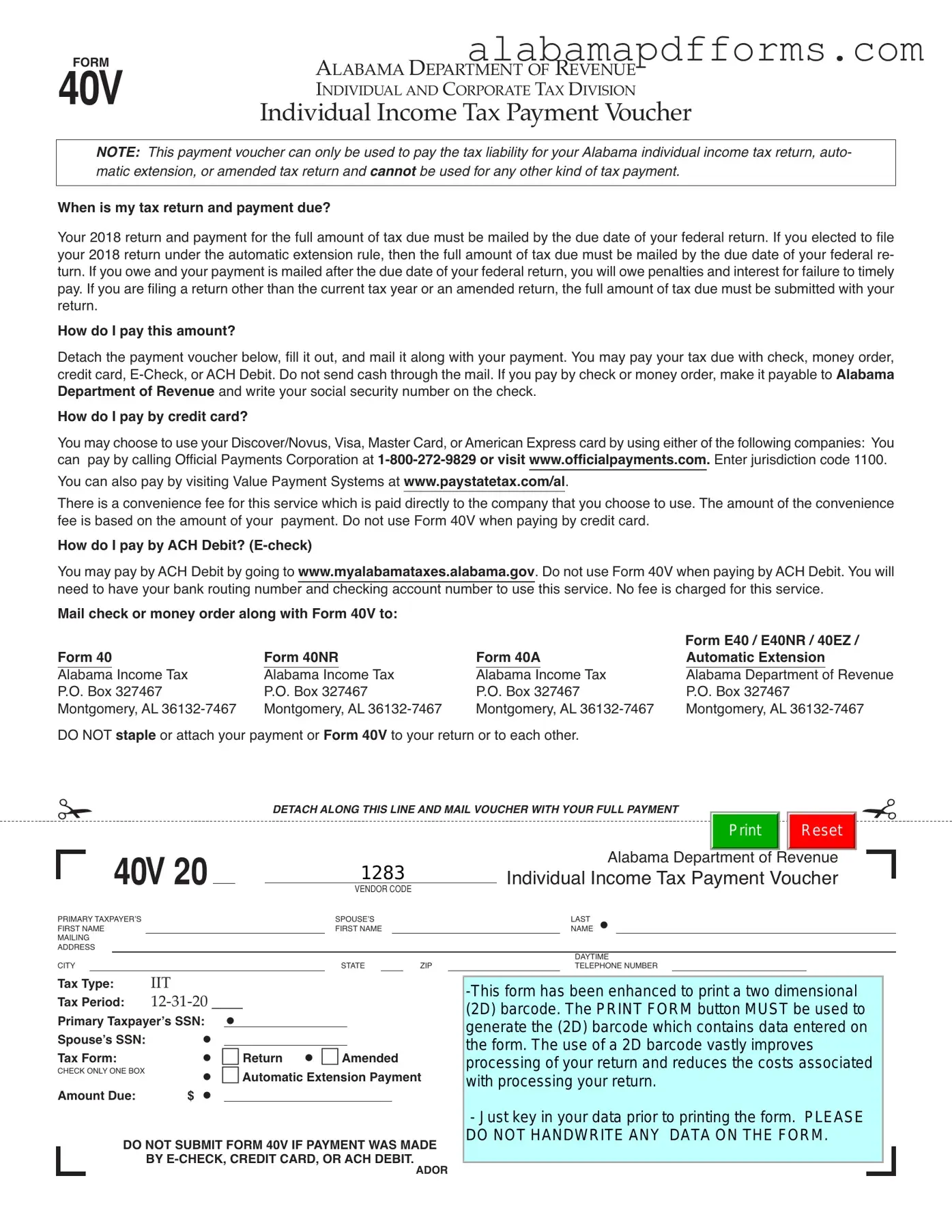

The Alabama Form 40V is similar to the IRS Form 1040-V, which is a payment voucher for individual income tax returns. Both forms serve the purpose of facilitating the payment of tax liabilities. When a taxpayer owes money, they can detach the voucher, fill it out, and send it along with their payment. Just like the Alabama Form 40V, the IRS Form 1040-V requires personal information, such as the taxpayer's name and Social Security number, to ensure proper crediting of the payment.

Another comparable document is the California Form 540-V. This form is used by California residents to submit payments for their state income tax returns. Similar to Alabama's Form 40V, it requires taxpayers to provide their identification details and the amount owed. Both forms emphasize the importance of timely submission to avoid penalties and interest, reinforcing the need for compliance with tax obligations.

The New York State Form IT-201-V is also akin to the Alabama Form 40V. This payment voucher is for New York residents who owe taxes on their individual income tax returns. Both forms allow taxpayers to make payments via check or money order, and they require the inclusion of the taxpayer's identification information. This ensures that the payment is correctly applied to the taxpayer's account, mirroring the process outlined in the Alabama Form 40V.

Similarly, the Texas Form 1040-V serves as a payment voucher for Texas residents. While Texas does not have a state income tax, this form is utilized for certain other tax obligations. Like the Alabama Form 40V, it requires detailed information from the taxpayer and emphasizes the need for timely payment to avoid additional fees. Both documents streamline the payment process for taxpayers, making it easier to fulfill their financial responsibilities.

For anyone preparing to enter into a rental agreement, understanding the steps involved is key. A well-prepared document helps in safeguarding both parties' interests. Visit this comprehensive guide to Lease Agreement forms to learn more about the essential components and best practices for drafting your own.

The Florida Form DR-15 is another document that shares similarities with the Alabama Form 40V. This form is used for making payments related to various taxes in Florida, including sales tax. Both forms require taxpayers to provide essential information to ensure accurate processing of payments. They also highlight the importance of submitting payments on time to prevent penalties, reinforcing a common theme across state tax forms.

The Illinois Form IL-1040-V is comparable as well. This form is used by Illinois residents to submit payments for their state income tax returns. Like the Alabama Form 40V, it requires the taxpayer's name and Social Security number, ensuring proper crediting of payments. Both forms serve as a clear reminder of the need to pay taxes on time to avoid any financial repercussions.

Another similar document is the Georgia Form 500-V. This payment voucher is for Georgia taxpayers who owe income taxes. It shares the same structure as the Alabama Form 40V, requiring identification details and the payment amount. Both forms aim to simplify the payment process, making it straightforward for taxpayers to fulfill their obligations.

The Virginia Form 760-V is also relevant. This form is used by Virginia residents to make payments for their state income tax returns. Like the Alabama Form 40V, it requires the taxpayer's name, Social Security number, and payment details. Both forms serve to facilitate timely payments, emphasizing the importance of compliance with tax laws.

Lastly, the Pennsylvania Form PA-40-V is similar in function. This payment voucher is for Pennsylvania taxpayers who owe income tax. It requires the same basic information as the Alabama Form 40V and is designed to ensure that payments are processed correctly. Both forms highlight the necessity of timely payment to avoid penalties, reinforcing the importance of meeting tax obligations.