The IRS Form 1040 serves as the standard individual income tax return for U.S. taxpayers. Like the Alabama 40X form, it allows individuals to report their income, deductions, and tax liability for a given tax year. The 1040 form is essential for calculating federal tax obligations and can be amended using Form 1040-X, which is similar to the Alabama 40X in that it addresses changes to previously filed returns. Both forms require taxpayers to provide personal information, income details, and any adjustments necessary for accurate reporting.

Form 1040-X is specifically designed for amending a federal income tax return. Much like the Alabama 40X, it allows taxpayers to correct errors or make adjustments to their original Form 1040. The process involves providing a clear explanation of the changes, which mirrors the Alabama form's requirement for detailing adjustments to income or deductions. Both forms aim to ensure that taxpayers can rectify mistakes and comply with tax regulations effectively.

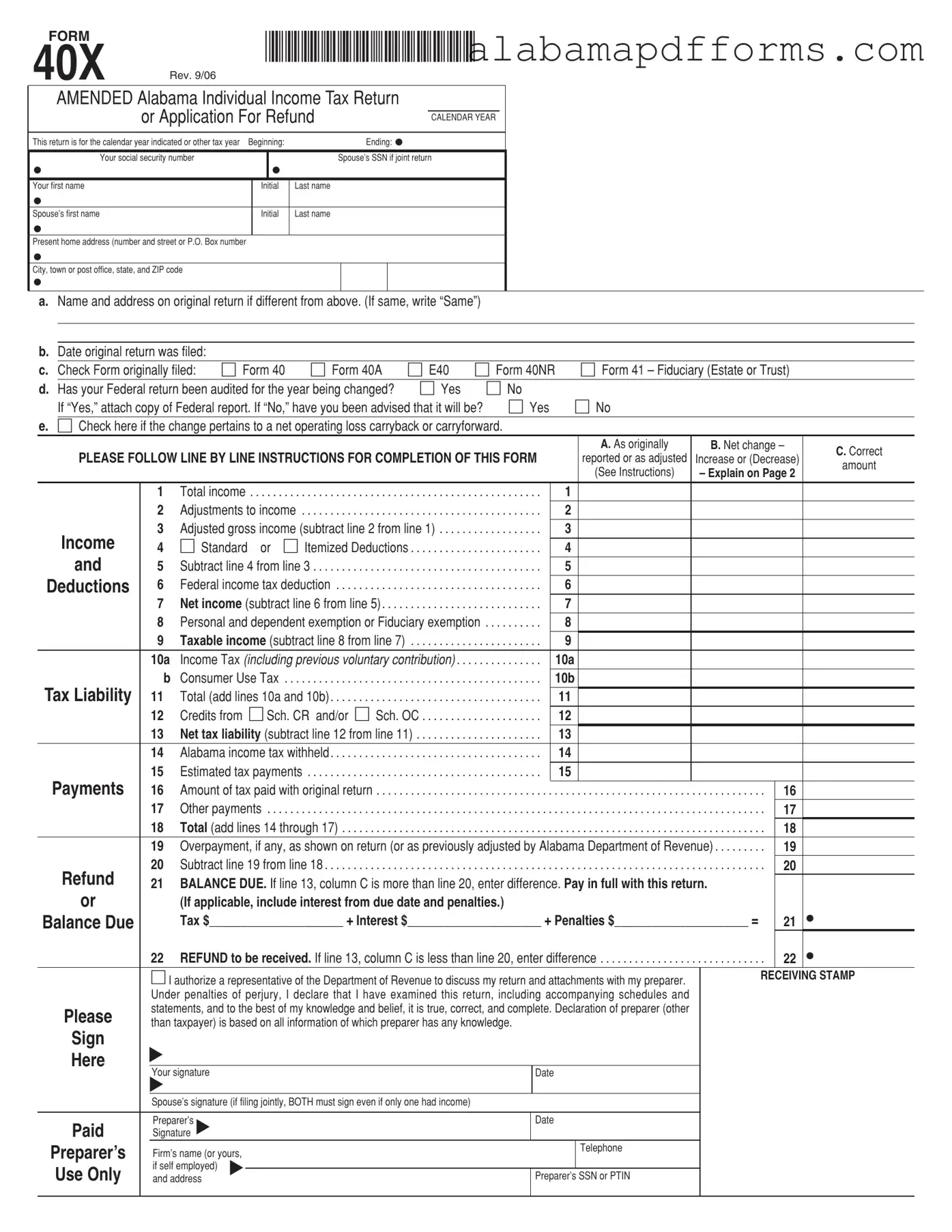

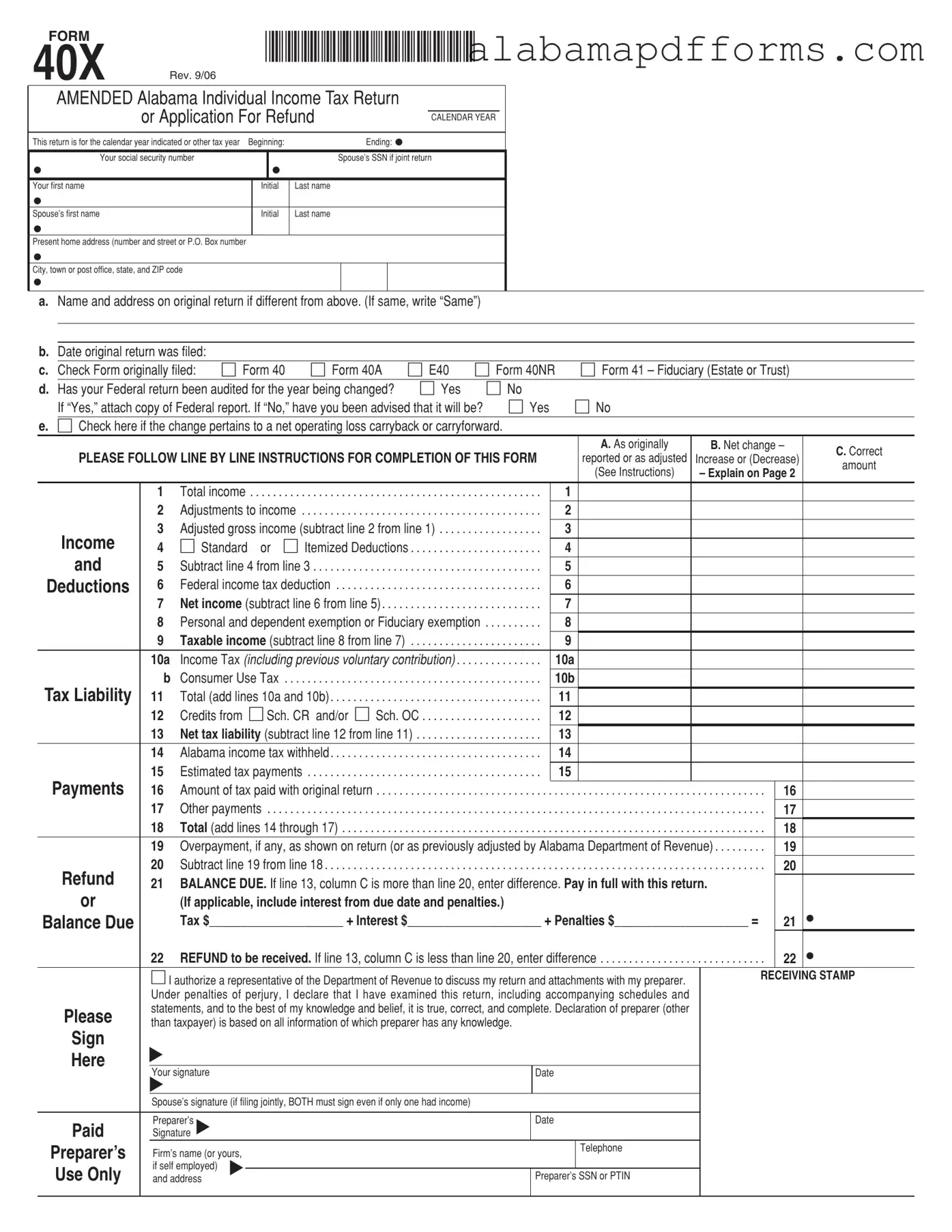

Form 40 is Alabama's standard individual income tax return, similar to the IRS Form 1040. The Alabama 40X form is used to amend this return. While Form 40 captures the original details of a taxpayer's income and deductions, the 40X allows for corrections and updates. Both forms share a common structure, including sections for personal information, income calculations, and tax liabilities, but the 40X focuses specifically on changes made after the original submission.

Form 40A is a simplified version of the Alabama income tax return for certain taxpayers. Like the Alabama 40X, it provides a streamlined approach to reporting income and deductions. The 40X can be used by individuals who initially filed a 40A and later need to amend their return. Both forms emphasize clarity and accuracy in reporting, making them accessible for individuals with varying levels of tax knowledge.

Form E40 is used for non-resident individuals who earn income in Alabama. This form is similar to the Alabama 40X in that it requires detailed reporting of income and deductions for those who may not be full-time residents. If a non-resident needs to amend their tax return, they would use the 40X form, which allows for adjustments similar to those made on the E40. Both forms ensure that non-residents accurately report their Alabama tax obligations.

Form 40NR is specifically for non-residents and part-year residents filing an income tax return in Alabama. The Alabama 40X serves a similar purpose for amending returns filed on the 40NR. Both forms require specific details about income earned in Alabama and allow for adjustments based on changes in circumstances or corrections. This ensures that non-residents are held accountable for their tax responsibilities while providing a means to rectify any errors.

Form 41 is designed for fiduciaries, such as estates or trusts, to report income and deductions. Like the Alabama 40X, it allows for amendments to previously filed fiduciary returns. Both forms require detailed reporting of income, deductions, and tax liabilities, with the 40X specifically catering to changes made to the original fiduciary return. This ensures that fiduciaries can accurately report their tax obligations and make necessary adjustments.

The IRS Form 1040 is an essential document for individual taxpayers in the United States, similar to the Alabama 40X form in that both are used for reporting income and calculating tax liability. Unlike the Alabama 40X form, which specifically addresses amendments or changes to a previously filed Alabama tax return, the IRS Form 1040 encompasses the entirety of individual income tax reporting. Adjustments made on the 40X can often have federal tax implications, and taxpayers may also need to reflect similar changes on their federal Form 1040 to maintain accuracy across their tax documentation. Additionally, understanding related agreements, such as a Hold Harmless Agreement, can provide further insight into liability considerations during the tax process.

Form CR is used to claim various tax credits in Alabama. While it serves a different purpose than the Alabama 40X, both forms can intersect when an individual needs to amend their return to reflect changes in credits claimed. The 40X allows taxpayers to adjust their overall tax liability, which may include updates to the credits reported on Form CR. This connection highlights the importance of accurate reporting across different forms for a complete tax picture.