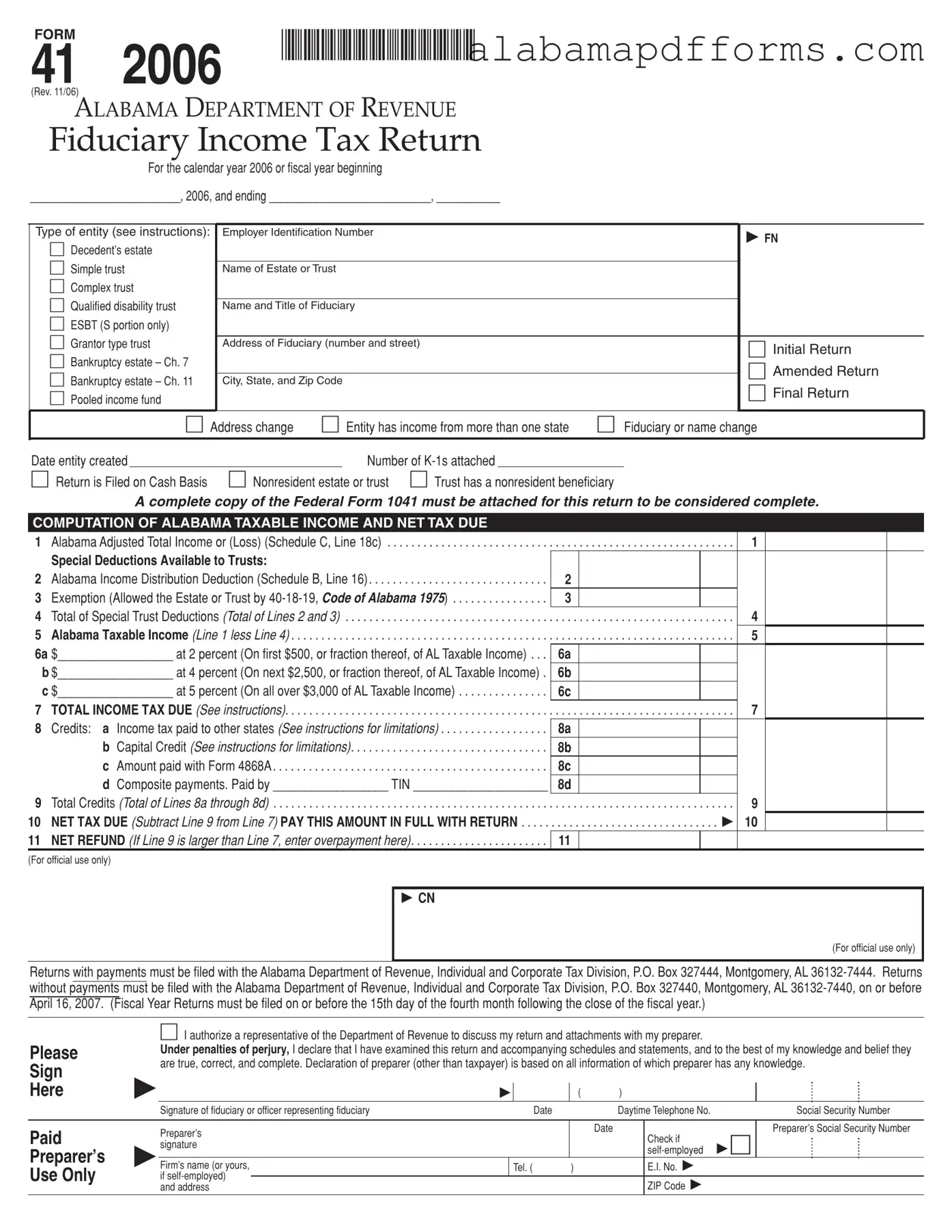

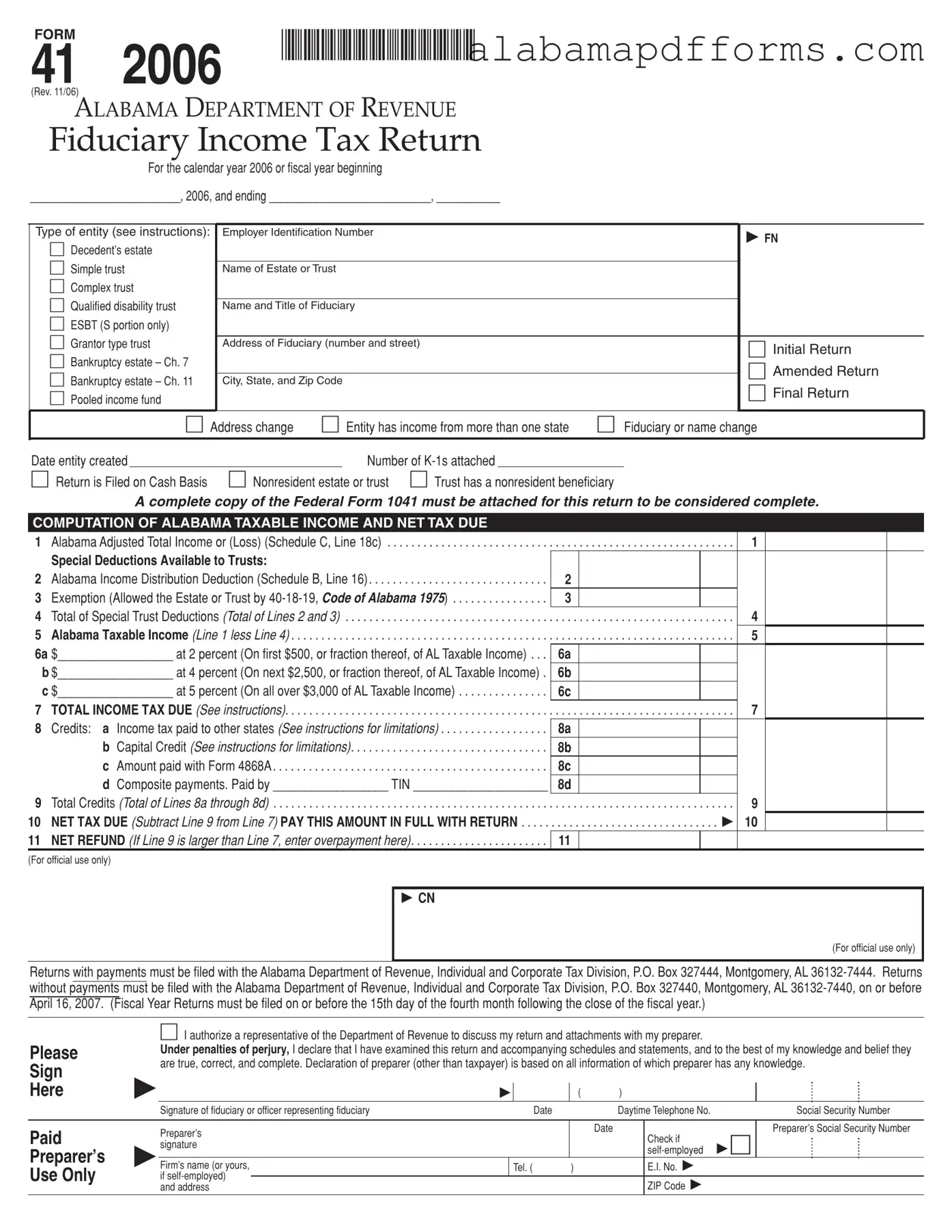

The Alabama Form 41 is comparable to the IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. Both forms serve the same purpose: reporting income, deductions, and credits for estates and trusts. They require similar information regarding the entity's income, deductions, and distributions to beneficiaries. The federal form also necessitates a complete picture of the trust or estate's financial situation, much like the Alabama form, ensuring that all relevant income and deductions are accurately reported.

Another similar document is the California Form 541, the California Fiduciary Income Tax Return. Like the Alabama Form 41, this form is used by estates and trusts to report their income and calculate taxes owed to the state. Both forms require details about the entity’s income, deductions, and distributions. Additionally, both forms have specific sections that address income distribution deductions, ensuring that beneficiaries are properly accounted for in the tax calculations.

To establish a clear rental agreement, it is essential to understand your rights and obligations, and a detailed lease agreement is an important tool for tenants. For personalized guidance, consider this comprehensive guide to your Lease Agreement and its implications in your rental management process. You can learn more by visiting this page on Lease Agreement forms.

The New York Form IT-205, the New York State Fiduciary Income Tax Return, is also akin to the Alabama Form 41. This document serves the same function in reporting income for estates and trusts in New York. Both forms require fiduciaries to report income, deductions, and distributions to beneficiaries. They also include sections for claiming specific deductions related to the estate or trust's income, making them similar in structure and purpose.

The Florida Form F-1120, the Florida Corporate Income/Franchise Tax Return, shares similarities with the Alabama Form 41 in that both are used to report income and calculate taxes owed. While the Florida form is specifically for corporations, it includes sections for reporting income and deductions that are comparable to those found in the Alabama form. Both forms aim to ensure that entities comply with state tax laws by accurately reporting their financial activities.

The Massachusetts Form 2, the Massachusetts Fiduciary Income Tax Return, is another document that parallels the Alabama Form 41. Both forms are used by estates and trusts to report income and calculate state tax obligations. They require fiduciaries to provide details about income, deductions, and distributions, ensuring that the financial activities of the estate or trust are thoroughly documented for tax purposes.

Additionally, the Illinois Form IL-1041, the Illinois Income Tax Return for Estates and Trusts, is similar to the Alabama Form 41. Both forms require fiduciaries to report income, deductions, and distributions to beneficiaries. They also include provisions for special deductions and credits, which help reduce the tax burden on the estate or trust. The structure and purpose of both forms are aligned, making them comparable in their function.

Lastly, the Pennsylvania Form PA-41, the Pennsylvania Fiduciary Income Tax Return, is akin to the Alabama Form 41. This form is designed for estates and trusts to report income and calculate tax liabilities in Pennsylvania. Both forms require detailed reporting of income, deductions, and distributions, ensuring that fiduciaries fulfill their tax obligations while providing a clear account of the financial activities of the estate or trust.