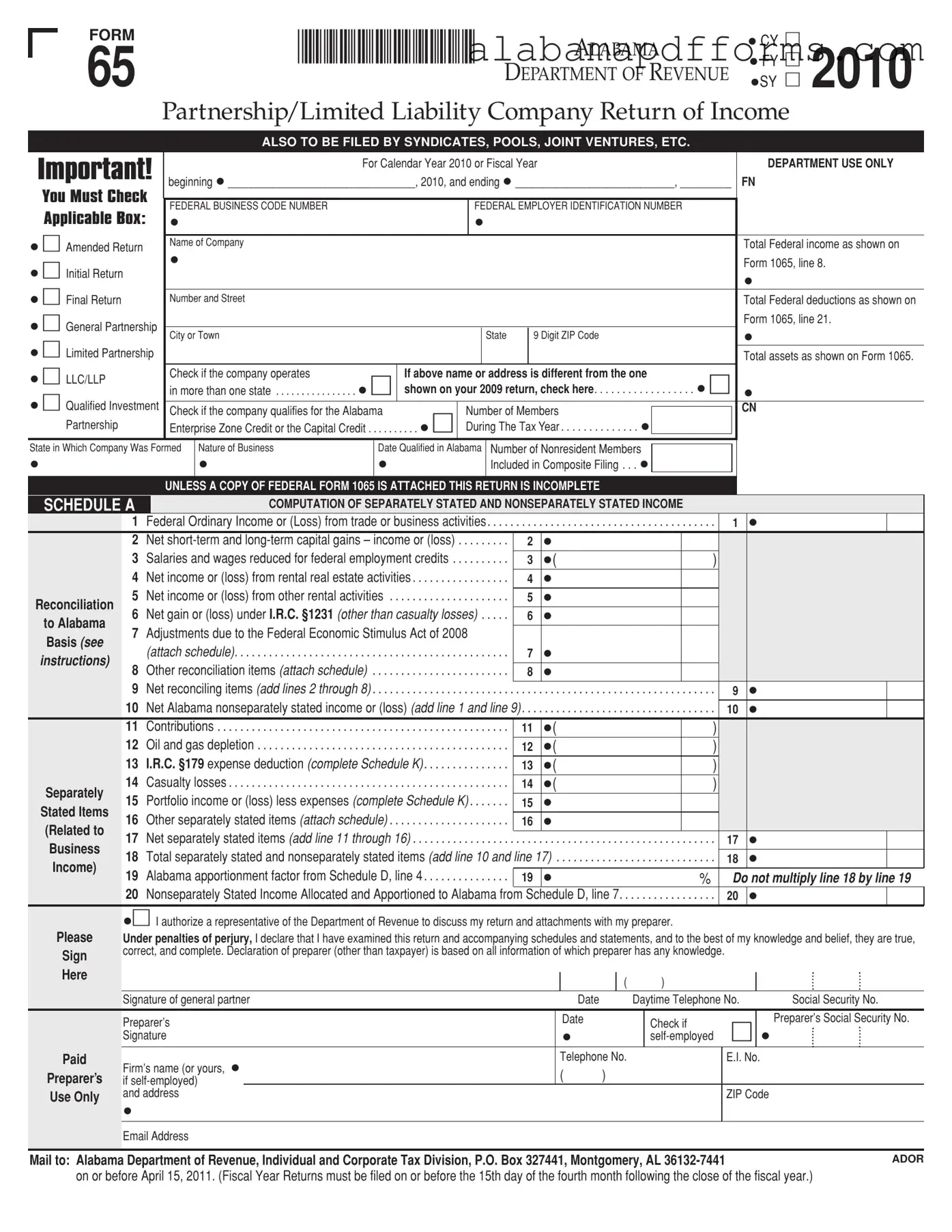

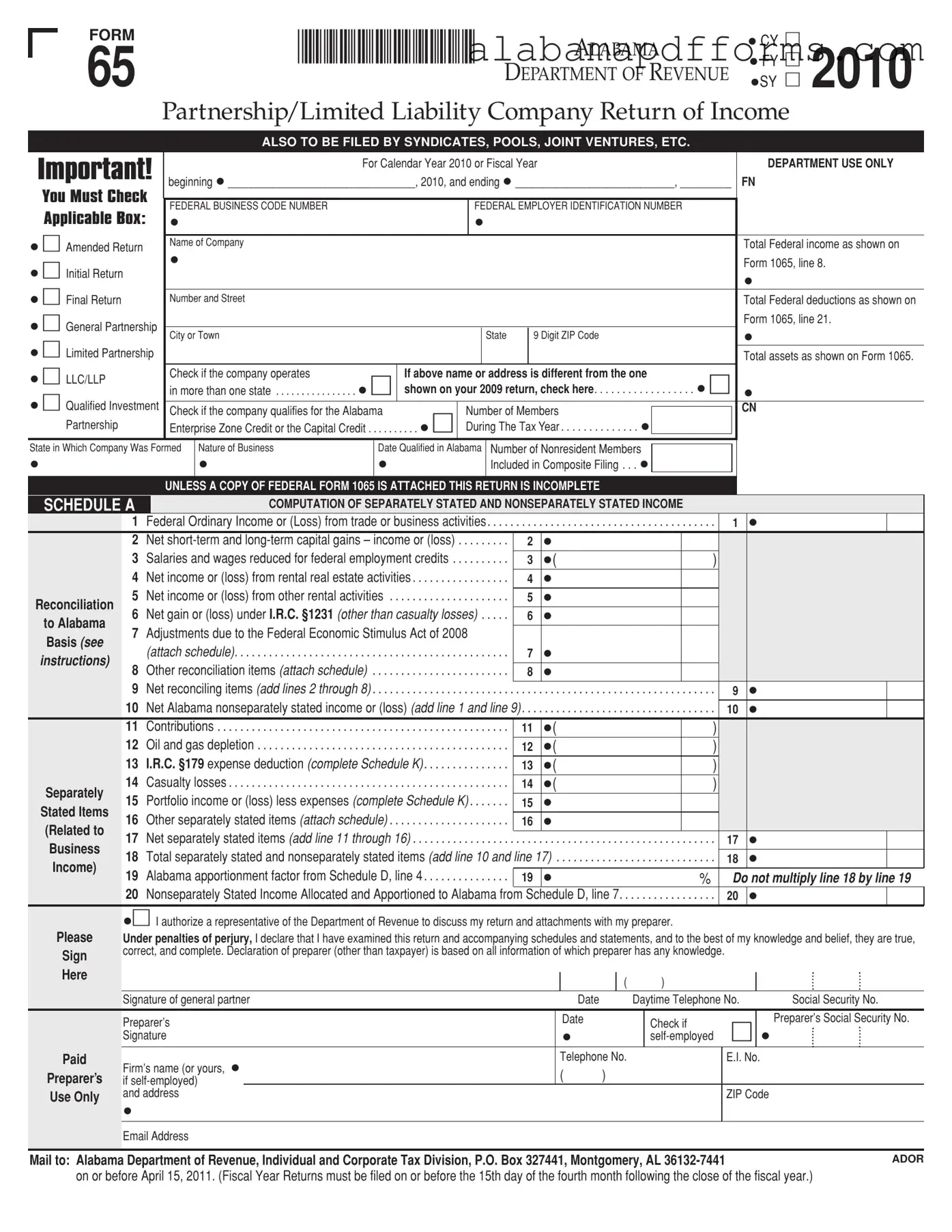

The Alabama 65 form is comparable to the IRS Form 1065, which is used by partnerships to report income, deductions, and credits. Both forms require detailed financial information, including total income, deductions, and assets. Just as the Alabama 65 form is specific to Alabama state tax requirements, Form 1065 adheres to federal tax regulations. Each form also necessitates a declaration of accuracy and completeness, ensuring that the information provided is truthful and verified by the responsible parties.

In the context of important legal documents, the Colorado Do Not Resuscitate Order form serves as a vital resource for individuals who wish to communicate their medical preferences distinctly. For those interested in understanding more about such forms, Colorado PDF Forms provides access to necessary templates that can help in ensuring one's wishes are documented clearly and legally recognized.

Another document similar to the Alabama 65 is the IRS Schedule K-1, which partnerships use to report each partner's share of income, deductions, and credits. The Alabama 65 form includes a section for the distributive share items, mirroring the function of Schedule K-1. Both documents aim to allocate income and deductions among partners, ensuring that each partner receives accurate information for their individual tax filings. This allocation process is crucial for compliance with both federal and state tax laws.

The Alabama Business Privilege Tax Return (Form CPT) shares similarities with the Alabama 65 form, as both are filed by business entities operating in Alabama. The Business Privilege Tax Return assesses a fee based on the business's net worth, while the Alabama 65 focuses on income reporting. Both forms require information on the business structure, such as partnerships and limited liability companies, and necessitate the reporting of various financial metrics, ensuring that businesses comply with state tax obligations.

The IRS Form 1120S, used by S corporations, is also akin to the Alabama 65 form. Both forms serve to report income, deductions, and credits for pass-through entities. The Alabama 65 form includes sections for separately stated items, similar to how Form 1120S allows for the reporting of specific items that may affect individual shareholders. This parallel is essential for ensuring that both state and federal tax reporting aligns for these types of entities.

Additionally, the Alabama Corporate Income Tax Return (Form 20C) resembles the Alabama 65 form in that both are used for reporting income by business entities in Alabama. While the Alabama 65 is specific to partnerships and LLCs, Form 20C is tailored for corporations. Both forms require comprehensive financial disclosures, including total income and deductions, and they share similar filing deadlines, emphasizing the importance of timely compliance with state tax regulations.

Lastly, the IRS Form 1065-B, which is designed for electing large partnerships, is comparable to the Alabama 65 form. Like the Alabama 65, Form 1065-B requires detailed reporting of income and deductions. Both forms facilitate the allocation of income among partners, ensuring accurate reporting for tax purposes. This similarity underscores the shared goal of both forms: to provide a transparent and accurate representation of a partnership's financial activities to tax authorities.