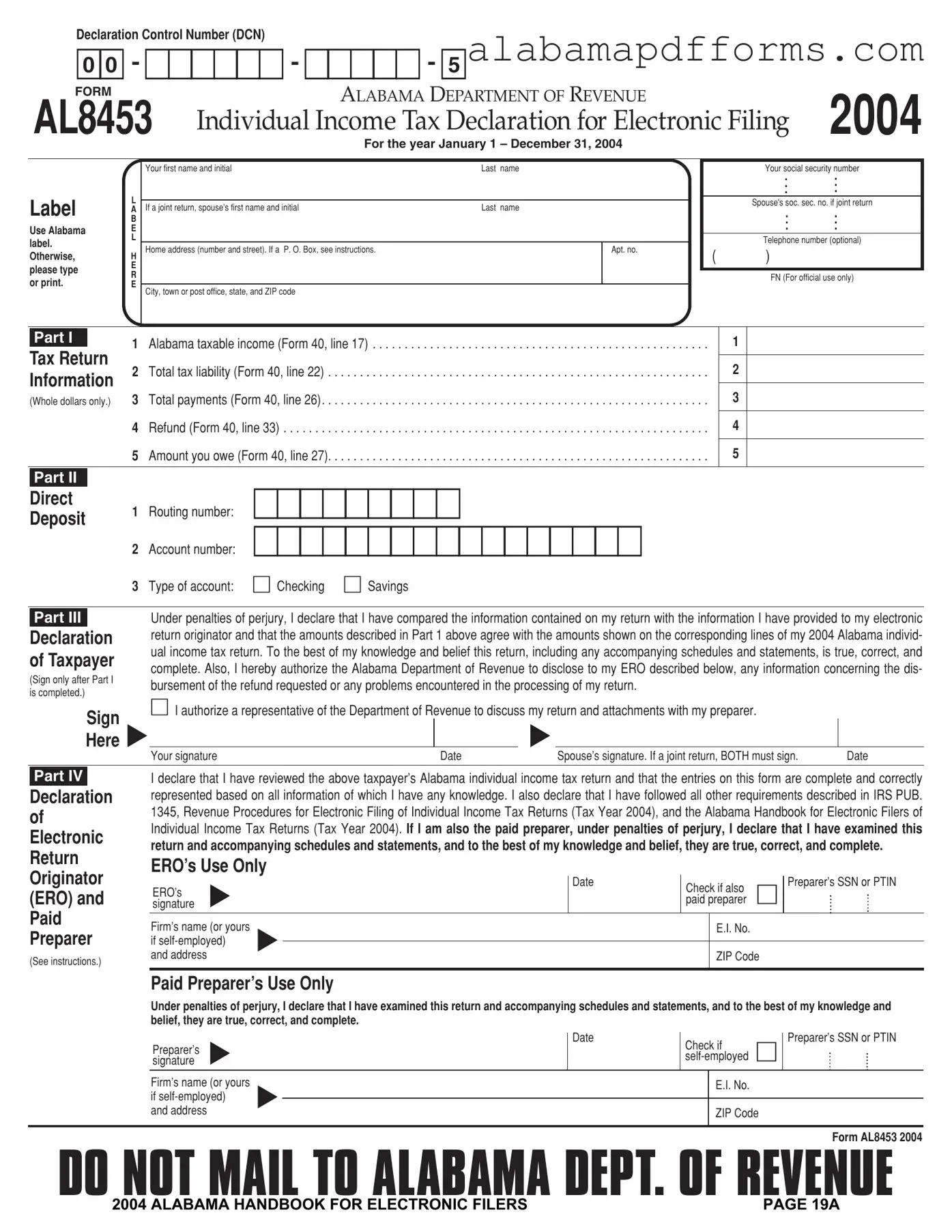

The IRS Form 8453 serves a similar purpose to the Alabama 8453 form. Both documents are declarations that allow taxpayers to confirm their electronic tax return information. The IRS Form 8453 is used for federal tax returns, whereas the Alabama 8453 is specific to state income tax. Each form requires taxpayer signatures and includes a declaration under penalties of perjury, ensuring that the information provided is accurate and complete. This similarity emphasizes the importance of honesty in tax reporting at both federal and state levels.

The California Form 8453 serves a similar function as the Alabama 8453. This form is also a declaration for electronic filing of individual income tax returns. Like the Alabama version, it requires taxpayers to affirm that the information on their tax return matches what is submitted electronically. Both forms aim to protect against fraudulent filings by requiring signatures and declarations of accuracy. This process helps maintain the integrity of the tax system in both states.

In various legal contexts, ensuring clarity and protection is essential, much like how the Hold Harmless Agreement provides a framework for individuals and organizations to navigate risks and liabilities effectively. By utilizing this agreement, parties can establish a clear understanding of responsibilities, which is vital in maintaining smooth operations in any endeavor.

The New York State Form IT-201 serves a similar purpose to the Alabama 8453 as well. This form is used for individual income tax returns and includes sections for taxpayer information and signatures. Both forms require the taxpayer to confirm the accuracy of their information and allow for electronic filing. The New York form also includes a declaration under penalties of perjury, reinforcing the need for truthful reporting, similar to the Alabama form.

The Florida Form DR-501 is another document akin to the Alabama 8453. It is utilized for electronic filing of individual income tax returns in Florida. Like the Alabama form, it requires the taxpayer to declare that the information is true and correct. Both forms are designed to facilitate the electronic filing process while ensuring that taxpayers take responsibility for the accuracy of their submissions. This helps prevent errors and potential fraud in the tax system.

The Texas Form 1040, while not a state income tax form, has similarities with the Alabama 8453 in its declaration aspect. The Texas 1040 requires taxpayers to sign a declaration affirming the accuracy of their information. Although Texas does not have a state income tax, the process of confirming the validity of tax information is consistent across both documents. This emphasizes the importance of accountability in tax reporting.

Lastly, the Illinois Form IL-8453 is comparable to the Alabama 8453. This form is used for electronic filing of individual income tax returns in Illinois. Both forms require the taxpayer's signature and a declaration of accuracy. They serve to ensure that the information submitted electronically is truthful and matches the paper return, should one be filed. This shared requirement reinforces the commitment to accurate tax reporting in both states.