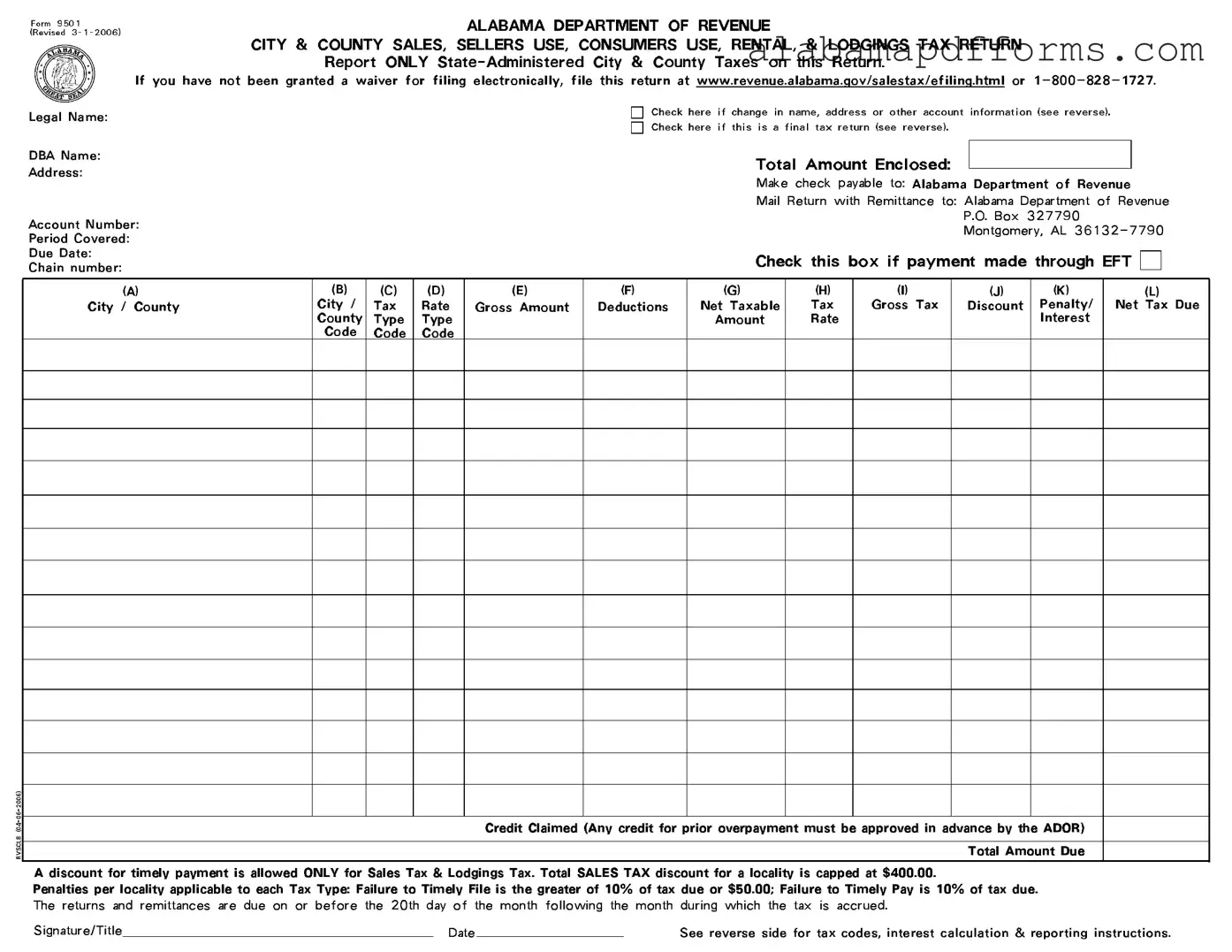

The Alabama 9501 form is similar to the IRS Form 1040, which is the standard individual income tax return. Both documents require taxpayers to report their income and calculate taxes owed. Just as the Alabama 9501 form collects specific information about state-administered taxes, the IRS Form 1040 gathers data on federal income taxes. Both forms require personal information, such as name and address, and include sections for deductions and credits, allowing taxpayers to reduce their tax liability. Completing either form accurately is essential to avoid penalties and ensure compliance with tax laws.

Another document similar to the Alabama 9501 form is the California Sales and Use Tax Return (Form BOE-401-A). This form serves a similar purpose by requiring businesses to report sales and use tax collected in California. Like the Alabama 9501, it includes sections for gross sales, deductions, and the calculation of net tax due. Both forms also provide a mechanism for taxpayers to claim discounts for timely payment, thereby incentivizing prompt remittance. The structure and requirements of these forms reflect the need for transparency and accuracy in tax reporting across different states.

The New York State Sales and Use Tax Return (Form ST-100) is another comparable document. This form is used by businesses to report sales and use taxes collected in New York. Similar to the Alabama 9501, it requires detailed reporting of sales amounts, deductions, and the calculation of taxes owed. Both forms include instructions for taxpayers to follow, ensuring they understand how to complete their returns correctly. The emphasis on accurate reporting and timely payment is a common theme across these tax forms, highlighting the importance of compliance with state tax regulations.

In addition, the Florida Sales and Use Tax Return (Form DR-15) bears similarities to the Alabama 9501 form. Businesses in Florida use this form to report sales tax and remit payments to the state. Like the Alabama form, it includes sections for gross sales, deductions, and tax rates. Both documents require businesses to be diligent in reporting their tax obligations accurately. The penalties for late filing or payment are also comparable, underscoring the importance of adhering to deadlines to avoid additional fees.

The Texas Sales and Use Tax Return (Form 01-114) is another document that shares characteristics with the Alabama 9501 form. This form is utilized by Texas businesses to report sales and use tax. Both forms require similar information, including gross sales, deductions, and the calculation of net tax due. They also provide guidance on penalties for late submissions. The similarities in structure and required information illustrate the common framework of state tax reporting, aimed at ensuring compliance and accountability among businesses.

The Illinois Sales and Use Tax Return (Form ST-1) is also comparable to the Alabama 9501 form. This form requires businesses to report their sales and use tax obligations in Illinois. Like the Alabama form, it includes fields for gross sales, allowable deductions, and tax calculations. Both forms emphasize the need for accurate reporting to avoid penalties and ensure compliance with state tax laws. The design and requirements of these forms reflect the shared goal of facilitating proper tax administration across states.

For those looking to ensure a smooth transaction, understanding the important aspects of a comprehensive Motor Vehicle Bill of Sale is critical. This form not only documents the sale but also protects the interests of both buyer and seller, making it a vital tool in the vehicle transfer process.

Lastly, the Pennsylvania Sales and Use Tax Return (Form REV-183) is similar to the Alabama 9501 form. Businesses in Pennsylvania use this form to report their sales and use tax. Similar to the Alabama form, it includes sections for gross sales, deductions, and the calculation of taxes owed. Both forms highlight the importance of timely filing and accurate reporting, with penalties in place for late submissions. This commonality reinforces the necessity for businesses to maintain compliance with state tax regulations, regardless of their location.