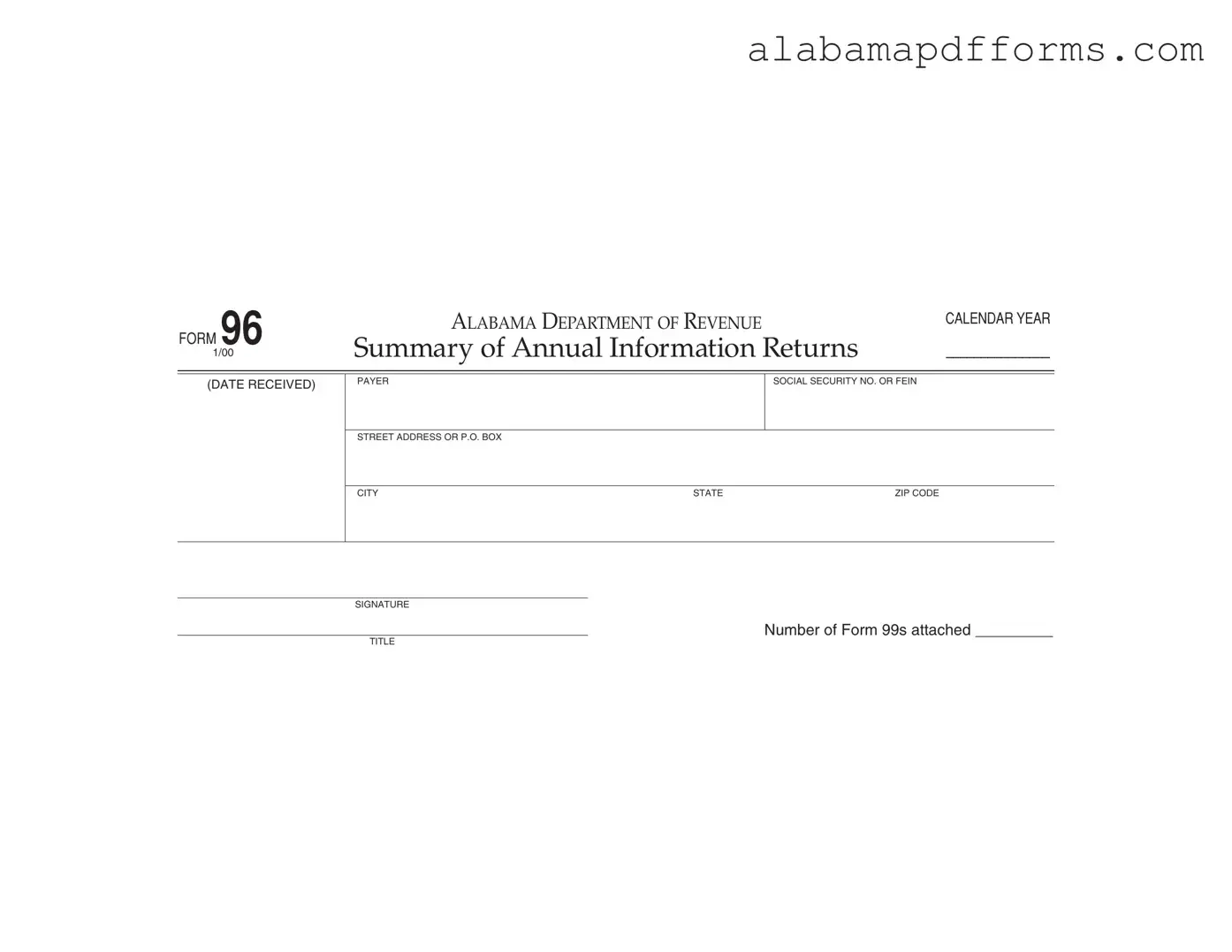

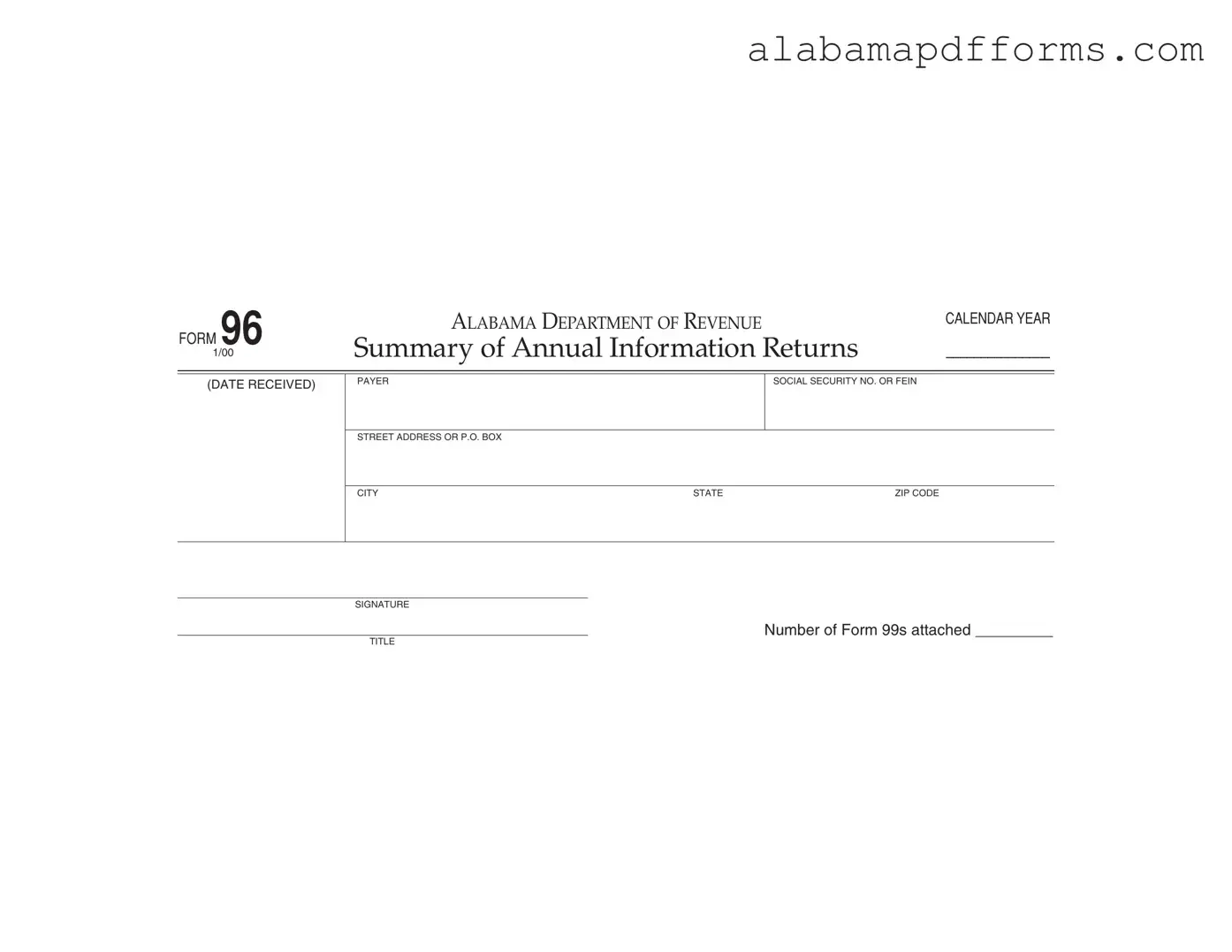

The Alabama Form 99 is closely related to the Alabama 96 form as both are used for reporting income payments to the state. Form 99 specifically requires individuals and entities to report payments of $1,500 or more made to Alabama taxpayers. This form is crucial for ensuring that the state collects the appropriate income tax from individuals who receive substantial payments. Just like the Alabama 96 form, which summarizes these annual returns, Form 99 must be filed annually and is due by March 15 of the following year. Both forms help maintain accurate records for tax purposes and ensure compliance with state tax laws.

Another document similar to the Alabama 96 form is the IRS Form 1099. This federal form is used to report various types of income other than wages, salaries, and tips. Just as the Alabama 96 form summarizes annual information returns, Form 1099 provides detailed information about payments made to individuals, including independent contractors and freelancers. The IRS requires that Form 1099 be issued for payments exceeding $600, which aligns with the reporting requirements of the Alabama 96. Both forms serve the purpose of tracking income and ensuring that taxes are paid accordingly.

The IRS Form W-2 is another document that shares similarities with the Alabama 96 form. While W-2 is specifically for reporting wages paid to employees, it also plays a vital role in income reporting. Employers must provide W-2 forms to their employees at the end of the year, detailing the income earned and taxes withheld. Like the Alabama 96, W-2 forms help the state and federal government track income and ensure compliance with tax obligations. Both forms must be filed annually and are critical for accurate income reporting.

The Alabama A-3 form is yet another document that parallels the Alabama 96 form. This form is used for the annual reconciliation of Alabama income tax withheld from employee wages. Employers who have withheld state income tax from their employees must file this form to summarize the total amount withheld for the year. Similar to the Alabama 96, the A-3 form ensures that the state receives accurate information regarding tax withholdings, thereby facilitating proper tax collection and compliance.

For landlords and tenants seeking to formalize their rental agreements, understanding the importance of a well-prepared Lease Agreement template is essential. This document lays out the rental terms in a clear manner to foster mutual understanding and protect both parties involved. For more information on this crucial process, check out this helpful Lease Agreement resource.

The IRS Form 945 is also relevant in this context, as it is used to report federal income tax withheld from nonpayroll payments. This includes payments made to independent contractors and other non-employees. Like the Alabama 96 form, which summarizes various payments made throughout the year, Form 945 serves a similar function at the federal level. Both forms ensure that the appropriate taxes are reported and remitted to the government, thereby maintaining compliance with tax laws.

Another important document is the Alabama Form 40, which is the state's individual income tax return. While the Alabama 96 form summarizes information returns, Form 40 is where individuals report their total income, deductions, and tax liability. Both forms are essential for tax compliance, but they serve different purposes in the tax reporting process. The Alabama 96 aids in the reporting of payments made, while Form 40 focuses on the individual's overall tax situation.

The IRS Schedule C is also similar to the Alabama 96 form, particularly for self-employed individuals. Schedule C is used to report income or loss from a business operated as a sole proprietorship. Just as the Alabama 96 form summarizes payments made to individuals, Schedule C summarizes income earned by self-employed individuals. Both documents are crucial for reporting income accurately and ensuring that the appropriate taxes are calculated and paid.

Form 1040, the U.S. Individual Income Tax Return, can also be compared to the Alabama 96 form. While the Alabama 96 focuses on reporting specific payments made to individuals, Form 1040 is the comprehensive tax return that individuals file to report their overall income and tax liability. Both forms play a critical role in the tax reporting process, with the Alabama 96 providing detailed information that contributes to the figures reported on Form 1040.

The IRS Form 1098 is another relevant document, as it is used to report mortgage interest paid by individuals. Similar to the Alabama 96 form, which summarizes various income payments, Form 1098 provides important information that can affect an individual's tax return. Both forms are essential for accurate tax reporting and compliance, ensuring that taxpayers receive the appropriate deductions and credits.

Lastly, the Alabama Form 40NR is similar in that it is used by non-residents filing income tax returns in Alabama. Like the Alabama 96 form, which deals with reporting payments made to Alabama taxpayers, Form 40NR is focused on ensuring that non-residents pay the correct amount of tax on income earned within the state. Both forms are vital for maintaining accurate tax records and ensuring compliance with Alabama's tax laws.