MOTOR VEHICLE DIVISION

P.O. Box 327680 • Montgomery, AL 36132-7680 • mvrecords@revenue.alabama.gov

Abandoned Motor Vehicle Record Request

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/forms.html

The undersigned hereby requests the current owner and lienholder information maintained by the Alabama Department of Revenue for the vehicle(s) listed below in order to comply with the noti- fication requirements of the Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13. The undersigned certifies that information received as a result of this request shall only be used to comply with the notification requirements of the Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13, and that the information received shall be considered confidential under the federal Driver’s Privacy Protection Act of 1994 (DPPA) (Title XXX of Public Law 103-322) as amended by Section 350 of Public Law 106-69. The federal Driver’s Privacy Protection Act of 1994 (DPPA) (Title XXX of Public Law 103-322) as amended by Section 350 of Public Law 106-69 was enacted to protect the interest of individuals and their privacy by pro- hibiting the disclosure and use of personal information contained in motor vehicle registration and title records, except as authorized by such individuals or by law. Personal information is defined as “information that identifies a person, including an individual’s social security number, name, address (but not the 5-digit zip code), telephone number, and medical or disability information.”

The fee for the title and registration records including owner and lienholder information is $10.00 for each vehicle subject to the Alabama title law or $5.00 for each vehicle not subject to the Alabama title law*. The required fees are collected in accordance with Code of Alabama 1975, Section 32-8-6(a)(7), and Department Rule and Regulation 810-5-75-.31.02. PAYMENT

MAILED MUST BE IN CERTIFIED FUNDS PAYABLE TO THE ALABAMA DEPARTMENT OF REVENUE. PERSONAL CHECKS WILL NOT BE ACCEPTED. DO NOT MAIL CASH. Cash may be received at the cashier’s counter located adjacent to Room 1202 in the Gordon Persons Building.

Please verify the vehicle identification number(s) and all other information prior to submitting the record request. An incorrect or illegible vehicle identification number will cause an incorrect record to be retrieved and will require that a new request form be executed and submitted with the fee for the correct vehicle search.

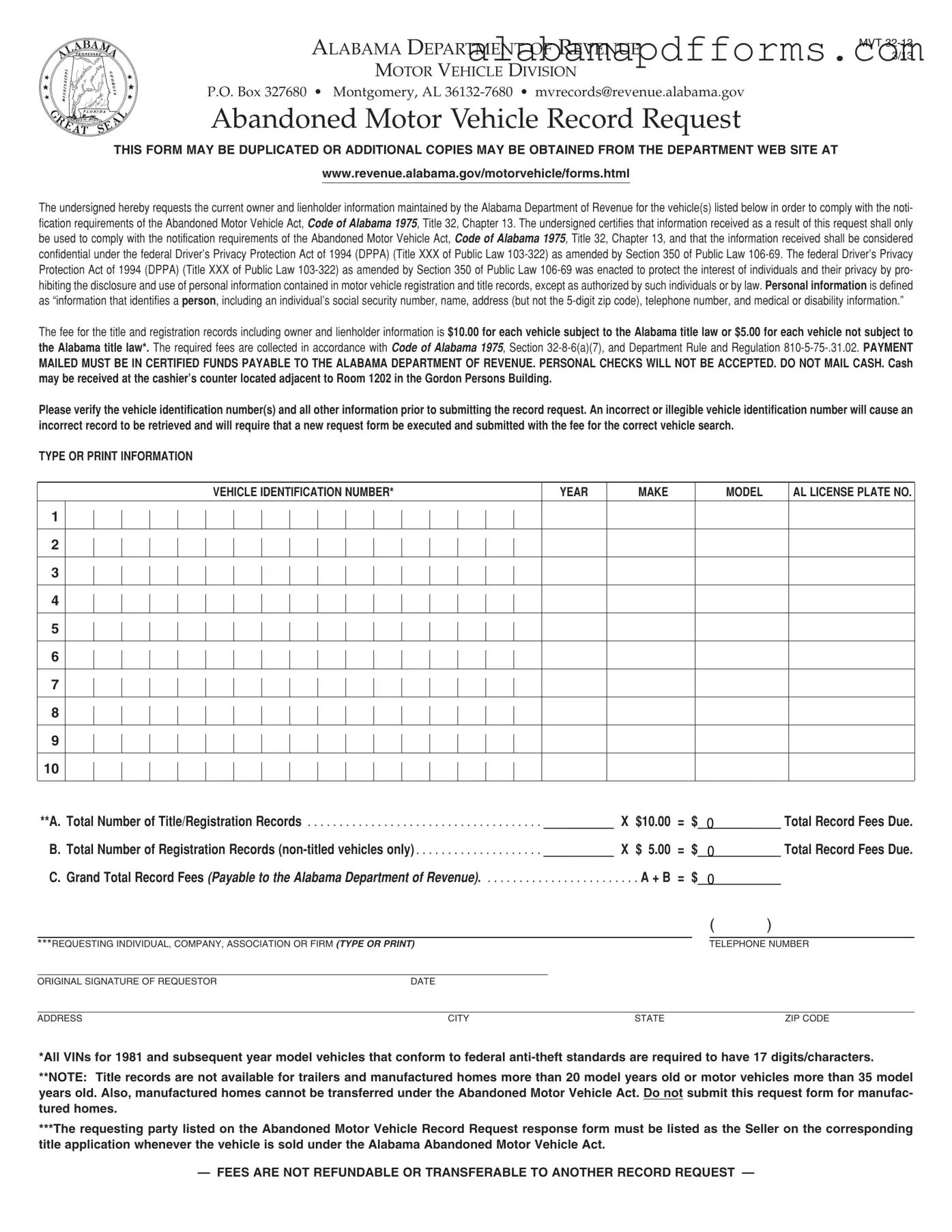

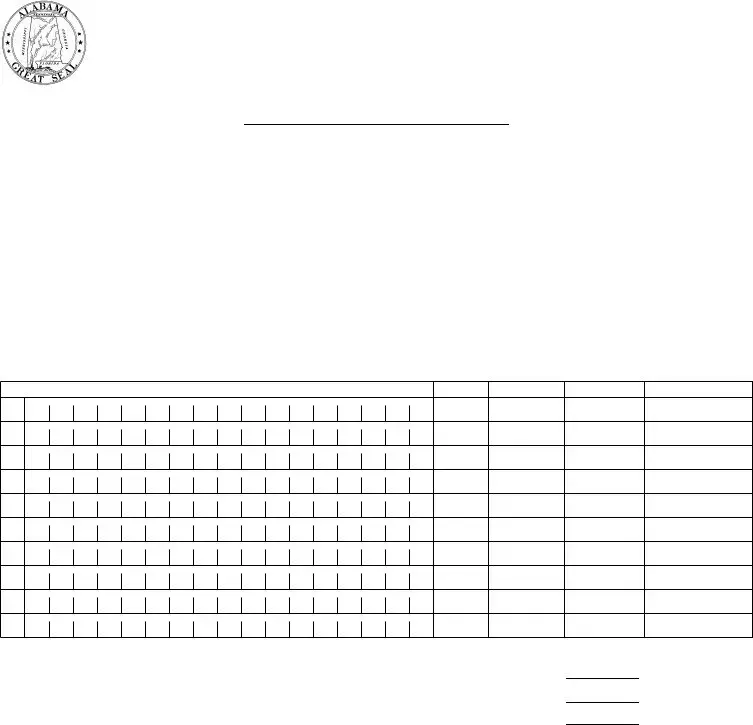

TYPE OR PRINT INFORMATION

VEHICLE IDENTIFICATION NUMBER* |

YEAR |

MAKE |

MODEL |

AL LICENSE PLATE NO. |

1

2

3

4

5

6

7

8

9

10

**A. |

Total Number of Title/Registration Records |

___________ |

X |

$10.00 |

= |

$ |

0 |

Total Record Fees Due. |

B. |

Total Number of Registration Records (non-titled vehicles only) |

___________ |

X |

$ 5.00 |

= |

$ |

0 |

Total Record Fees Due. |

C. |

Grand Total Record Fees (Payable to the Alabama Department of Revenue) |

. . . . . . . . . . . . |

. . |

. A + B = $ |

0 |

|

|

|

|

( |

) |

|

|

|

|

|

***REQUESTING INDIVIDUAL, COMPANY, ASSOCIATION OR FIRM (TYPE OR PRINT) |

|

|

|

TELEPHONE NUMBER |

|

|

|

|

|

|

|

ORIGINAL SIGNATURE OF REQUESTOR |

DATE |

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

CITY |

STATE |

ZIP CODE |

*All VINs for 1981 and subsequent year model vehicles that conform to federal anti-theft standards are required to have 17 digits/characters.

**NOTE: Title records are not available for trailers and manufactured homes more than 20 model years old or motor vehicles more than 35 model years old. Also, manufactured homes cannot be transferred under the Abandoned Motor Vehicle Act. Do not submit this request form for manufac- tured homes.

***The requesting party listed on the Abandoned Motor Vehicle Record Request response form must be listed as the Seller on the corresponding title application whenever the vehicle is sold under the Alabama Abandoned Motor Vehicle Act.

— FEES ARE NOT REFUNDABLE OR TRANSFERABLE TO ANOTHER RECORD REQUEST —