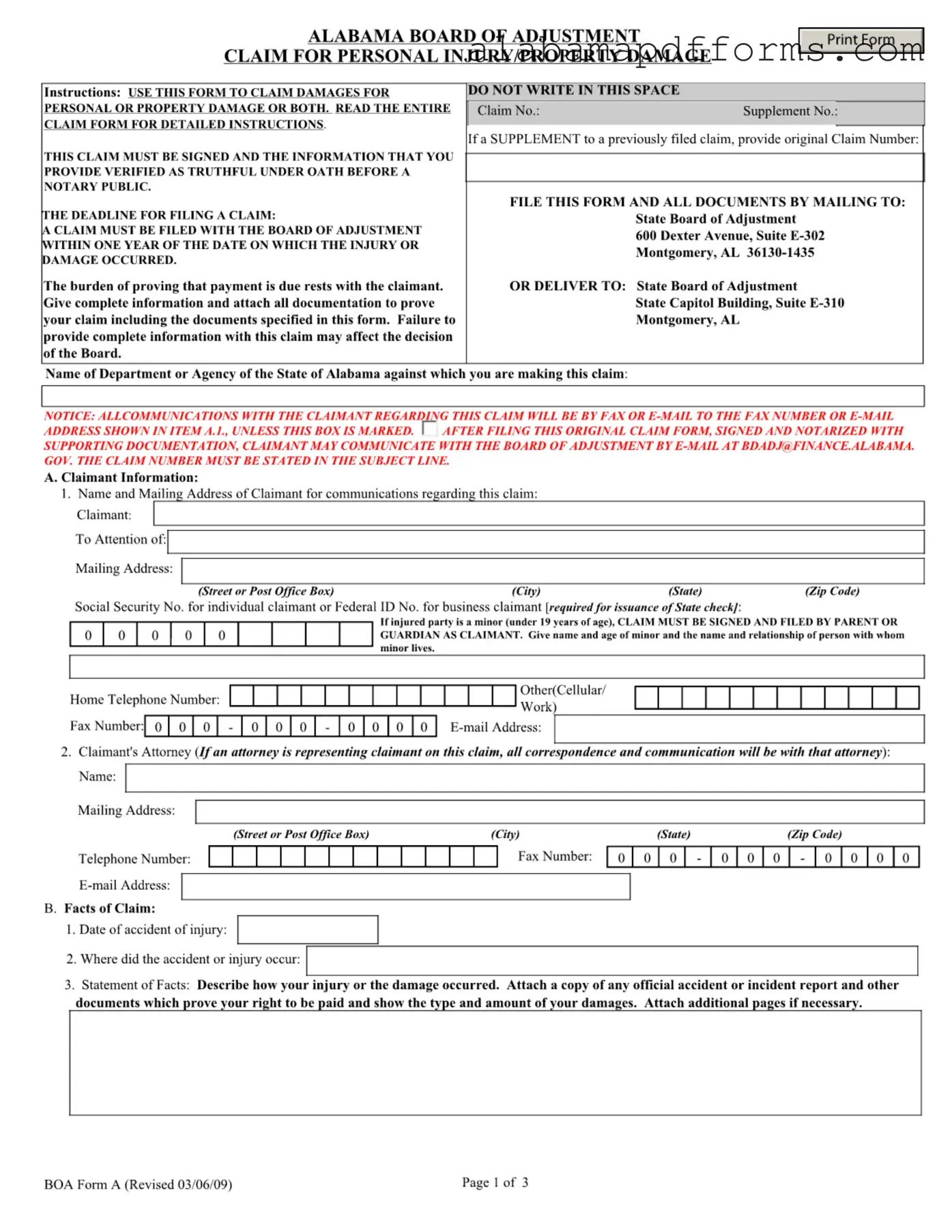

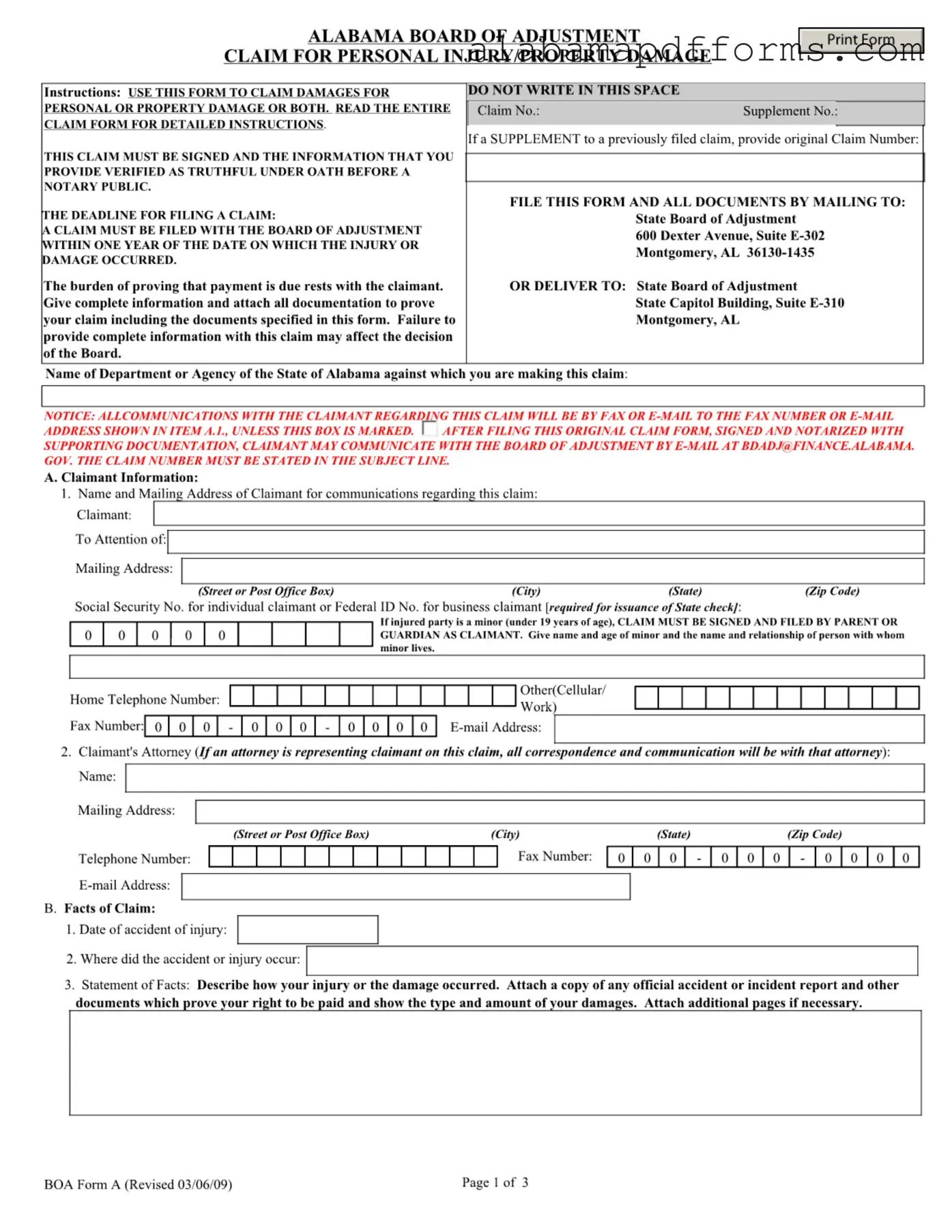

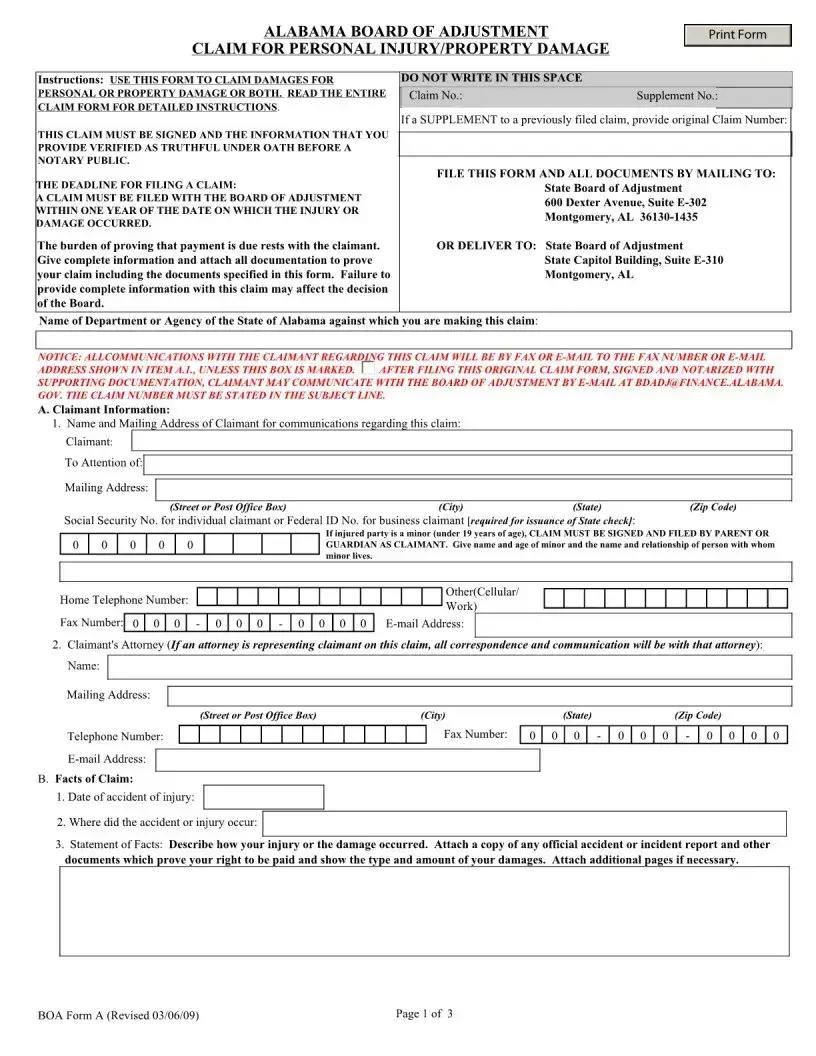

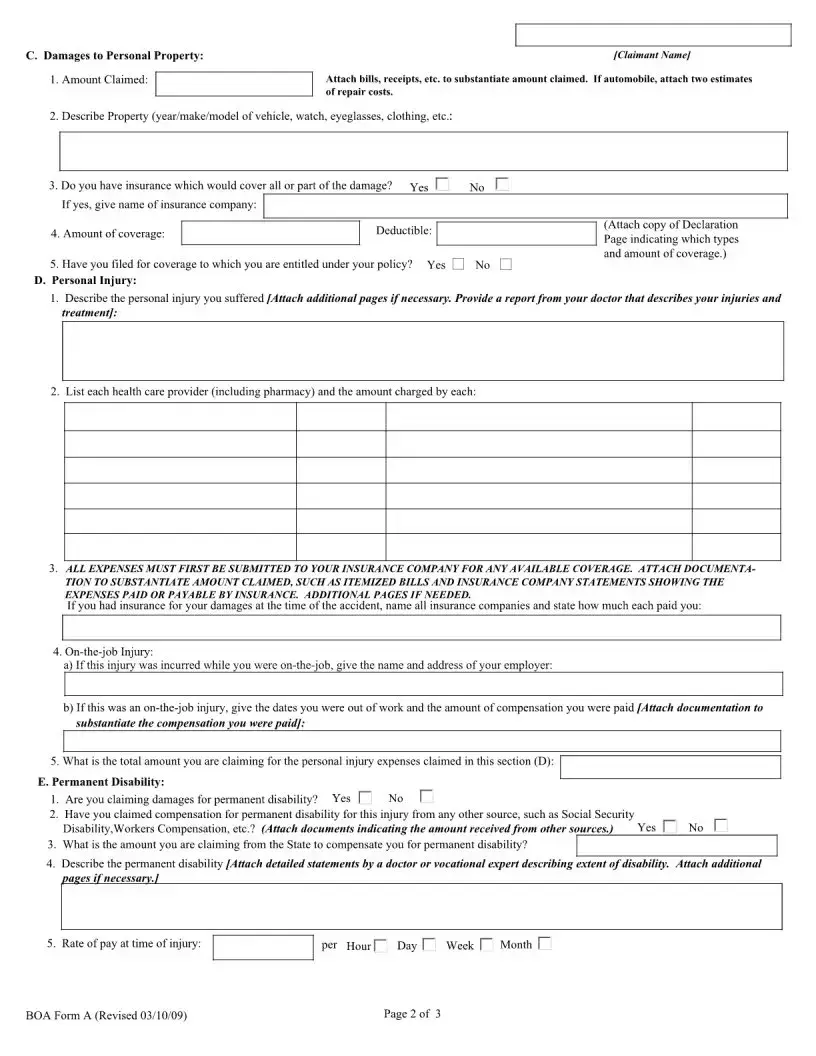

The Alabama Board of Adjustment Claim Form is similar to the Personal Injury Claim Form used in many states. Both documents serve the purpose of allowing individuals to seek compensation for injuries or damages they have suffered. They require claimants to provide detailed information about the incident, including dates, locations, and descriptions of the injuries or damages. Additionally, both forms necessitate the submission of supporting documentation, such as medical records or repair estimates, to substantiate the claims being made.

Another comparable document is the Workers’ Compensation Claim Form. This form is specifically designed for employees who have sustained injuries while performing their job duties. Like the Alabama Boa A form, it requires a detailed account of the incident and often mandates that claimants provide medical documentation. However, the Workers’ Compensation Claim Form is tailored to address workplace injuries and typically includes questions about the employer and the nature of the work-related incident.

The Auto Accident Claim Form is also similar, focusing specifically on claims arising from vehicle accidents. Claimants must detail the circumstances of the accident, including the date, location, and parties involved. Both forms require documentation such as police reports and medical records. However, the Auto Accident Claim Form may emphasize vehicle damage and insurance coverage more than personal injury, making it distinct in its focus.

The Medical Malpractice Claim Form shares similarities as well, as it is used when individuals seek compensation for injuries caused by medical professionals. Like the Alabama Boa A form, it requires detailed information about the incident, including the healthcare provider involved and the nature of the alleged malpractice. Both forms necessitate supporting documentation, such as medical records and expert opinions, to substantiate the claims.

The Homeowners Insurance Claim Form is another document that aligns with the Alabama Boa A form. This form is utilized when homeowners file claims for property damage, such as from natural disasters or accidents. Similar to the Boa A form, it requires a description of the damage, the date it occurred, and supporting documentation like repair estimates. However, this form specifically addresses property damage rather than personal injury claims.

The Slip and Fall Incident Report is also comparable, as it documents injuries sustained on someone else's property due to negligence. Like the Alabama Boa A form, it requires details about the incident, including the date, location, and circumstances leading to the injury. Both forms aim to establish liability and require supporting evidence, such as witness statements or photographs of the scene.

In navigating the complexities of various claim forms, it may also be beneficial to understand the significance of a Hold Harmless Agreement, which can provide essential legal protection by outlining the responsibilities and liabilities of the parties involved.

The Product Liability Claim Form is relevant as well, focusing on injuries caused by defective products. This form shares similarities with the Alabama Boa A form in that it requires detailed information about the injury and the product involved. Claimants must provide evidence to support their claims, such as receipts and photographs of the product, mirroring the documentation requirements of the Boa A form.

Lastly, the Disability Claim Form is similar in that it is used to seek compensation for disabilities resulting from injuries. Like the Alabama Boa A form, it requires claimants to provide detailed medical documentation and personal information. Both forms aim to establish the extent of the injury and the impact it has on the claimant's life, making them comparable in purpose and structure.