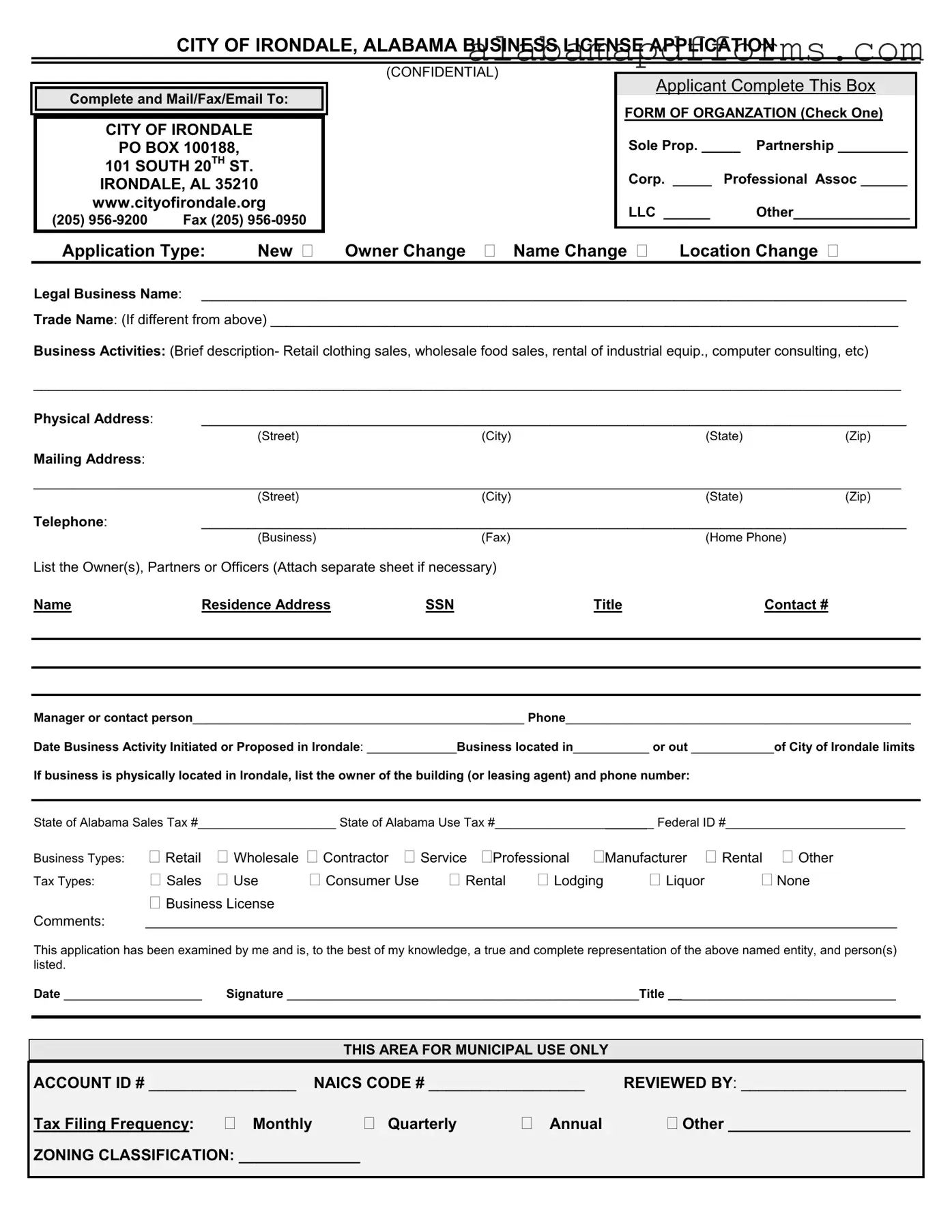

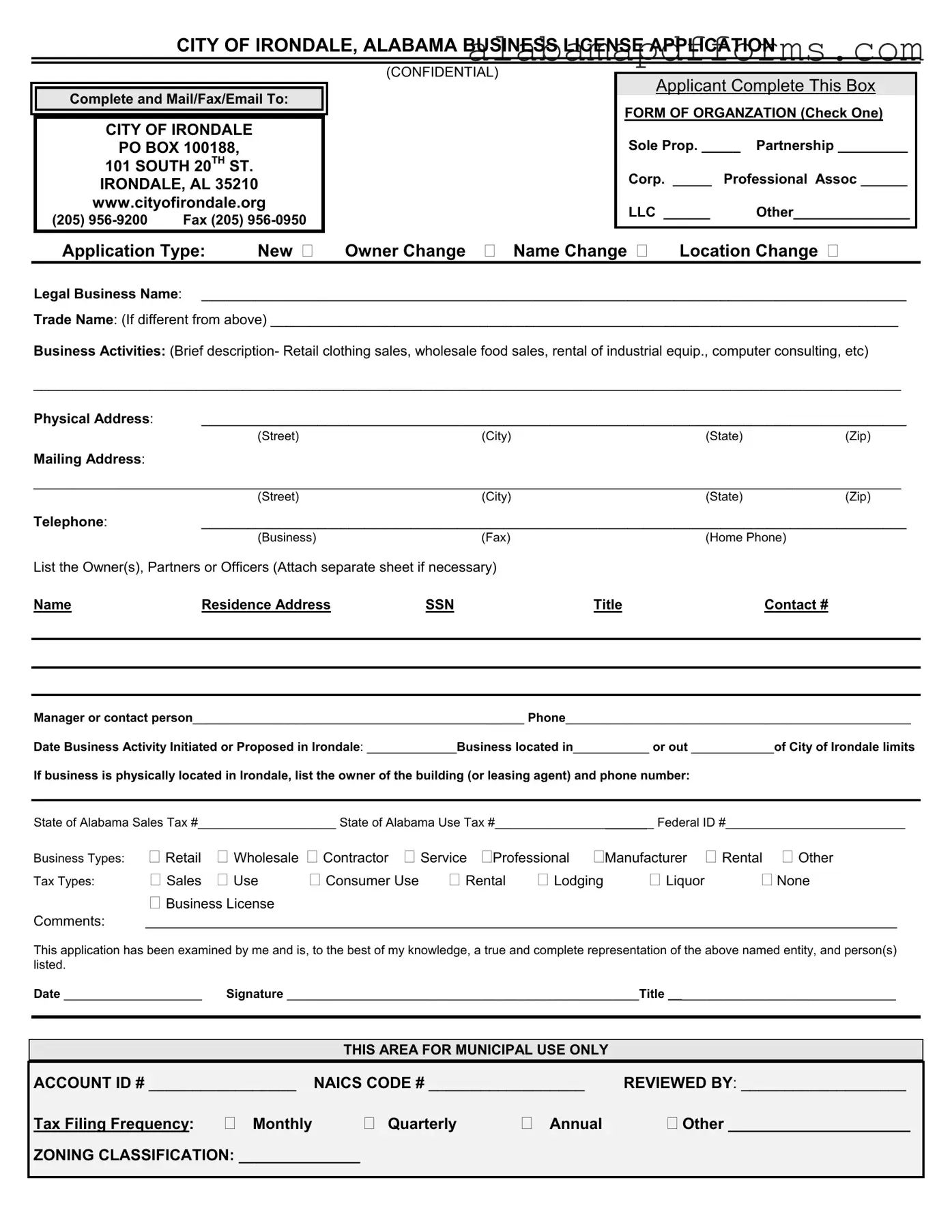

CITY OF IRONDALE, ALABAMA BUSINESS LICENSE APPLICATION

Complete and Mail/Fax/Email To:

CITY OF IRONDALE

PO BOX 100188,

101 SOUTH 20TH ST. IRONDALE, AL 35210 www.cityofirondale.org

|

|

|

(205) 956-9200 |

Fax (205) 956-0950 |

|

|

Application Type: |

New |

(CONFIDENTIAL) |

|

|

|

|

Applicant Complete This Box |

|

|

|

FORM OF ORGANZATION (Check One) |

|

Sole Prop. _____ |

Partnership _________ |

|

Corp. _____ Professional Assoc ______ |

|

LLC ______ |

Other_______________ |

|

|

|

Owner Change Name Change |

Location Change |

Legal Business Name: ___________________________________________________________________________________________

Trade Name: (If different from above) _________________________________________________________________________________

Business Activities: (Brief description- Retail clothing sales, wholesale food sales, rental of industrial equip., computer consulting, etc)

________________________________________________________________________________________________________________

Physical Address: |

___________________________________________________________________________________________ |

|

(Street) |

(City) |

(State) |

(Zip) |

Mailing Address:

________________________________________________________________________________________________________________

(Street)(City)(State)(Zip)

Telephone: |

___________________________________________________________________________________________ |

|

(Business) |

(Fax) |

(Home Phone) |

List the Owner(s), Partners or Officers (Attach separate sheet if necessary)

Name |

Residence Address |

SSN |

Title |

Contact # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manager or contact person________________________________________________ Phone__________________________________________________

Date Business Activity Initiated or Proposed in Irondale: _____________Business located in___________ or out ____________of City of Irondale limits

If business is physically located in Irondale, list the owner of the building (or leasing agent) and phone number:

State of Alabama Sales Tax #____________________ State of Alabama Use Tax #________________ |

|

_ Federal ID #__________________________ |

Business Types: |

Retail |

Wholesale |

Contractor Service Professional Manufacturer |

Rental Other |

Tax Types: |

Sales |

Use |

Consumer Use |

Rental |

Lodging |

|

Liquor |

None |

Business License

Comments: _________________________________________________________________________________________________

This application has been examined by me and is, to the best of my knowledge, a true and complete representation of the above named entity, and person(s) listed.

Date ____________________ Signature ___________________________________________________Title _________________________________

THIS AREA FOR MUNICIPAL USE ONLY

ACCOUNT ID # _________________ |

NAICS CODE # __________________ |

REVIEWED BY: ___________________ |

Tax Filing Frequency: Monthly |

Quarterly |

Annual |

Other _____________________ |

ZONING CLASSIFICATION: ______________ |

|

|

|

|

|

|

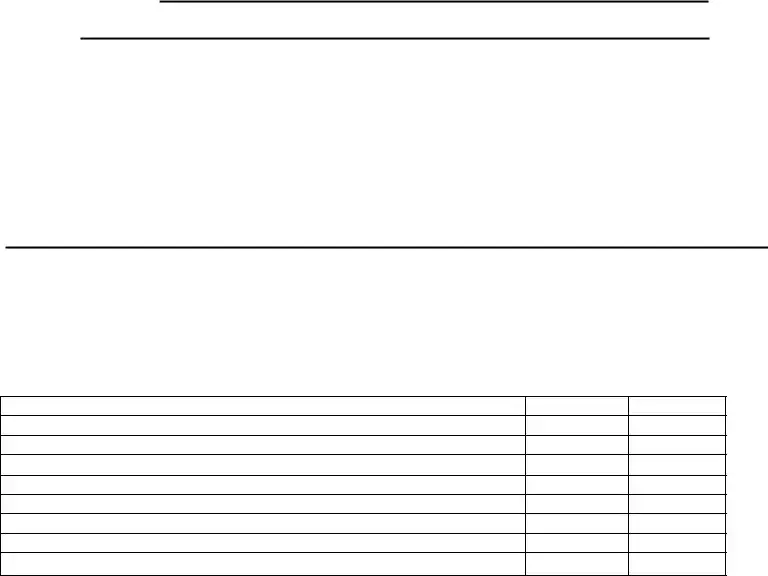

City of Irondale

Attention: Revenue Department

101 South 20th Street

Irondale, AL 35210

Name of Business:

Address:

Contact Name: ______________________________ Telephone #: _____________________

NAICS # (North American Industry Classification System) ____________________

ALL SALES ARE SHIPPED BY COMMON CARRIER AND NO PHYSICAL PRESENCE IN THE CITY OF IRONDALE. ___________YES

Date__________Signature______________________________Title______________

If any of the below question are answered “YES” a Business License is required (in order to process your application, your payment must be included).

1.If all questions are answered “NO” and all merchandise sold at retail was shipped by common carrier you must complete the business license application and report taxes only.

YES NO

Physical Presence (business location) or any of the below:

Representative(s) who visit or deliver to business

Contractor performed a job (in the City of Irondale)

Salesperson came (into the City of Irondale)

Delivery in own truck (in the City of Irondale)

Maintains Equipment (in the City of Irondale)

Leasing Equipment (in the City of Irondale)

Leasing (in the City of Irondale)

Sales are not shipped by common carrier

License fees are determined by the exact nature and type of your business. You should contact the Irondale Revenue Department at (205) 956-9200 for more information. This will determine the types of licenses required. Some licenses require State Regulatory Permits in order to issue, such as auto dealers, food establishments, and various contractors.

This application has been examined by me and is, to the best of my knowledge, a true and complete representation of the above named entity, and person(s) listed.

Date________Signature__________________________________Title_____________

THIS FORM MUST BE SIGNED AND RETURNED WITH APPLICATION

PLEASE READ THE FOLLOWING INFORMATION CONCERNING THE COMPLETION OF THIS FORM

•PLEASE COMPLETE ALL AREAS OF THE FORM EXCEPT FOR THE MUNICIPAL USE ONLY AREA AT THE BOTTOM.

•FORM SHOULD BE TYPED OR PRINTED LEGIBLY

•FORM SHOULD BE DATED AND SIGNED BY AN OWNER, PARTNER, OR OFFICER OF THE BUSINESS

•FORM WILL INITIATE THE PROCESS FOR REGISTERING YOUR BUSINESS WITH THE MUNICIPALITY

⇒IF YOUR BUSINESS WILL HAVE A PHYSICAL LOCATION WITHIN THE MUNICIPALITY PLEASE USE THAT ADDRESS ON THE FRONT OF THIS FORM. (Complete separate forms for each physical location in the city)

⇒AFTER COMPLETING THIS FORM IT CAN BE MAILED, SENT BY FAX, OR WHERE POSSIBLE, SENT BY ELECTRONIC MAIL TO THE MUNICIPALITY.

⇒UPON RECEIPT OF THE COMPLETED FORM, THE MUNICIPALITY WILL PROVIDE ANY ADDITIONAL FORMS AND INFORMATION REGARDING OTHER SPECIFIC REQUIREMENTS TO YOU IN ORDER TO COMPLETE THE LICENSING PROCESS.

ALL LICENSE RENEWALS ARE DUE JANUARY 1 AND DELINQUENT AFTER JANUARY 31, WITH THE FOLLOWING EXCEPTIONS:

INSURANCE COMPANY LICENSE: DUE JANUARY 1, DELINQUENT AFTER MARCH 1

This form is intended as a simplified, standard mechanism for businesses to initiate contact with a municipality concerning their activities within that city. A business license will be required prior to engaging in business. If a business intends to maintain a physical location within the city, there are normally zoning and building code approvals required prior to the issuance of a license.

In certain instances, a business may simply be required to register with the city to create a mechanism for the reporting and payment of any tax liabilities. If that is the case, you will be provided the materials for that registration process.

The completion and submission of this form does not guarantee the approval or subsequent issuance of a license to do business. Any prerequisites for a particular type and location of the business must be satisfied prior to licensing.

SHOULD THERE BE ANY QUESTI ONS CONCERNI NG THE COMPLETI ON OF THI S FORM REGI STRATI ON PROCESS, PLEASE CALL ( 205) 956 - 9200 OR FAX ( 205) 956 - 0950

EXPLANATI ON.

OR THE LI CENSI NG FEE AND/ OR TO OBTAI N A MORE DETAI LED

Each per son, fir m , cor por at ion or ot her business ent it y m ust obt ain a Cit y of I r ondale business license pr ior t o conduct ing business act iv it y in t he Cit y of I r ondale. The license y ear is Januar y 1 t hr ough Decem ber 31 . Business license r enew als ar e due Januar y 1 and delinquent aft er Januar y 31 each y ear . Pr oof of St at e cer t ificat ion is r equir ed for cer t ain classificat ions.