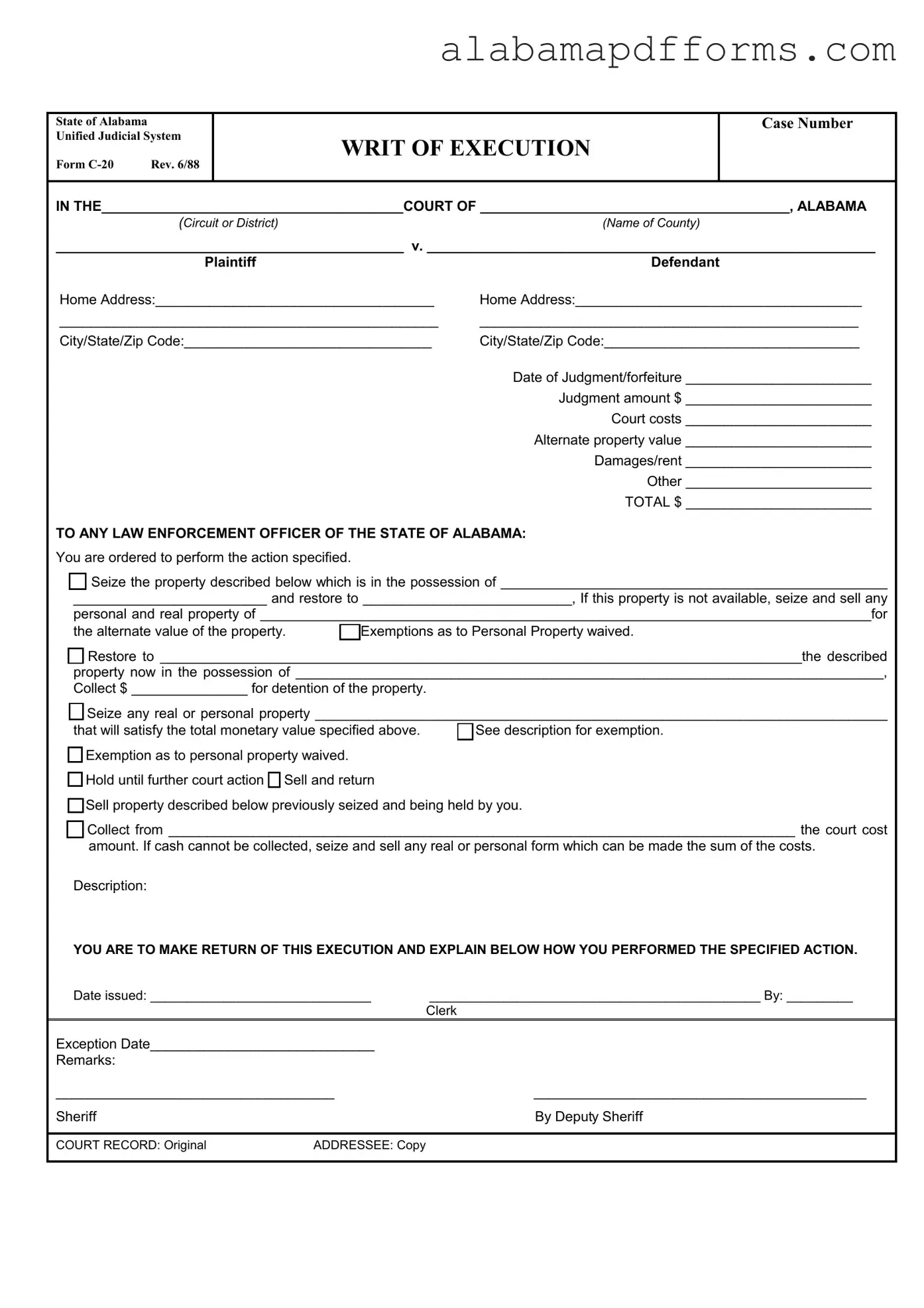

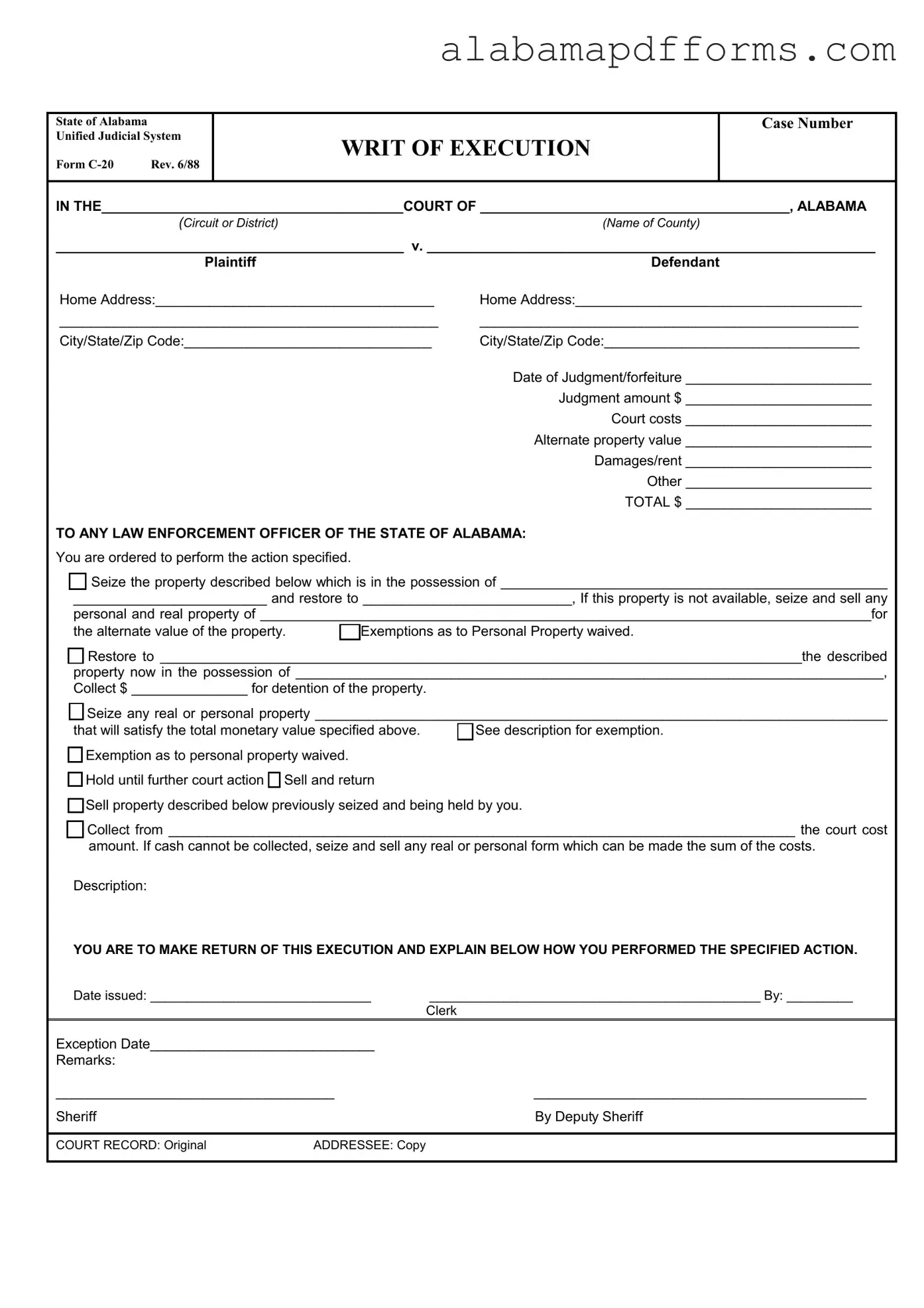

The Alabama C 20 form is similar to a Writ of Attachment. A Writ of Attachment allows a creditor to seize a debtor's property before a judgment is made. Both documents serve to enforce a legal claim, but the Writ of Attachment is typically used to secure assets in anticipation of a potential judgment. This preemptive action helps ensure that the debtor does not dispose of their assets before the court can make a ruling.

Another document akin to the C 20 form is the Writ of Garnishment. This legal tool allows a creditor to collect a debt directly from a third party holding the debtor's assets, such as an employer or bank. Similar to the C 20, it aims to recover a judgment amount but does so by targeting funds rather than physical property. Both forms require legal proceedings and can lead to the seizure of assets to satisfy debts.

The C 20 form also resembles a Judgment Lien. A Judgment Lien is a legal claim against a debtor's property after a court judgment has been rendered. Like the C 20, it serves to enforce a monetary judgment, but a Judgment Lien typically remains in effect until the debt is satisfied or the property is sold. This document ensures that creditors have a legal claim to the debtor's property as a form of security for the debt owed.

A similar document is the Notice of Default. This is issued when a borrower fails to meet the terms of a loan agreement. While the C 20 form focuses on the enforcement of a judgment, the Notice of Default serves as a preliminary step that can lead to foreclosure or repossession. Both documents are part of the process of collecting debts, but they operate at different stages in the legal proceedings.

When dealing with property transfers, one might consider the use of a Colorado Quitclaim Deed, which plays an essential role in facilitating the transfer of real estate ownership without the guarantees that come with a warranty deed. This can be particularly useful for resolving family disputes or clarifying title issues, and for those interested in learning more about the specifics of this process, visit quitclaimdeedtemplate.com/colorado-quitclaim-deed-template for a comprehensive guide and template.

The C 20 form is also comparable to a Replevin Action. This legal action allows a party to recover personal property that is wrongfully taken or retained. Like the C 20, it involves the court's intervention to reclaim property, but a Replevin Action specifically targets the return of goods rather than monetary judgments. Both processes involve legal proceedings to enforce rights over property.

Another related document is the Execution on Judgment. This is a broader term that encompasses various methods of enforcing a court's judgment, including the C 20 form. Both documents aim to collect on a judgment, but the Execution on Judgment can refer to multiple forms of enforcement, such as garnishment, attachment, or property seizure, making it a more general term in the enforcement process.

The C 20 form shares similarities with a Claim of Exemption. While the C 20 is used to execute a judgment, a Claim of Exemption allows a debtor to assert that certain property should not be seized. Both documents involve the rights of creditors and debtors, but the Claim of Exemption focuses on protecting specific assets from being sold to satisfy debts, highlighting the balance between creditor rights and debtor protections.

The form is also akin to a Bankruptcy Filing. When individuals or businesses file for bankruptcy, they seek relief from debts and may list their assets for protection. Like the C 20, bankruptcy proceedings can lead to the resolution of debts, but bankruptcy offers a more comprehensive framework for debt relief, including the potential discharge of certain obligations, which is not available under a Writ of Execution.

Another document similar to the C 20 is a Settlement Agreement. This legal document outlines the terms agreed upon by both parties to resolve a dispute outside of court. While the C 20 is a tool for enforcing a judgment, a Settlement Agreement can prevent the need for such enforcement by allowing both parties to come to a mutually acceptable resolution. Both documents are integral to the legal process but serve different purposes in the resolution of disputes.

Lastly, the C 20 form is comparable to a Foreclosure Notice. A Foreclosure Notice is issued when a lender seeks to reclaim property due to non-payment of a mortgage. Both documents involve the seizure of property to satisfy a debt, but a Foreclosure Notice specifically pertains to real estate and mortgage agreements, while the C 20 can apply to various types of judgments and property. Both processes are part of the larger framework of debt enforcement.