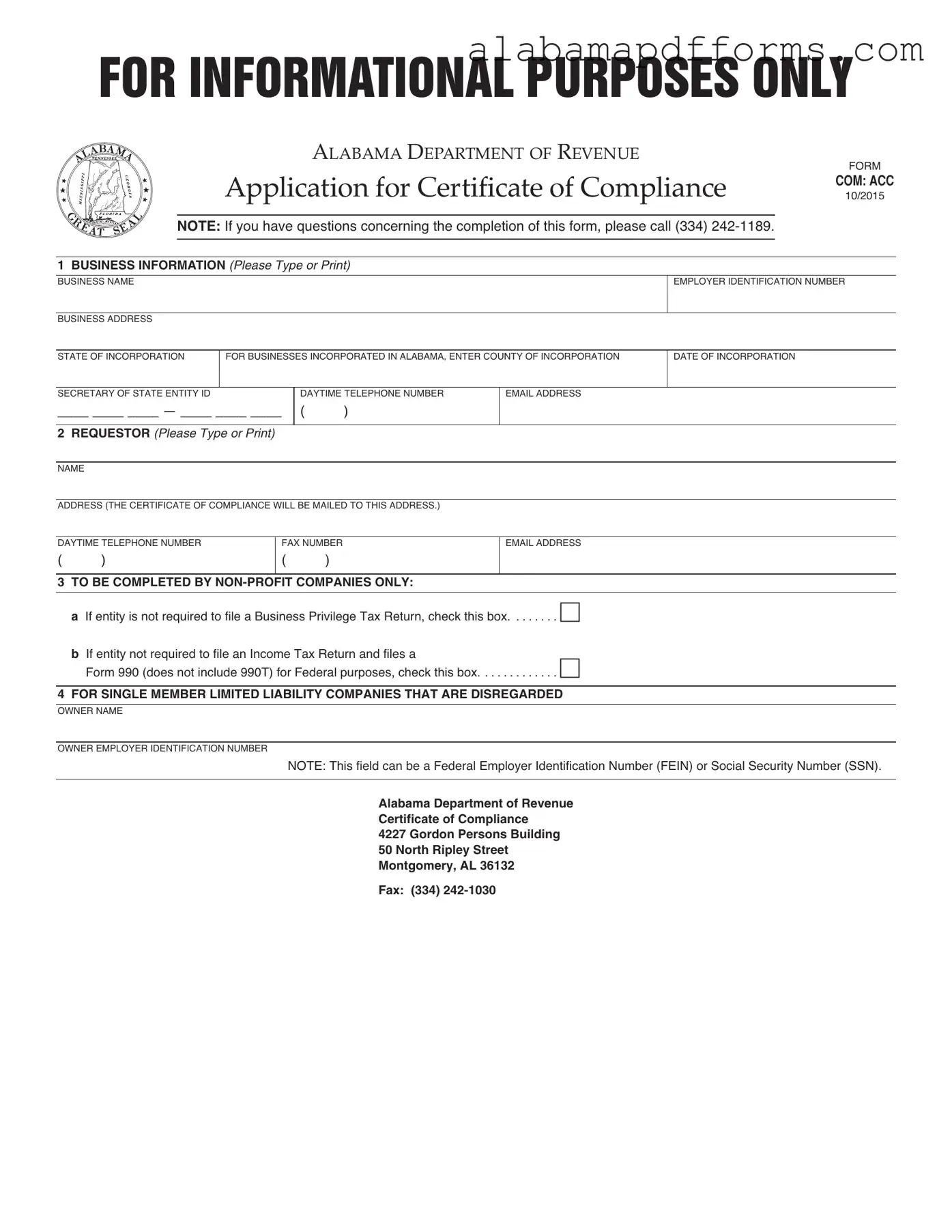

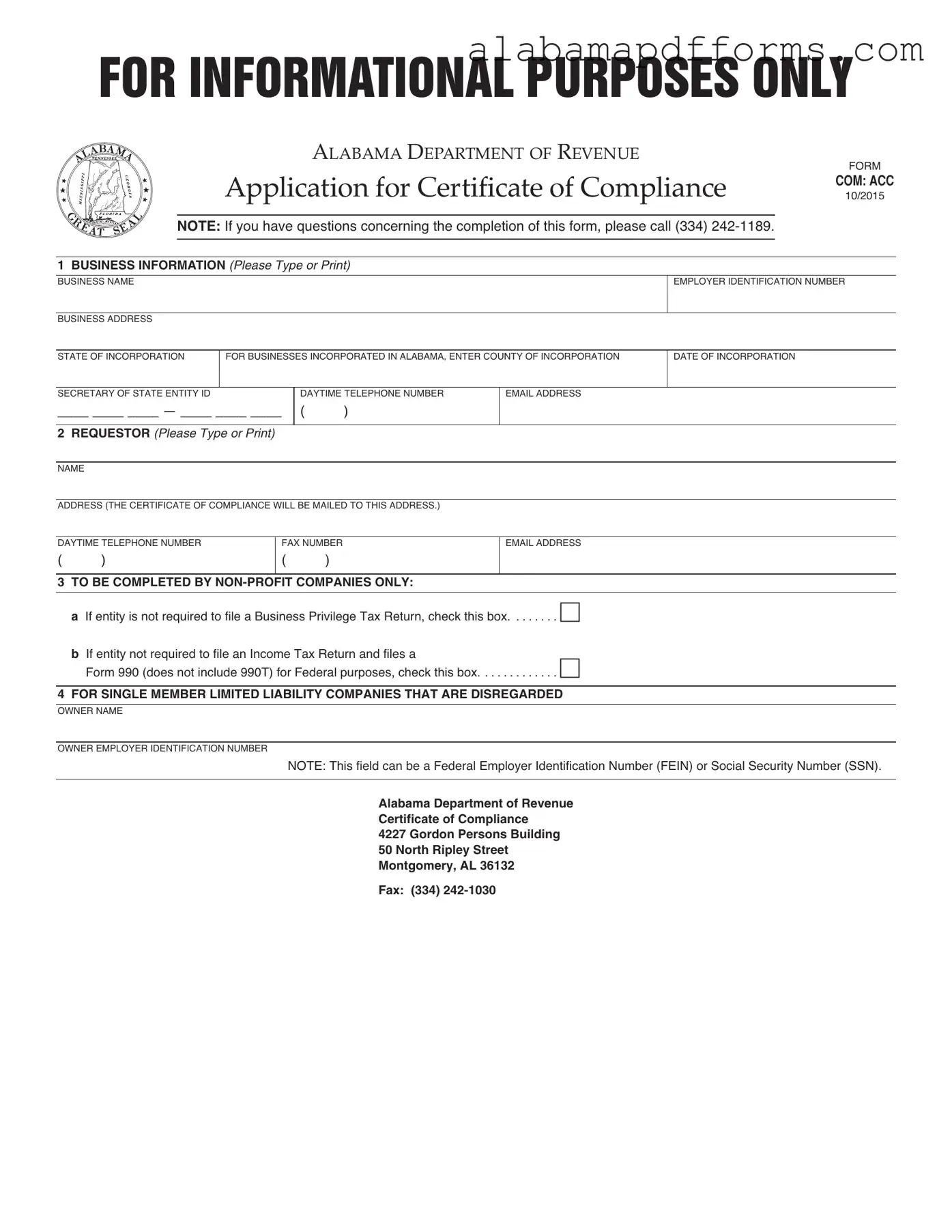

Fill Out a Valid Alabama Certificate Of Compliance Form

The Alabama Certificate of Compliance form is an essential document used by businesses to verify their compliance with state regulations. This certificate is particularly important for entities seeking to confirm their standing with the Alabama Department of Revenue. Completing this form accurately ensures that businesses can maintain their good standing and fulfill necessary legal obligations.

Fill Out Your Document Online

Fill Out a Valid Alabama Certificate Of Compliance Form

Fill Out Your Document Online

Fill Out Your Document Online

or

➤ Alabama Certificate Of Compliance PDF Form

Your form is halfway done

Complete and edit Alabama Certificate Of Compliance online in minutes, hassle-free.