|

|

|

|

|

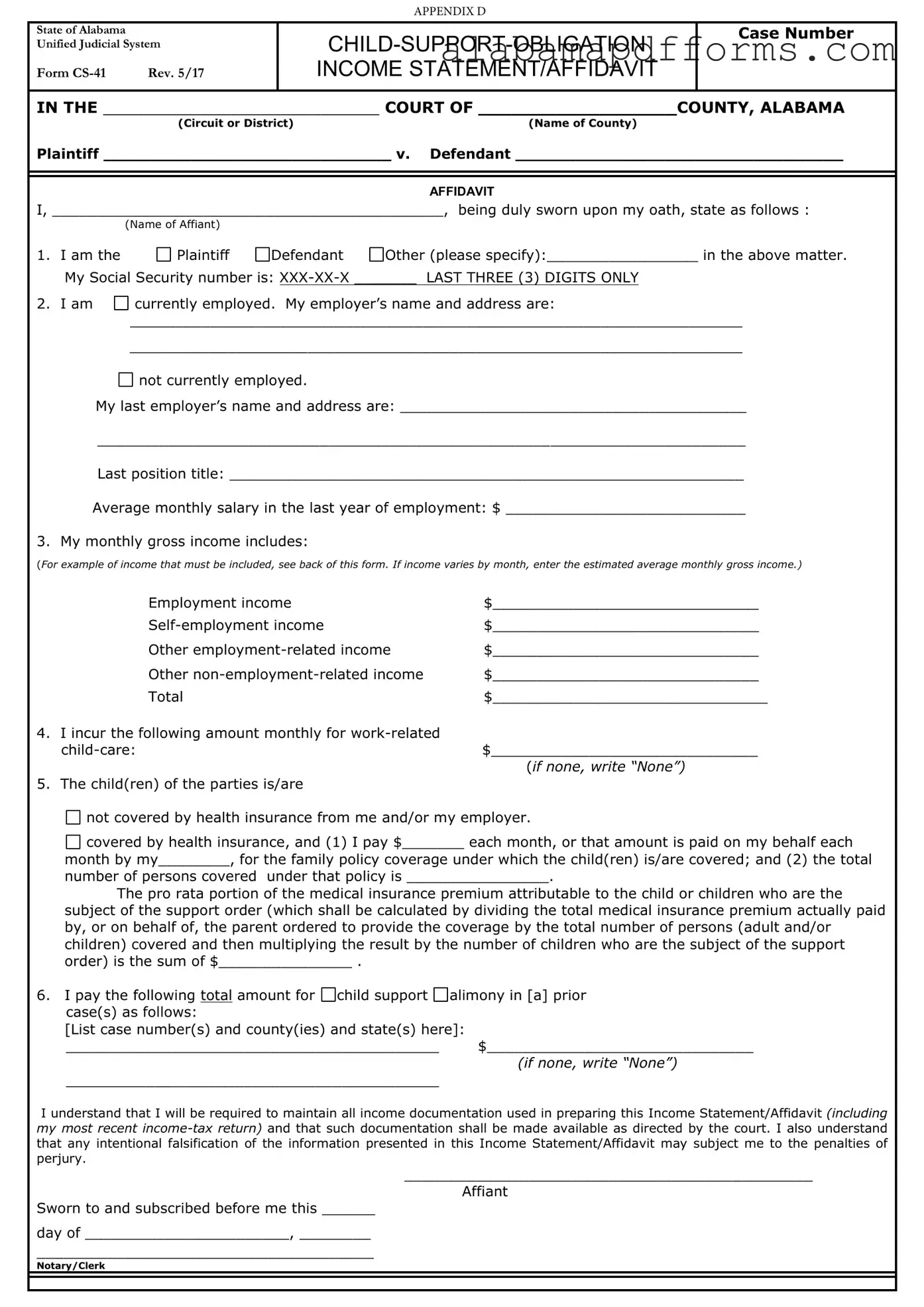

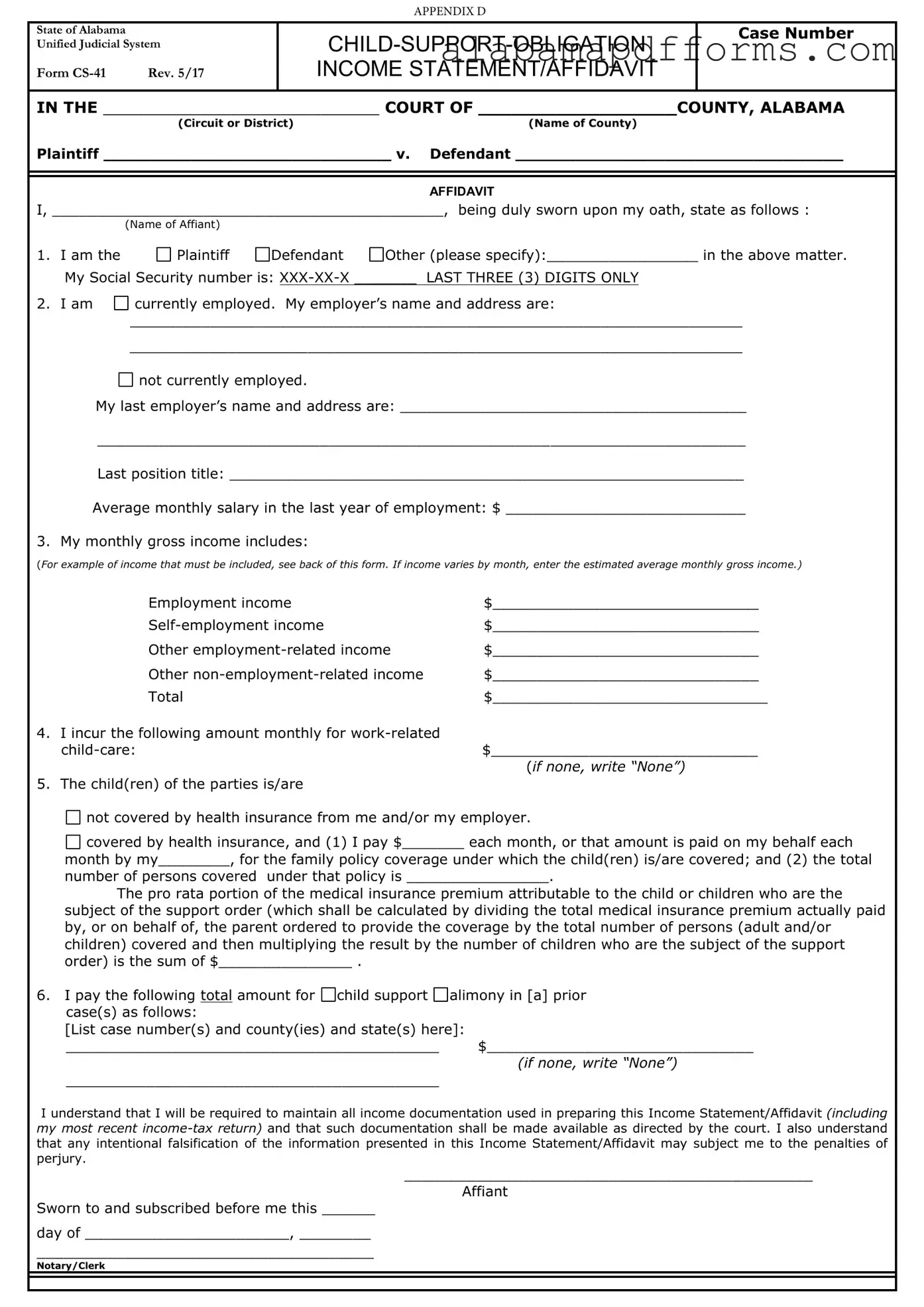

APPENDIX D |

|

State of Alabama |

|

|

|

CHILD-SUPPORT-OBLIGATION |

Case Number |

Unified Judicial System |

|

|

|

Form CS-41 |

Rev. 5/17 |

|

|

INCOME STATEMENT/AFFIDAVIT |

|

|

|

|

IN THE ____________________________ COURT OF __________________COUNTY, ALABAMA |

|

(Circuit or District) |

|

|

(Name of County) |

|

Plaintiff _____________________________ v. |

Defendant _________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFIDAVIT |

|

I, ____________________________________________, being duly sworn upon my oath, state as follows : |

(Name of Affiant) |

|

|

|

|

|

|

1. I am the |

Plaintiff |

Defendant |

Other (please specify):_________________ in the above matter. |

My Social Security number is: XXX-XX-X _______ |

LAST THREE (3) DIGITS ONLY |

|

2. I am |

currently employed. My employer’s name and address are: |

|

|

_____________________________________________________________________ |

_____________________________________________________________________

not currently employed.

not currently employed.

My last employer’s name and address are: _______________________________________

_________________________________________________________________________

Last position title: __________________________________________________________

Average monthly salary in the last year of employment: $ ___________________________

3. My monthly gross income includes:

(For example of income that must be included, see back of this form. If income varies by month, enter the estimated average monthly gross income.)

|

Employment income |

$______________________________ |

|

Self-employment income |

$______________________________ |

|

Other employment-related income |

$______________________________ |

|

Other non-employment-related income |

$______________________________ |

|

Total |

$_______________________________ |

4. |

I incur the following amount monthly for work-related |

|

|

child-care: |

$______________________________ |

|

|

(if none, write “None”) |

5. |

The child(ren) of the parties is/are |

|

not covered by health insurance from me and/or my employer.

not covered by health insurance from me and/or my employer.

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

month by my________, for the family policy coverage under which the child(ren) is/are covered; and (2) the total

number of persons covered under that policy is ________________.

The pro rata portion of the medical insurance premium attributable to the child or children who are the subject of the support order (which shall be calculated by dividing the total medical insurance premium actually paid by, or on behalf of, the parent ordered to provide the coverage by the total number of persons (adult and/or children) covered and then multiplying the result by the number of children who are the subject of the support order) is the sum of $_______________ .

6.I pay the following total amount for

child support

child support

alimony in [a] prior case(s) as follows:

alimony in [a] prior case(s) as follows:

[List case number(s) and county(ies) and state(s) here]:

__________________________________________ $______________________________

(if none, write “None”)

__________________________________________

I understand that I will be required to maintain all income documentation used in preparing this Income Statement/Affidavit (including my most recent income-tax return) and that such documentation shall be made available as directed by the court. I also understand that any intentional falsification of the information presented in this Income Statement/Affidavit may subject me to the penalties of perjury.

______________________________________________

Affiant

Sworn to and subscribed before me this ______

day of _______________________, ________

______________________________________

Form CS-41 (Back)

EXAMPLES OF INCOME THAT MUST BE INCLUDED IN YOUR GROSS MONTHLY INCOME

1.Employment Income – shall include, but not be limited to, salary, wages, bonuses, commissions, severance pay, worker’s compensation, pension income, unemployment insurance, disability insurance, and Social Security benefits.

2.Self–Employment Income – shall include, but not be limited to, income from self-employment, rent, royalties, proprietorship of a business, or joint ownership of a partnership or closely held corporation. “Gross income” means gross receipts minus ordinary and necessary expenses required to produce this income.

3.Other Employment–Related Income – shall include, but not be limited to, the average monthly value of any expense reimbursements or in-kind payments received in the course of employment that are significant and reduce personal living expenses, such as a furnished automobile, a clothing allowance, and a housing allowance.

4.Other Non-Employment-Related Income – shall include, but not be limited to, dividends, interest, annuities, capital gains, gifts, prizes, and pre-existing periodic alimony.

RULE 32, ALABAMA RULES OF JUDICIAL ADMINISTRATION, PROVIDES THE FOLLOWING DEFINITIONS:

Income. For purposes of the guidelines specified in this Rule, “income” means the actual gross income of a parent, if the parent is employed to full capacity, or if the parent is unemployed or underemployed, then it means the actual gross income the parent has the ability to earn.

Gross Income.

“Gross income” includes income from any source, and includes, but is not limited to, income from salaries,

wages, commissions, bonuses, dividends, severance pay, pensions, interest, trust income, annuities, capital gains, Social Security benefits, workers’ compensation benefits, unemployment-insurance benefits, disability-

insurance benefits, gifts, prizes, and preexisting periodic alimony.

“Gross income” does not include child support received for other children or benefits received from means- tested public-assistance programs, including, but not limited to, Temporary Assistance for Needy Families, Supplemental Security Income, food stamps, and general assistance.

Self–employment Income.

For income from self-employment, rent, royalties, proprietorship of business, or joint ownership of a partnership or closely held corporation, “gross income” means gross receipts minus ordinary and necessary

expenses required to produce such income, as allowed by the Internal Revenue Service, with the exceptions noted in Rule 32 (B)(3)(b).

Under those exceptions, “ordinary and necessary expenses” does not include amounts allowable by the Internal Revenue Service for the accelerated component of depreciation expenses, investment tax credits, or any other business expenses determined by the court to be inappropriate for determining gross income for purposes of calculating child support.

Other Income. Expense reimbursements or in-kind payments received by a parent in the course of employment of self-employment or operation of a business shall be counted as income if they are significant and reduce personal living expenses.

not currently employed.

not currently employed.

not covered by health insurance from me and/or my employer.

not covered by health insurance from me and/or my employer.

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

child support

child support

alimony in [a] prior case(s) as follows:

alimony in [a] prior case(s) as follows: