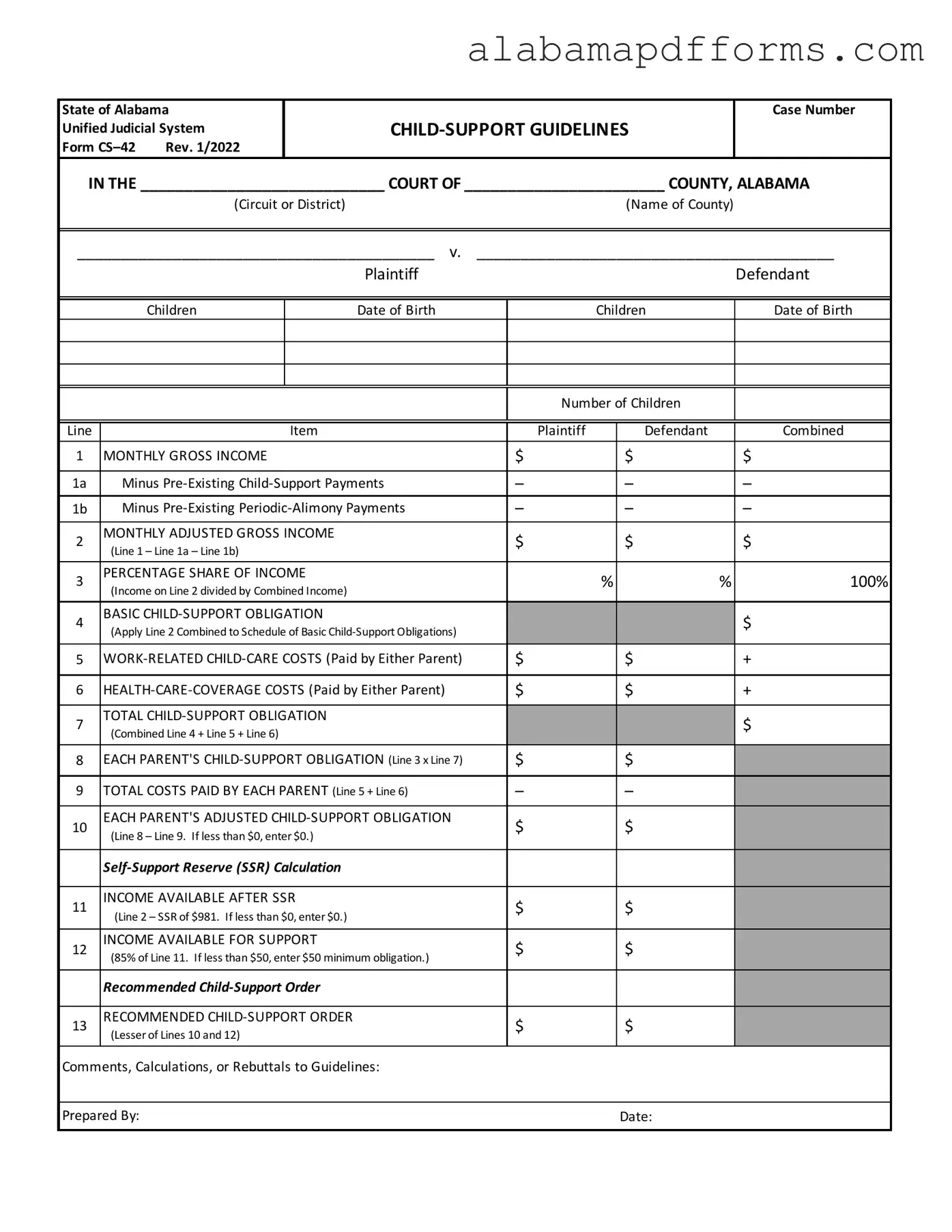

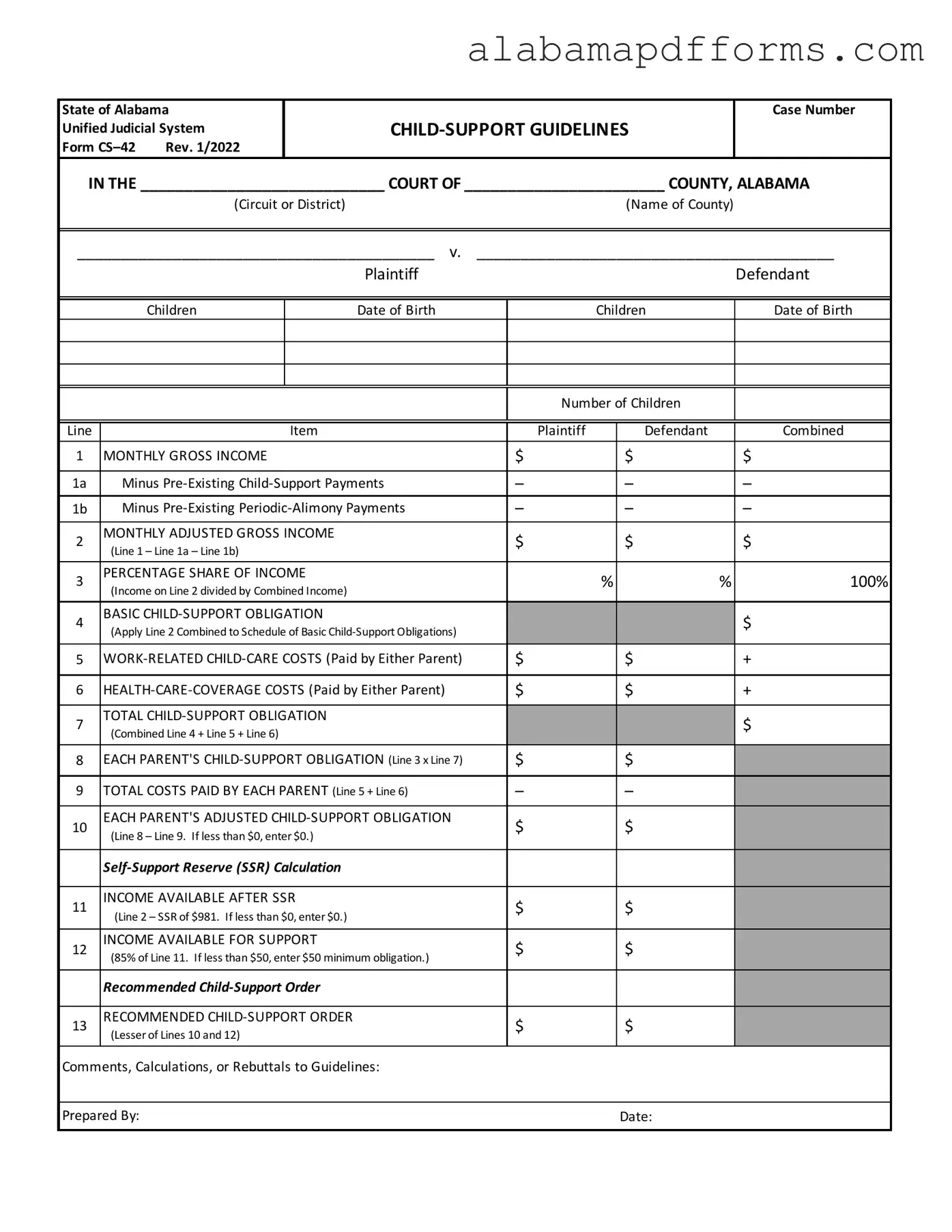

The Alabama Child Support Sheet form is similar to the Florida Child Support Guidelines Worksheet. Both documents aim to calculate child support obligations based on the income of both parents. They include sections for gross income, deductions for pre-existing support payments, and adjustments for child care and health care costs. The overall structure is designed to ensure that both parents contribute fairly to their children's needs, and they provide a clear method for determining financial responsibilities.

Another comparable document is the Georgia Child Support Worksheet. This worksheet also breaks down income and expenses to arrive at a child support figure. It features a calculation for the combined income of both parents and includes deductions for other support obligations. The Georgia form emphasizes the importance of accurately reporting income and expenses to ensure a fair outcome for all parties involved.

The Texas Child Support Guidelines form is yet another similar document. Like the Alabama Child Support Sheet, it uses a formula based on both parents' incomes to determine the support obligation. The Texas form includes sections for additional costs, such as medical expenses and child care, ensuring that all relevant financial factors are considered in the final calculation. This helps to create a comprehensive view of the financial responsibilities each parent holds.

The California Child Support Calculation form shares similarities as well. It focuses on the income of both parents and incorporates various deductions to arrive at the final support amount. The California form also allows for adjustments based on the needs of the child, ensuring that the best interests of the child are prioritized in the financial agreement.

The New York Child Support Worksheet is another relevant document. This worksheet calculates child support obligations based on the parents' combined income, similar to the Alabama Child Support Sheet. It includes provisions for additional expenses, such as health care and child care, and ensures that both parents' financial situations are taken into account. This promotes a balanced approach to child support determination.

In addition to the various financial forms discussed, it is important to consider legal documents that outline individual wishes regarding medical care, such as a Do Not Resuscitate Order. These documents, including the Colorado PDF Forms, ensure that medical personnel have a clear understanding of a patient's preferences in critical situations, paralleling the need for clarity and transparency in financial disclosures found in child support documentation.

The Illinois Child Support Calculator is comparable as well. It provides a structured format for calculating child support obligations based on the income of both parents. This calculator includes deductions for other support payments and considers additional costs, such as health insurance and daycare expenses. The Illinois form aims to create a fair and equitable child support arrangement.

The Ohio Child Support Worksheet also mirrors the Alabama Child Support Sheet in its purpose and structure. It calculates the financial obligations of both parents based on their income and includes adjustments for other support obligations. The Ohio worksheet emphasizes transparency in financial reporting, ensuring that both parents contribute appropriately to their children's upbringing.

Lastly, the Michigan Child Support Formula is another similar document. It calculates child support obligations by assessing the income of both parents and accounting for necessary expenses. The Michigan formula includes provisions for health care and child care costs, ensuring a comprehensive approach to determining child support. This document, like the Alabama Child Support Sheet, is designed to promote fairness and the best interests of the child.