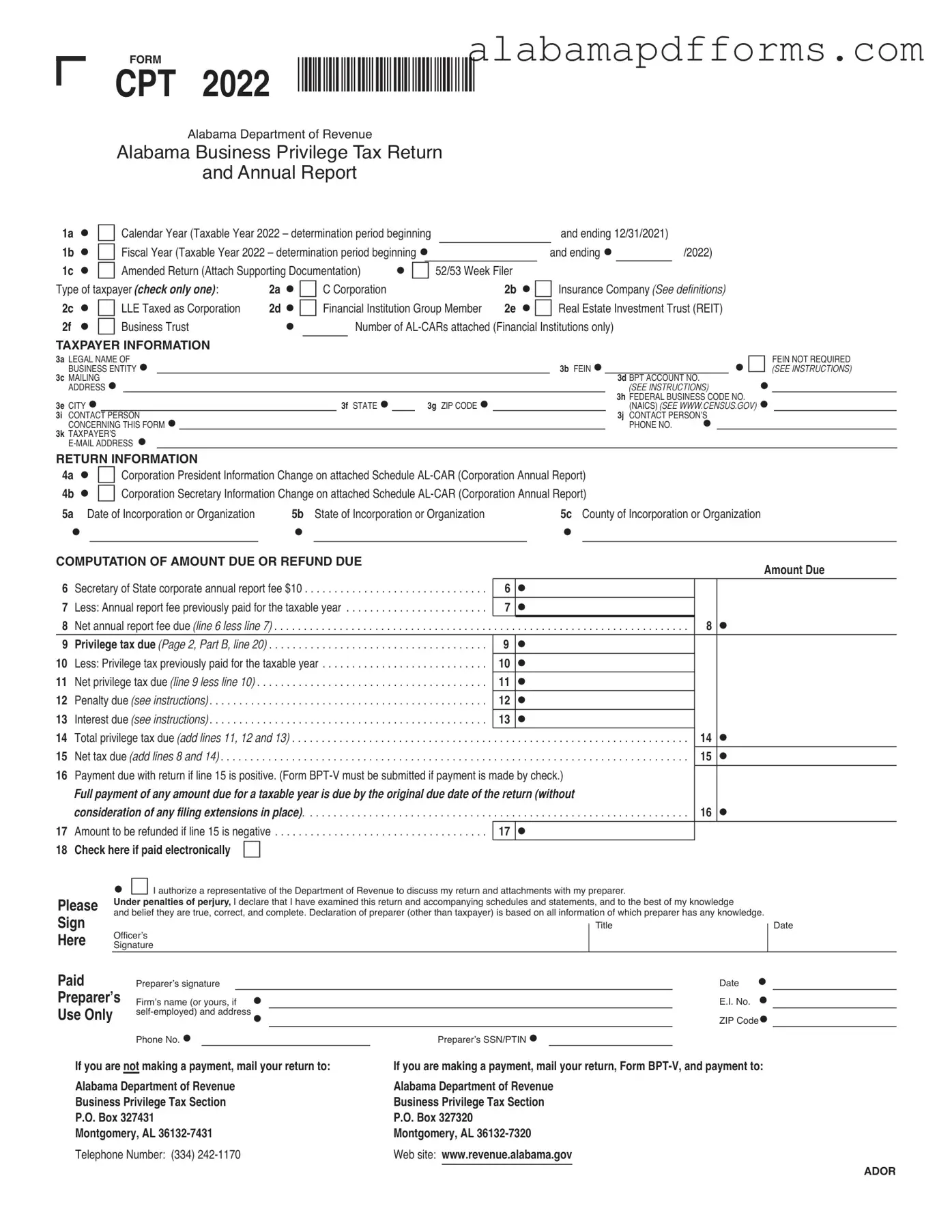

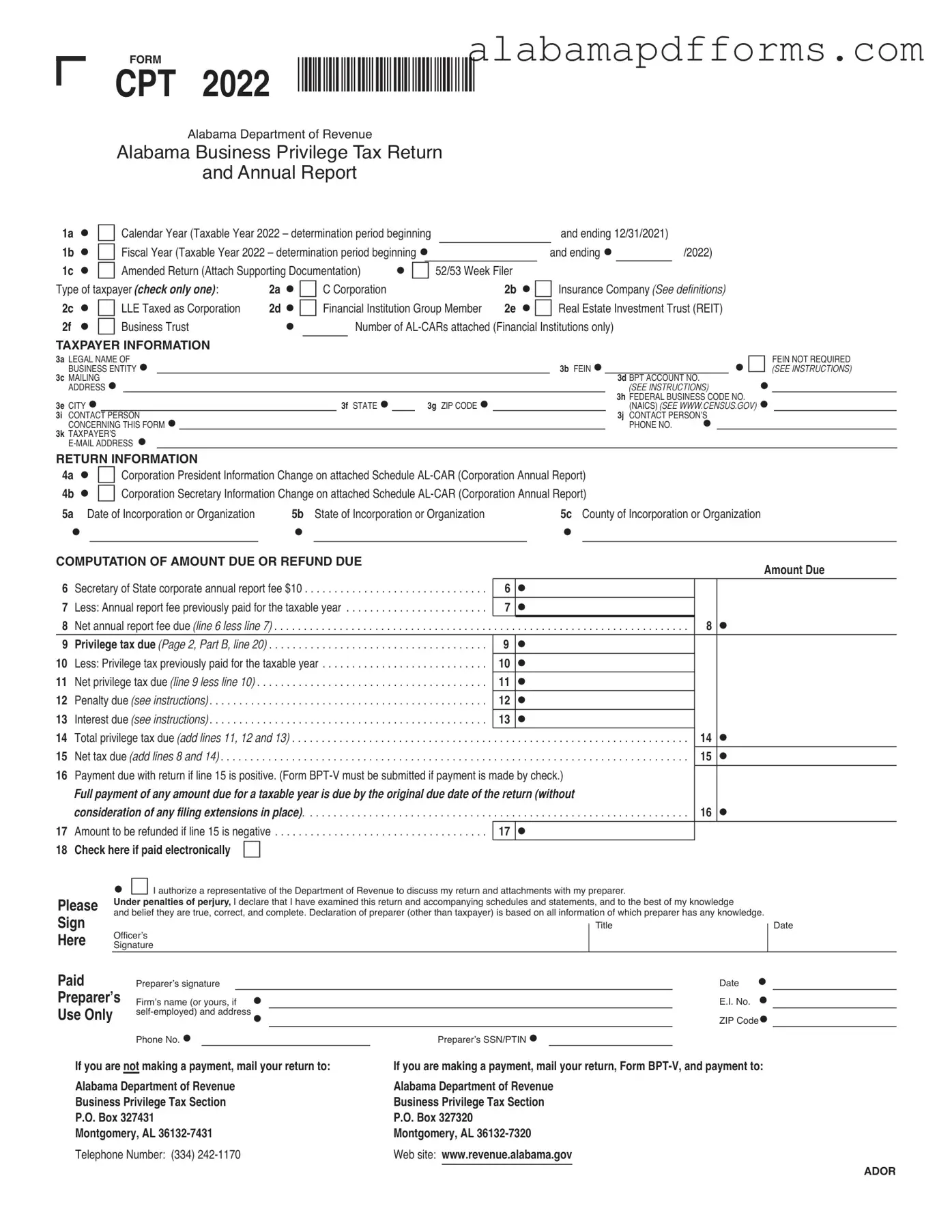

The Alabama Business Privilege Tax Return (CPT) shares similarities with the California Corporate Franchise Tax Board Form 100. Both forms require corporations to report their income and calculate taxes owed based on net income or net worth. The California form also includes sections for taxpayer information, determination periods, and tax computations, reflecting a similar structure aimed at assessing corporate tax obligations. Each form mandates the filing of an annual report and includes specific instructions regarding penalties for late submissions.

For boat owners in California, ensuring the proper transfer of ownership is crucial, which is why utilizing forms like the Marine Bill of Sale can facilitate a smooth transaction process. This document protects both parties involved by clearly recording essential details of the sale, thus serving as a vital part of the buying and selling experience.

Another document akin to the Alabama CPT is the New York State Corporation Franchise Tax Return (CT-3). This form serves C-Corporations in New York and requires details about the corporation’s income, deductions, and credits. Like the Alabama form, it necessitates taxpayer identification information and has a clear layout for tax calculations. Both documents also include provisions for amended returns, emphasizing the importance of accuracy in corporate tax reporting.

The Texas Franchise Tax Report is another document comparable to the Alabama CPT. Texas corporations must file this report annually, detailing their revenue and calculating the franchise tax based on their margin. Similar to the Alabama form, it requires basic information about the corporation and provides a framework for calculating tax liabilities. Both forms also allow for deductions and credits, reflecting the states' efforts to ensure fair taxation of corporations.

Additionally, the Florida Corporate Income Tax Return (F-1120) is similar to the Alabama CPT form. Corporations in Florida must complete this form to report their income and calculate the corporate income tax. Both documents include sections for taxpayer information, income reporting, and tax computation. Furthermore, they both require corporations to maintain compliance with state regulations and file returns by specific deadlines to avoid penalties.

The Illinois Corporation Income and Replacement Tax Return (IL-1120) is another relevant document. This form is used by corporations to report their income and calculate taxes owed to the state of Illinois. Similar to the Alabama CPT, it requires detailed information about the corporation, including its financial status and tax calculations. Both forms aim to ensure that corporations meet their tax obligations while allowing for certain deductions and credits based on specific criteria.

The Pennsylvania Corporate Net Income Tax Return (RCT-101) also bears resemblance to the Alabama CPT form. Corporations in Pennsylvania utilize this form to report their income and calculate the corporate net income tax. Both documents require comprehensive financial data and include sections for various deductions and credits. They also emphasize the importance of timely filing to avoid penalties, maintaining a consistent approach to corporate taxation across states.

Another document that aligns with the Alabama CPT is the Ohio Corporate Franchise Tax Report (FT-1120). Corporations in Ohio use this form to report their taxable income and calculate the franchise tax owed. Similarities include the structure of the form, which captures taxpayer information, income details, and tax computations. Both forms also allow for the inclusion of various deductions, reflecting the states' approaches to corporate taxation.

Lastly, the Massachusetts Corporate Excise Tax Return (Form 355) is comparable to the Alabama CPT form. Corporations in Massachusetts must file this return to report their income and calculate the excise tax owed. Both forms require detailed taxpayer information and provide a framework for income reporting and tax calculations. They also share common deadlines for submission and penalties for late filings, emphasizing the importance of compliance in corporate tax responsibilities.