The Alabama DD-1 form is similar to the IRS Form 8888, which allows taxpayers to direct their tax refunds into one or more bank accounts. Both forms require individuals to provide their banking information and authorize automatic deposits. The IRS Form 8888 also offers the option to split refunds between accounts, similar to how the DD-1 form allows changes in direct deposit instructions. Both forms emphasize the importance of accurate account details to ensure proper transactions.

Another document comparable to the Alabama DD-1 is the Social Security Administration's Direct Deposit Authorization form. This form enables recipients of Social Security benefits to authorize direct deposits into their bank accounts. Like the DD-1, it requires the beneficiary's name, Social Security number, and banking information. Both forms serve to streamline the payment process, ensuring that funds are deposited directly into the claimant's account without delay.

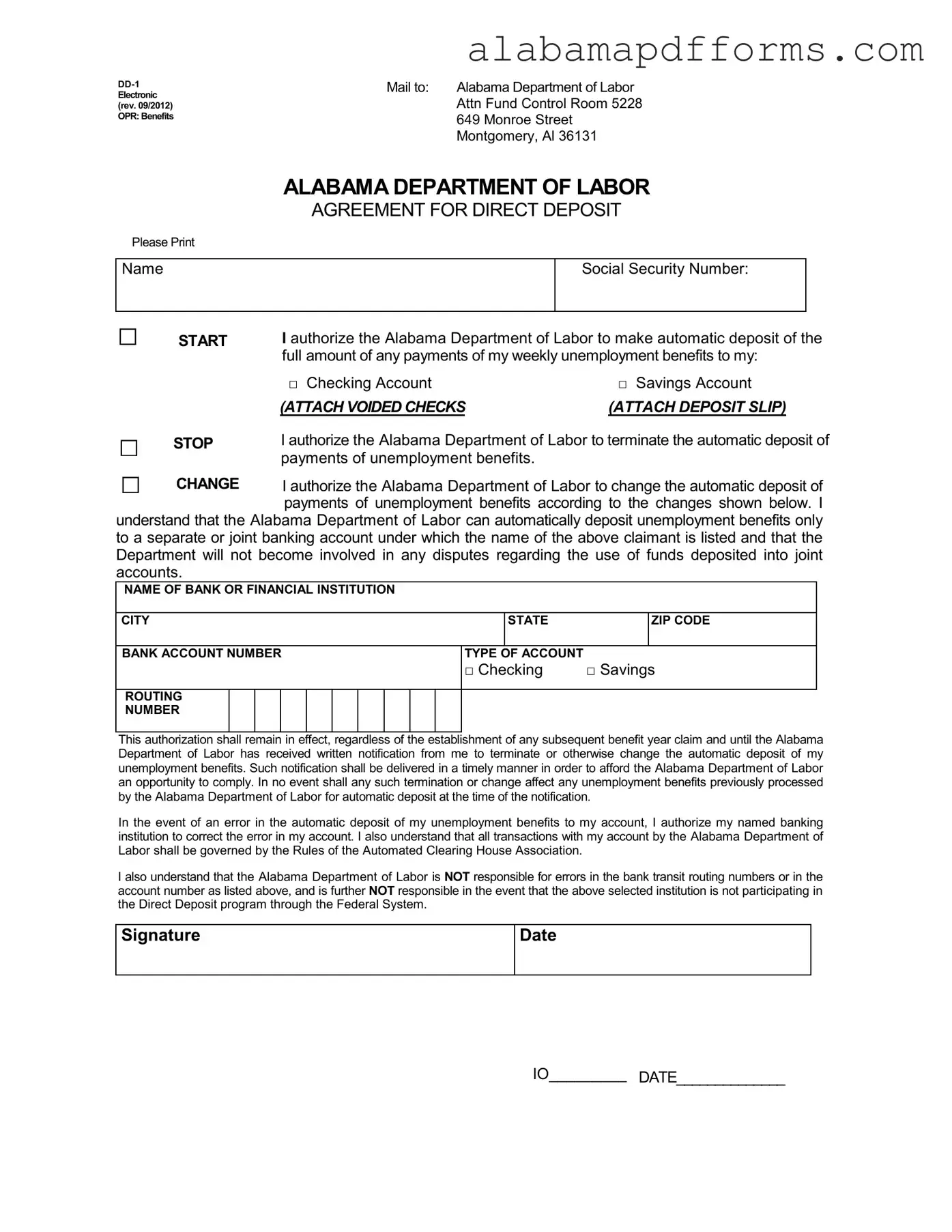

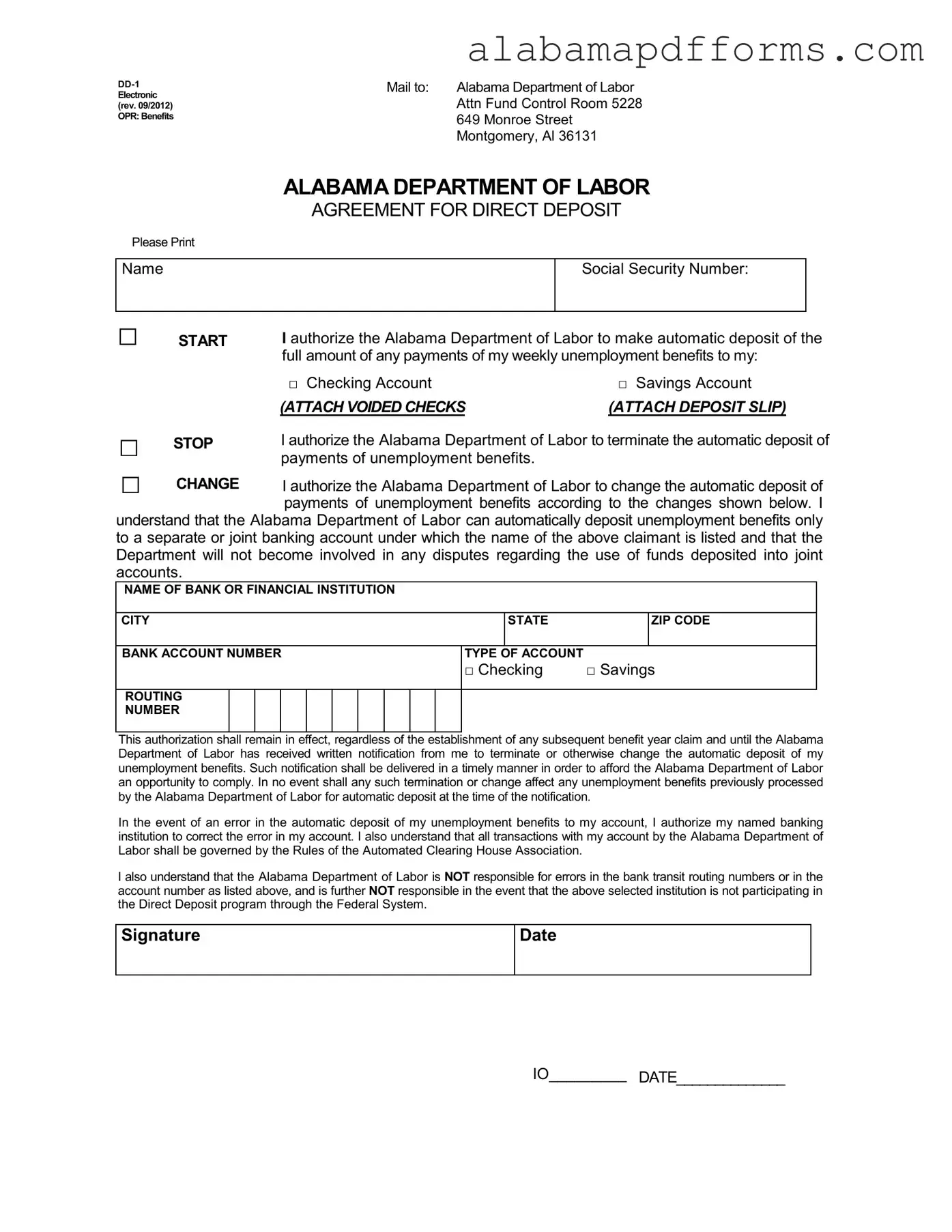

The Unemployment Insurance Direct Deposit form used by many states shares similarities with the Alabama DD-1 form. This document allows individuals receiving unemployment benefits to opt for direct deposit into their bank accounts. Both forms aim to facilitate timely payments and require similar information, such as the account type and routing numbers. They also highlight the necessity of notifying the respective agency of any changes to banking information.

Additionally, the Veterans Affairs Direct Deposit Enrollment form is akin to the DD-1. This form allows veterans to enroll in direct deposit for their benefits. It requires personal information and banking details, just like the Alabama DD-1. Both documents ensure that payments are made efficiently and directly to the claimant’s account, thus enhancing convenience for the recipient.

The Direct Deposit Authorization form for pension plans also resembles the Alabama DD-1. This document allows pension recipients to authorize their pension payments to be deposited directly into their bank accounts. Both forms necessitate detailed banking information and highlight the importance of accurate data to avoid payment errors. They serve to provide a seamless way for individuals to receive their benefits.

Another similar document is the Electronic Funds Transfer (EFT) form used by various government agencies. This form allows individuals to authorize the electronic transfer of funds into their accounts for various benefits. Like the DD-1, it requires essential banking information and emphasizes the need for accuracy to prevent issues with deposits. Both forms aim to simplify the payment process for recipients.

If you're considering managing someone else's affairs, it's essential to understand the role of a reliable Power of Attorney document. This form not only specifies the authority granted but also clarifies the responsibilities that come with such authority, ensuring that the appointed individual can act in the best interests of the other party when necessary.

Finally, the Direct Deposit Enrollment form for payroll purposes is comparable to the Alabama DD-1. This form allows employees to authorize their wages to be deposited directly into their bank accounts. Both documents require the employee's personal information and banking details. They are designed to ensure that payments are made efficiently, reducing the need for paper checks and expediting the receipt of funds.