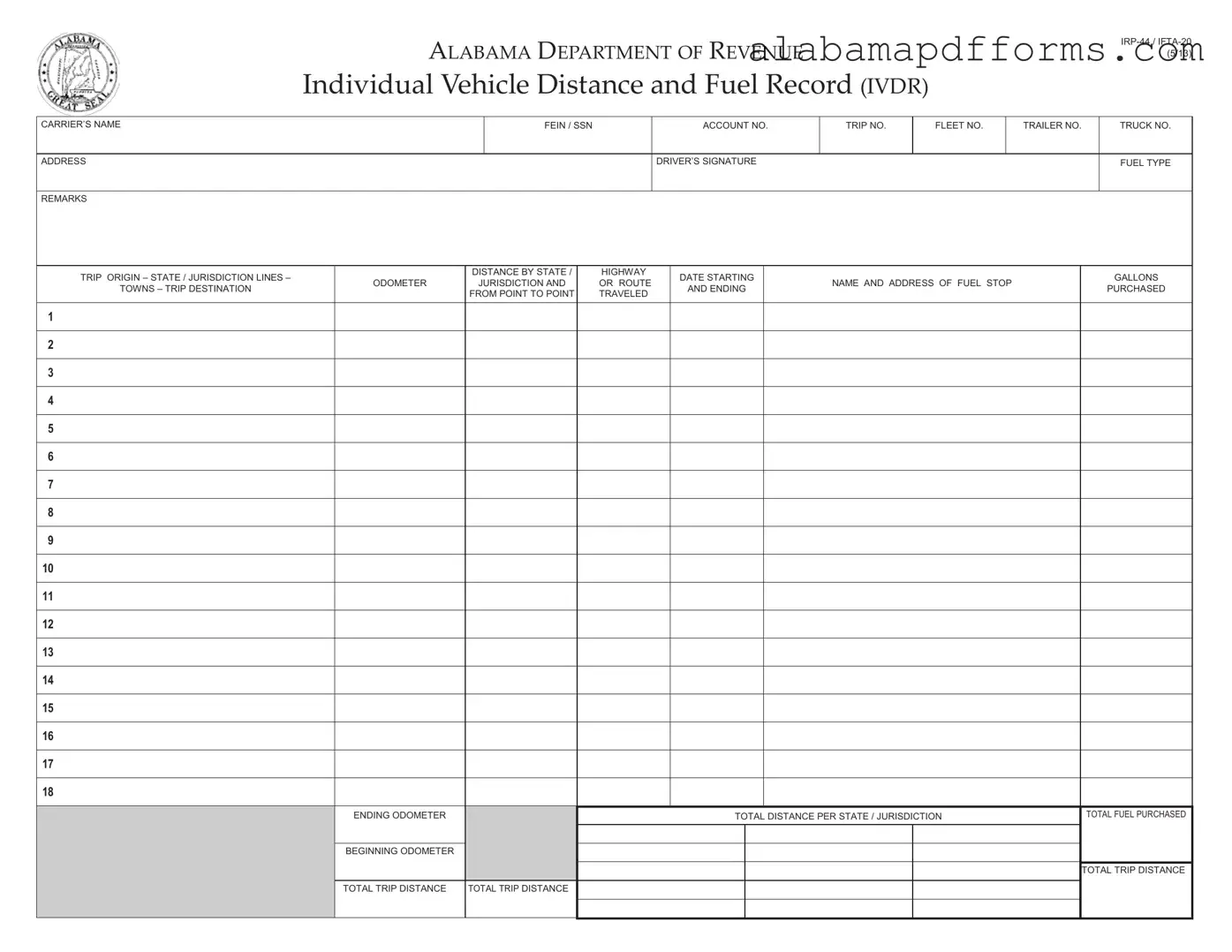

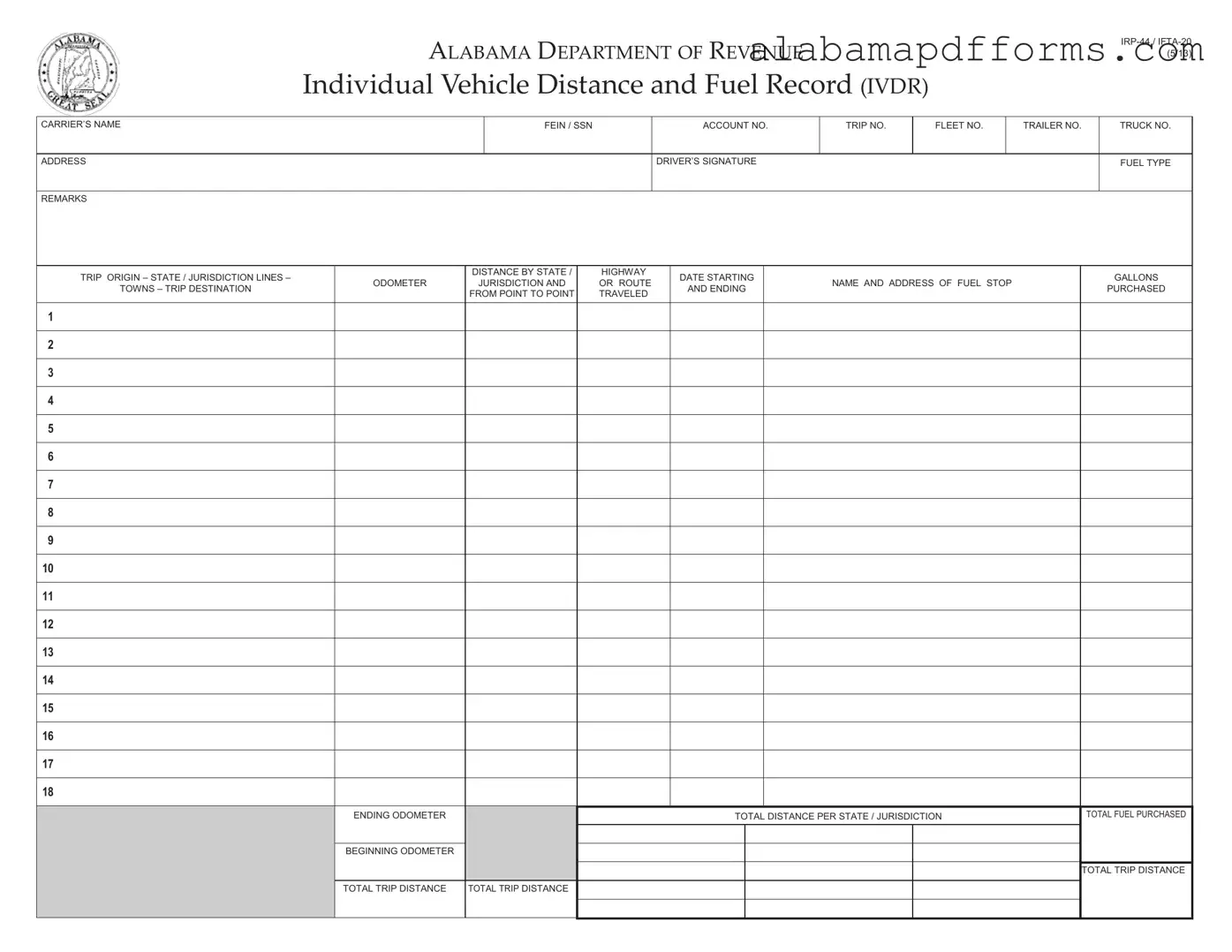

The IFTA-20 form, also known as the International Fuel Tax Agreement Fuel Tax Report, is similar to the Alabama IRP 44 form in that both documents track fuel usage and mileage for commercial vehicles. The IFTA-20 is specifically designed for reporting fuel taxes owed to various jurisdictions based on miles driven and fuel purchased. Just like the IRP 44, it requires details about the trip, including distances traveled in different states and the amount of fuel purchased. Both forms help ensure compliance with tax obligations for interstate trucking operations.

The IRP (International Registration Plan) application is another document that shares similarities with the Alabama IRP 44 form. This application is used by carriers to register their vehicles for operation across multiple jurisdictions. It collects information about the vehicle's mileage, registration fees, and the states in which the vehicle will operate. Like the IRP 44, it emphasizes accurate reporting of distances traveled and helps facilitate the allocation of fees based on usage across state lines.

The Vehicle Distance Record (VDR) serves a similar purpose to the Alabama IRP 44 form by documenting the distance traveled by commercial vehicles. This record is crucial for companies to maintain compliance with various state regulations. It requires detailed information about trips, including starting and ending odometer readings, which mirrors the data collection method in the IRP 44. Both forms aim to provide a clear account of vehicle operation for taxation and regulatory purposes.

The DOT (Department of Transportation) mileage report is akin to the Alabama IRP 44 form as it tracks the miles driven by commercial vehicles. This report is often required for audits and compliance checks. Like the IRP 44, it necessitates detailed trip information, including the jurisdictions crossed and the total distance traveled. Both documents serve as essential tools for ensuring that trucking companies adhere to transportation regulations.

The fuel purchase receipt is another document that shares common ground with the Alabama IRP 44 form. This receipt provides proof of fuel purchases made during trips, which is vital for accurate reporting on fuel taxes. Similar to the IRP 44, it requires details about the fuel type and quantity purchased, allowing for a comprehensive overview of fuel expenses related to specific trips. Both documents work together to ensure that carriers meet their tax obligations.

The trip log is similar to the Alabama IRP 44 form in that it records the details of each journey undertaken by a commercial vehicle. This log includes information such as the date, route, and distances traveled, which are essential for tax reporting and compliance. Like the IRP 44, it helps maintain an accurate account of vehicle usage, ensuring that all necessary information is available for regulatory review.

To ensure proper estate planning, individuals can utilize a comprehensive Last Will and Testament form that outlines their wishes regarding asset distribution and care of dependents after passing. This form is essential for communicating preferences clearly and legally, providing peace of mind for the future.

The IRS Form 2290, used for heavy vehicle use tax, also bears resemblance to the Alabama IRP 44 form. This form is required for vehicles that exceed a certain weight threshold and is based on the miles driven. While the primary focus is on tax payment, both forms require accurate mileage reporting and vehicle identification. This commonality highlights the importance of keeping detailed records for tax purposes in the trucking industry.

The state-specific fuel tax return is another document similar to the Alabama IRP 44 form. These returns are filed with state revenue departments to report fuel usage and calculate taxes owed. Like the IRP 44, they require comprehensive data about fuel purchases and distances traveled across jurisdictions. Both documents are crucial for ensuring compliance with state fuel tax regulations.

Finally, the quarterly fuel tax report is comparable to the Alabama IRP 44 form as it summarizes fuel usage and mileage for a specific period. This report is typically required by state authorities and helps in calculating the total fuel tax liability. Similar to the IRP 44, it focuses on accurate record-keeping of fuel purchases and trip details, ensuring that trucking companies fulfill their tax obligations efficiently.