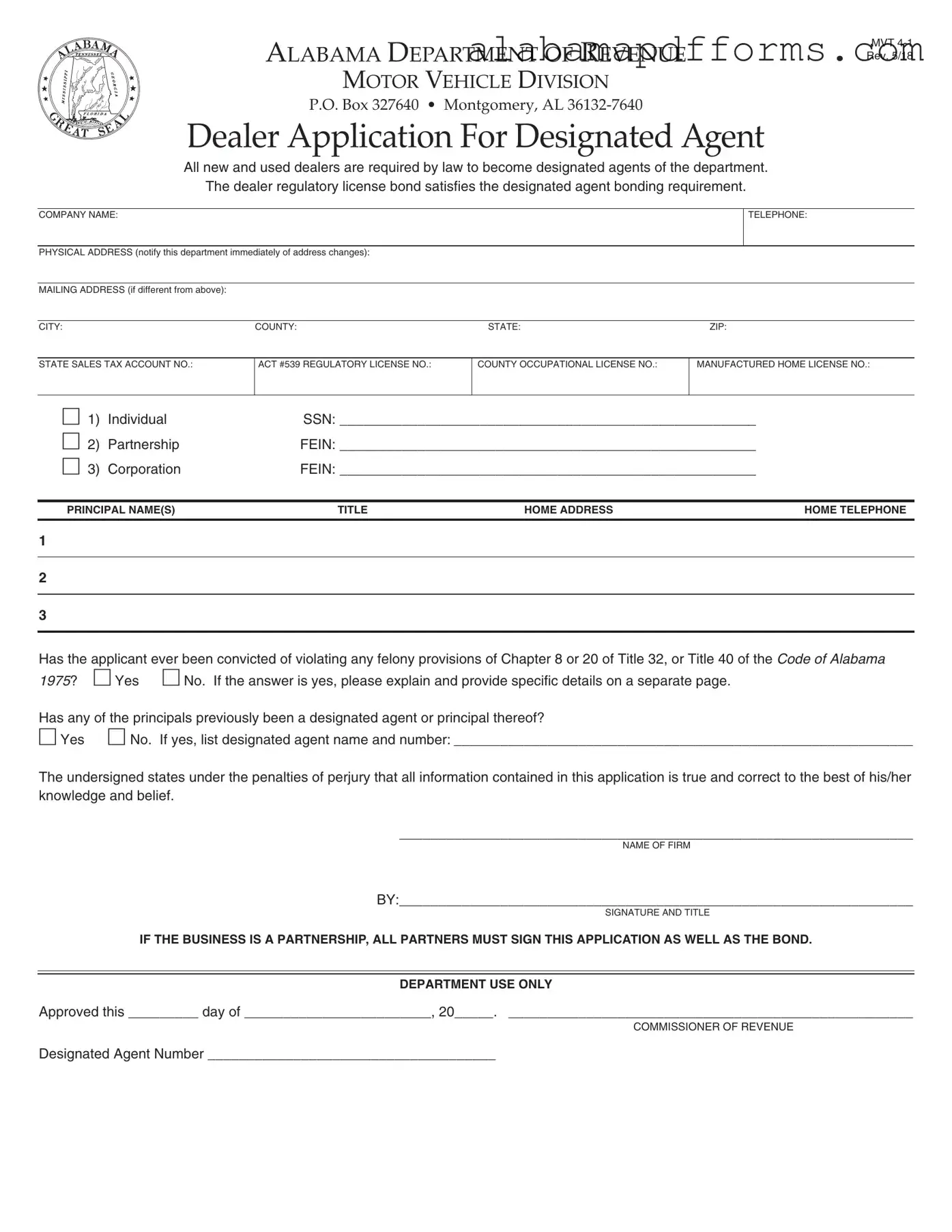

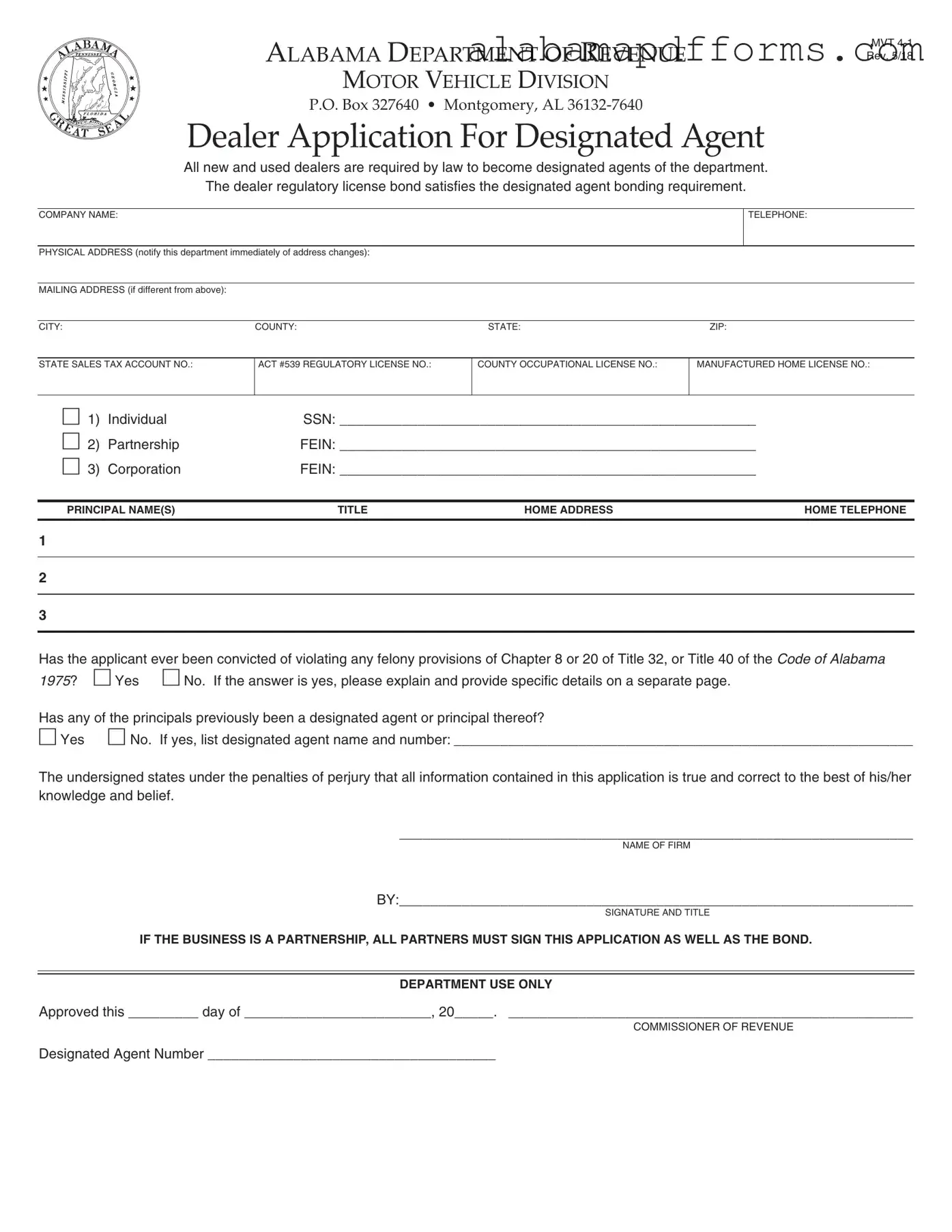

The Alabama Mvt 4 1 form shares similarities with the Application for a Business License. Both documents require detailed information about the business, including the company name, address, and contact information. Just like the Mvt 4 1 form, the business license application asks for identification numbers such as the state sales tax account number and federal employer identification number. Each document also includes a section where the applicant must affirm the accuracy of the provided information, often under penalty of perjury, ensuring accountability in the application process.

Another document that resembles the Alabama Mvt 4 1 form is the Dealer License Application. This application is used by individuals and businesses wishing to operate as vehicle dealers. Similar to the Mvt 4 1 form, it requires information about the business structure, including whether it is a sole proprietorship, partnership, or corporation. Both forms also require disclosures regarding the criminal history of the applicants, ensuring that those who have been convicted of specific offenses are identified before being granted a license to operate.

The Certificate of Title Application is another document that has comparable elements to the Mvt 4 1 form. Both applications gather essential information about the vehicle, including identification numbers and ownership details. While the Mvt 4 1 form focuses on the dealer's qualifications, the Certificate of Title Application emphasizes the vehicle's history. Nonetheless, both documents require the applicant's signature, confirming that the information provided is true and accurate.

The Sales Tax Registration Application also bears similarities to the Mvt 4 1 form. Both documents ask for the applicant's business information and tax identification numbers. The Sales Tax Registration Application is crucial for businesses to comply with state tax laws, just as the Mvt 4 1 form ensures that dealers meet regulatory requirements. Each form emphasizes the importance of providing accurate information and may involve penalties for false statements.

The Business Entity Registration form is another document that aligns with the Mvt 4 1 form. This form is used to officially register a business with the state. Like the Mvt 4 1 form, it requires details about the business structure, ownership, and contact information. Both documents necessitate that the individuals involved in the business affirm the accuracy of the information provided, which helps maintain transparency and compliance with state regulations.

Understanding the paperwork involved in property transactions can be daunting, but resources are available to help clarify the process. For instance, if you are considering estate planning options that include property transfers, the Oklahoma Transfer-on-Death Deed simplifies the process by allowing property to transfer directly to beneficiaries after death. For more information on this type of deed, you can visit https://todform.com/blank-oklahoma-transfer-on-death-deed/, where further details and requirements are provided to assist you in making informed decisions regarding your real estate.

The Application for a Federal Employer Identification Number (EIN) is similar to the Mvt 4 1 form in that it collects critical information about the business entity. Both applications require the legal name, address, and type of business structure. Obtaining an EIN is essential for tax purposes, just as the Mvt 4 1 form is necessary for compliance with state dealer regulations. Each document plays a vital role in ensuring that businesses operate within legal frameworks.

Lastly, the Motor Vehicle Dealer Bond form shares features with the Alabama Mvt 4 1 form. Both documents are part of the process for establishing a dealership and require similar information about the business and its owners. The Motor Vehicle Dealer Bond form specifically addresses the bonding requirements for dealers, while the Mvt 4 1 form includes a section on the dealer regulatory license bond. Both documents ultimately aim to ensure that dealers operate in a lawful and ethical manner.