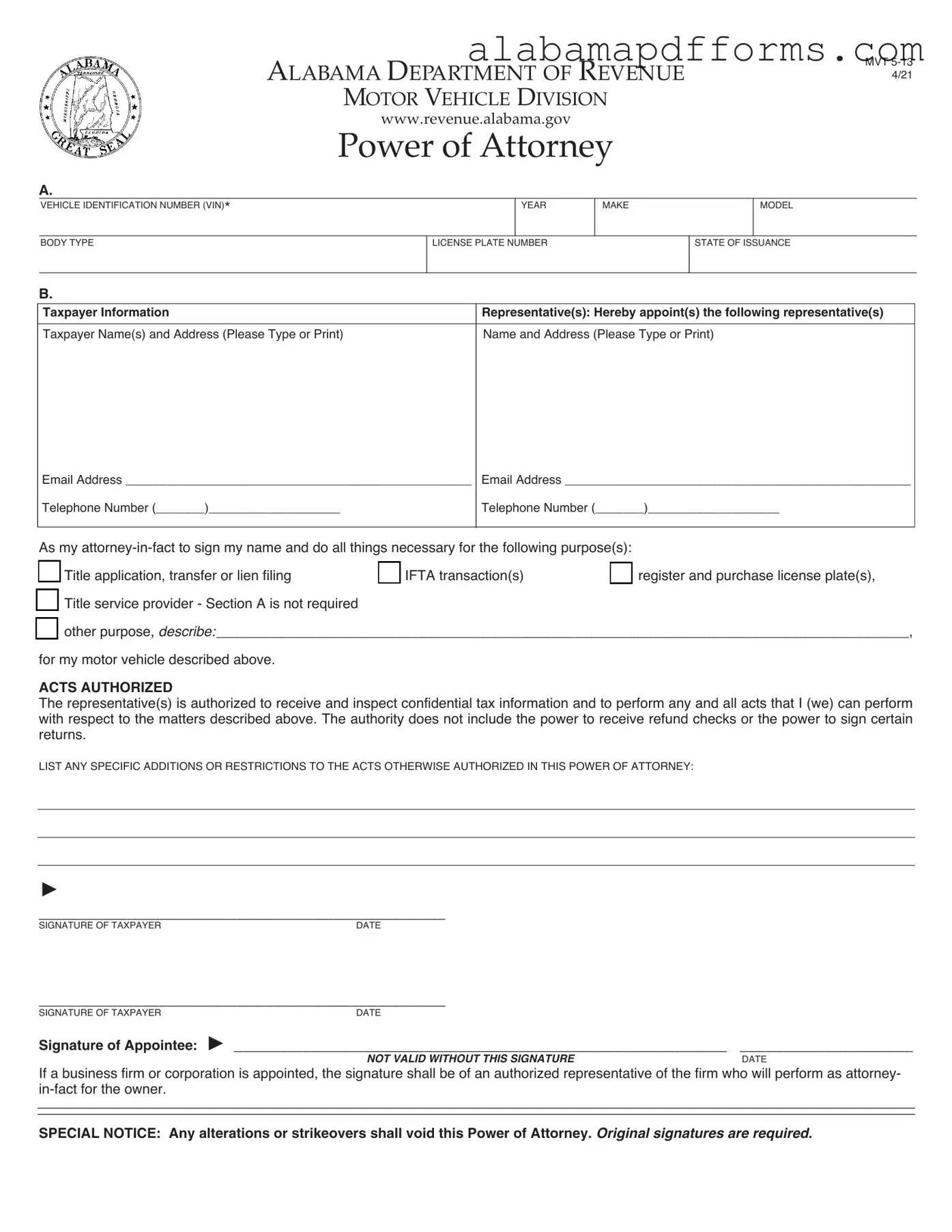

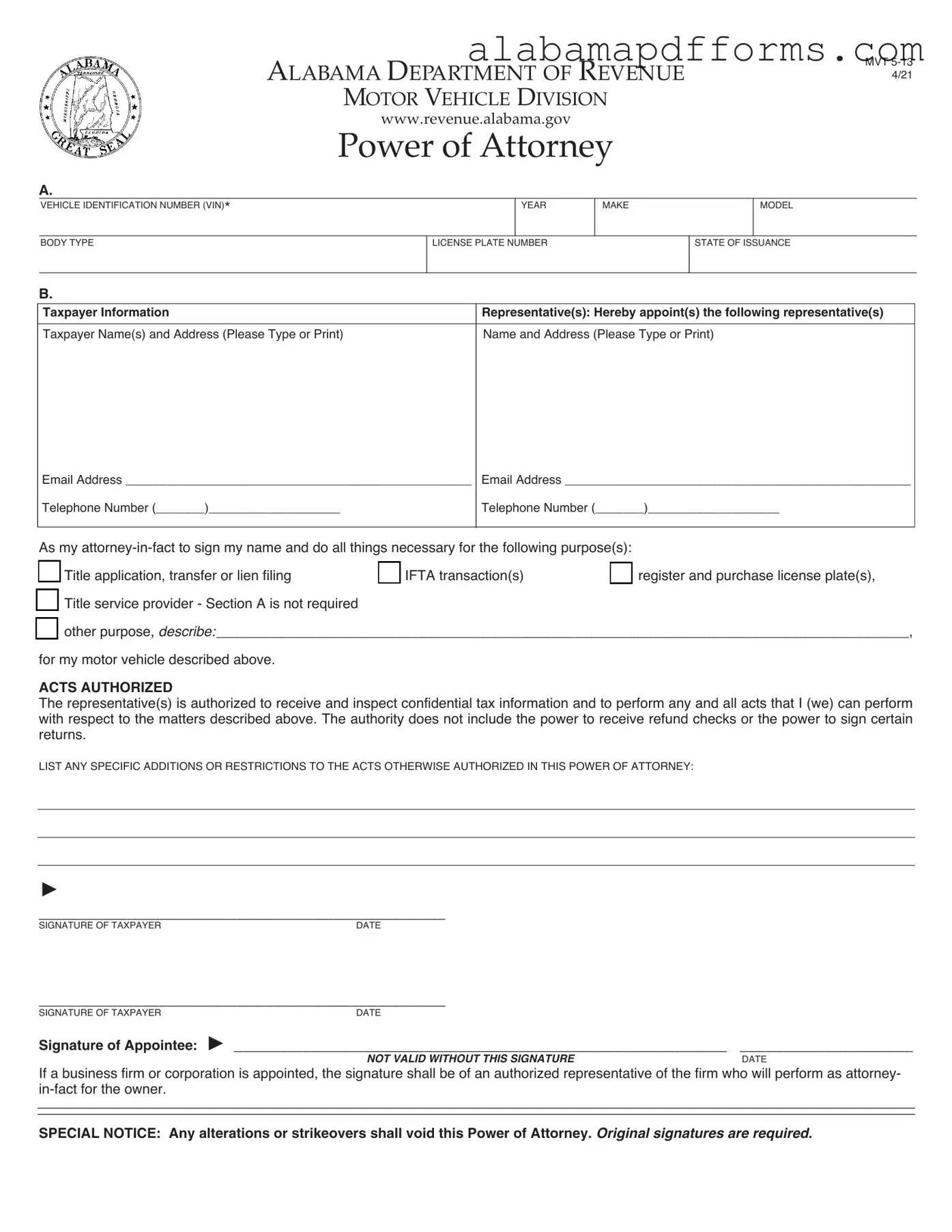

The Alabama Mvt 5 13 form is akin to a general Power of Attorney (POA) document, which grants an individual the authority to act on behalf of another person in legal or financial matters. Just like the Mvt 5 13 form, a general POA allows the appointed representative to handle a variety of tasks, such as signing documents and making decisions. However, while the Mvt 5 13 is specific to motor vehicle transactions and related tax matters, a general POA can encompass a broader range of responsibilities, including managing real estate, handling bank accounts, and making healthcare decisions. This specificity helps streamline the process for vehicle-related issues while still providing the necessary legal authority to the representative.

In navigating the complexities of vehicle ownership transfers, it is essential to utilize the appropriate documentation, such as the Motor Vehicle Bill of Sale form, which plays a vital role in ensuring a secure and legally binding transaction between the buyer and seller.

Another document similar to the Alabama Mvt 5 13 form is the Limited Power of Attorney. This type of document allows a principal to delegate specific powers to an agent for a defined purpose or period. Like the Mvt 5 13, the Limited Power of Attorney can be tailored to focus on particular tasks, such as vehicle title transfers or tax filings. The key difference lies in the scope of authority; the Limited Power of Attorney restricts the agent's powers to only those specified, while the Mvt 5 13 form is designed explicitly for motor vehicle transactions, ensuring that the appointed representative has the necessary authority to act in those specific matters.

The Alabama Mvt 5 13 form also shares similarities with the IRS Form 2848, known as the Power of Attorney and Declaration of Representative. This IRS form allows individuals to appoint a representative to act on their behalf before the Internal Revenue Service. Both documents enable the appointed representative to receive and inspect confidential information and perform certain acts on behalf of the principal. However, the Mvt 5 13 is focused solely on motor vehicle issues, whereas Form 2848 pertains to tax matters and dealings with the IRS, illustrating the specialized nature of the Mvt 5 13 in the context of vehicle ownership and registration.

Lastly, the Alabama Mvt 5 13 form is comparable to the Vehicle Power of Attorney used in various states. This document permits a designated individual to manage all aspects of vehicle ownership, including registration, title transfers, and lien filings. Similar to the Mvt 5 13, a Vehicle Power of Attorney grants specific powers related to motor vehicles, ensuring that the appointed representative can act on behalf of the vehicle owner. However, the Vehicle Power of Attorney may vary in format and requirements from state to state, making the Mvt 5 13 unique to Alabama's regulations while still serving the same fundamental purpose of facilitating vehicle-related transactions.