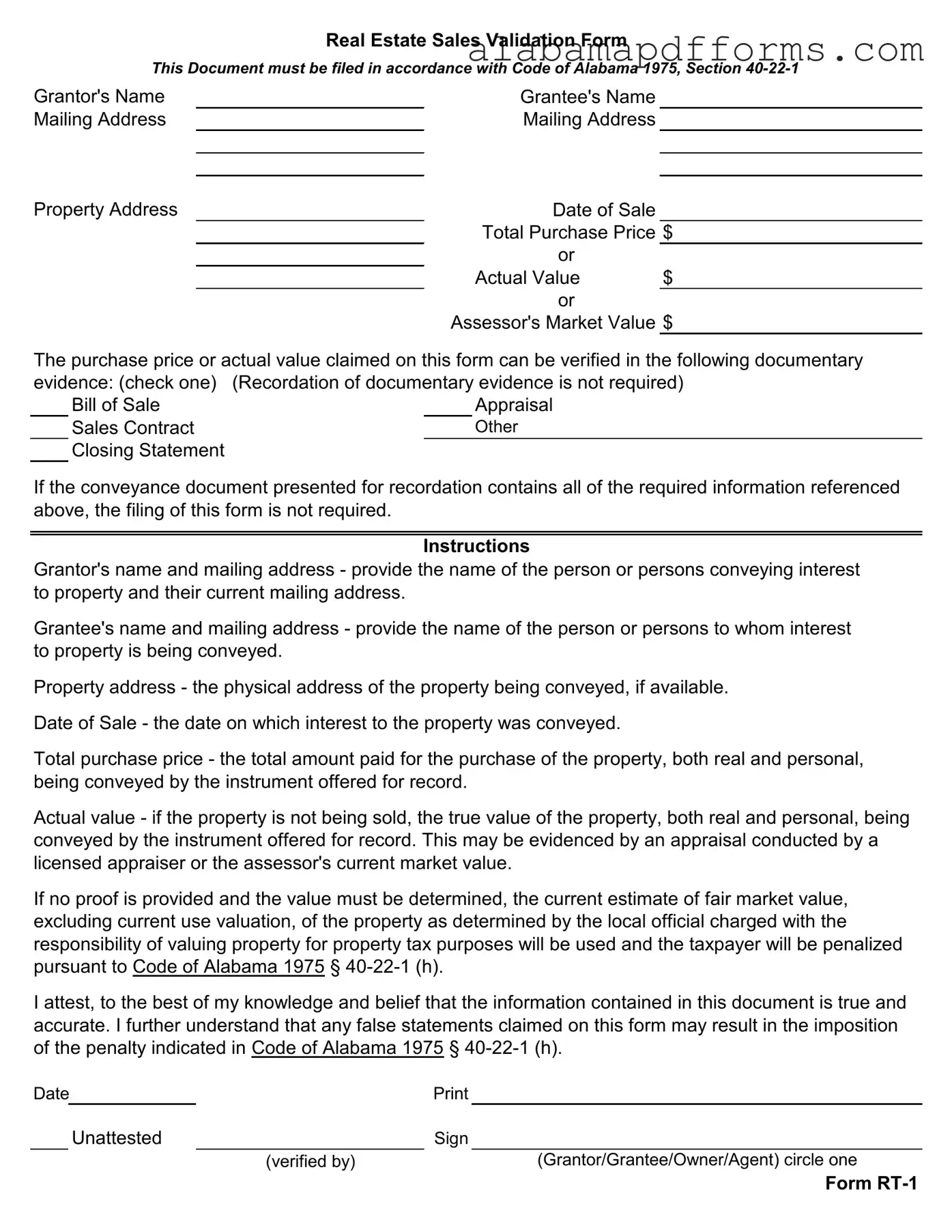

The Alabama Rt 1 form, known as the Real Estate Sales Validation Form, shares similarities with the HUD-1 Settlement Statement. Both documents are utilized in real estate transactions and aim to provide clarity on the financial aspects of a sale. The HUD-1 form outlines the details of the closing costs and fees associated with a real estate transaction, ensuring that both the buyer and seller are aware of the financial obligations. Just like the Rt 1 form, it requires essential information such as the parties involved, property details, and total purchase price, making it a critical component in the closing process.

Another document comparable to the Alabama Rt 1 form is the Sales Contract. This contract is a legally binding agreement between the buyer and seller, detailing the terms of the sale. Similar to the Rt 1 form, it includes the names of the parties involved, property address, and purchase price. The Sales Contract serves as a foundational document in the transaction, establishing the framework for the sale, while the Rt 1 form provides validation for tax purposes, ensuring compliance with state regulations.

In many real estate transactions, it's crucial to include various legal forms to protect the interests of all parties involved. One important document is the Hold Harmless Agreement, which safeguards one party from liabilities incurred by another during the process. This agreement not only helps clarify responsibilities but also minimizes potential conflicts by delineating which party assumes risks associated with the transaction.

The Quitclaim Deed is also akin to the Alabama Rt 1 form in that it facilitates the transfer of property ownership. This document allows a property owner to transfer their interest in a property without providing any warranties about the title. While the Quitclaim Deed itself does not require the same level of detail regarding the sale price or valuation, it often accompanies the Rt 1 form to ensure that the transaction is recorded properly and that the sale price is validated for tax assessment purposes.

Similar to the Rt 1 form, the Warranty Deed provides a legal framework for transferring property ownership. Unlike the Quitclaim Deed, a Warranty Deed guarantees that the seller has clear title to the property and the right to sell it. Both documents require the names of the grantor and grantee, property address, and date of sale. The Warranty Deed, along with the Rt 1 form, ensures that the transaction is properly documented and that the buyer is protected against any claims on the property.

The Appraisal Report is another document that parallels the Alabama Rt 1 form, particularly regarding property valuation. An appraisal provides an independent assessment of a property's value, which can be crucial when determining the purchase price. Just as the Rt 1 form requires verification of the purchase price or actual value, the Appraisal Report serves as a reliable source of information to support the figures reported in the Rt 1 form, ensuring that the sale reflects fair market value.

The Bill of Sale is also similar to the Alabama Rt 1 form, particularly when personal property is involved in the transaction. A Bill of Sale serves as a receipt for the transfer of ownership of personal property and often accompanies real estate transactions. Like the Rt 1 form, it includes information about the buyer and seller, as well as a description of the property being sold. Both documents help to clarify the terms of the sale and provide a record for future reference.

The Closing Statement, often used in conjunction with the HUD-1 form, is another document that aligns with the Alabama Rt 1 form. It summarizes the financial details of the transaction, including the total purchase price and any adjustments or credits. Both the Closing Statement and the Rt 1 form aim to provide transparency in the transaction, ensuring that all parties understand the financial implications of the sale and that the necessary information is reported for tax purposes.

Finally, the Property Transfer Tax Form is similar to the Alabama Rt 1 form in that it is used to report the transfer of real estate for tax purposes. This form typically requires information about the property, the parties involved, and the sale price. Like the Rt 1 form, it serves to validate the transaction and ensure compliance with state tax regulations. Both forms play an essential role in the documentation of real estate transactions, helping to maintain accurate public records.