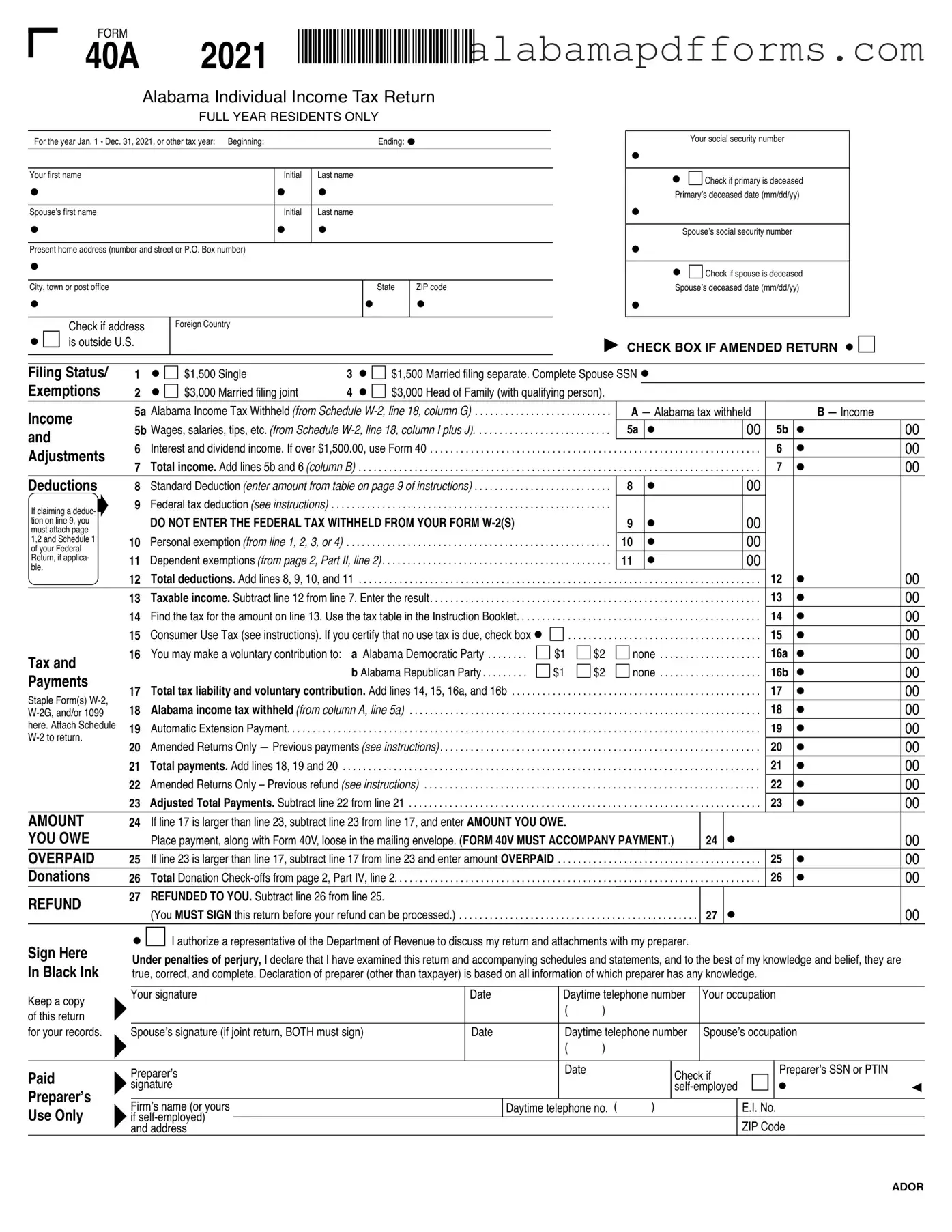

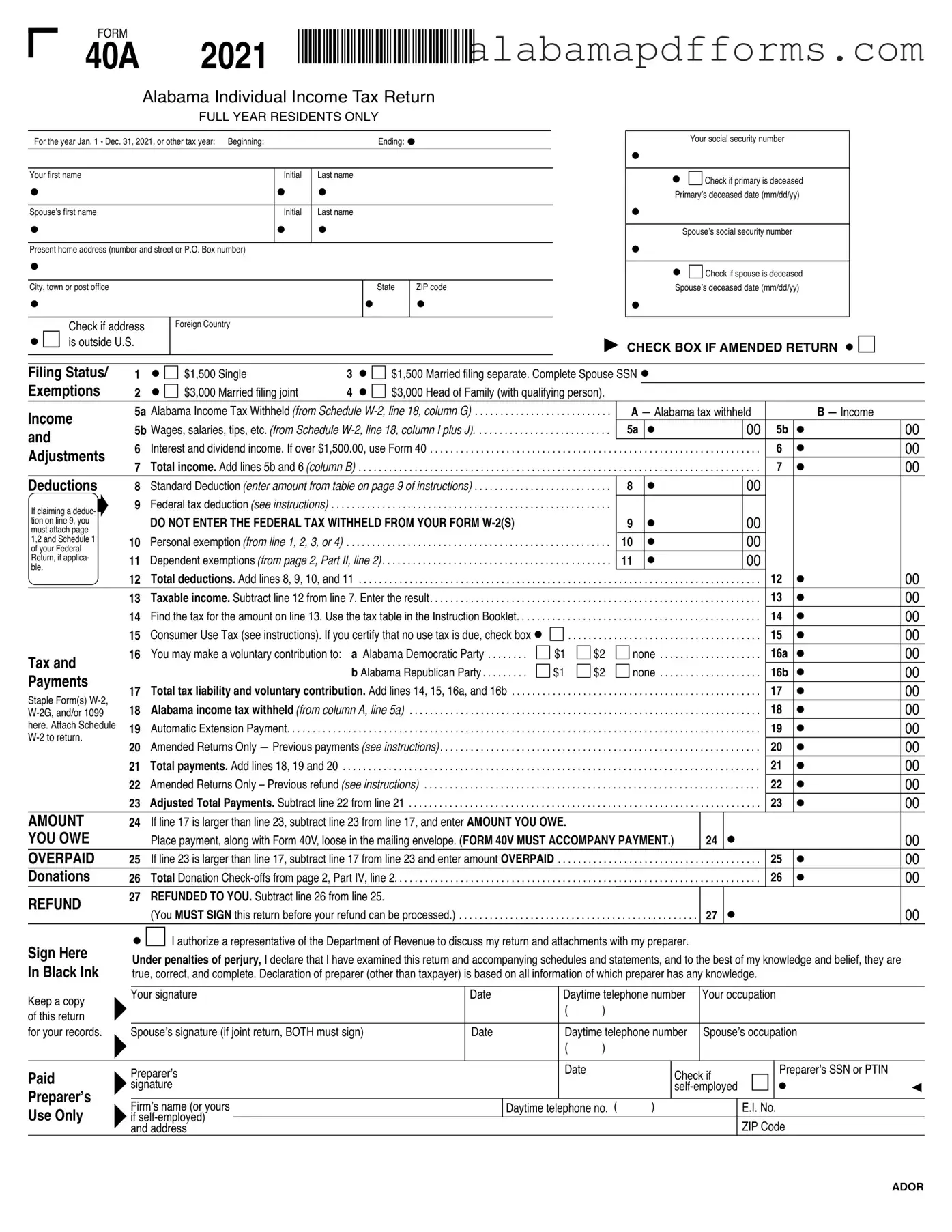

The Alabama State Tax Return 40A form shares similarities with the IRS Form 1040, which is the standard individual income tax return used by residents of the United States. Both forms require taxpayers to report their income, claim deductions, and calculate their tax liability. While Form 1040 is more comprehensive, allowing for various income types and deductions, Form 40A is specifically tailored for Alabama residents, focusing on state-specific tax regulations and rates. Each form necessitates the inclusion of personal information, such as Social Security numbers and filing status, to ensure accurate processing by the respective tax authorities.

Another document akin to the Alabama State Tax Return 40A is the IRS Form 1040A. This form serves as a simplified version of the 1040 and is designed for taxpayers with straightforward tax situations. Similar to Form 40A, it allows for the reporting of income, claiming of standard deductions, and the calculation of tax owed. However, Form 1040A imposes certain restrictions on the types of income that can be reported, paralleling the limitations found in Form 40A, which caters specifically to Alabama tax regulations.

The IRS Form 1040EZ is also comparable to the Alabama State Tax Return 40A. This form is the simplest federal tax return available, intended for individuals with no dependents and a limited income. Like Form 40A, it streamlines the filing process by minimizing the information required. Both forms focus on basic income reporting and tax calculations, making them accessible for individuals with uncomplicated financial situations.

Form 40 is another document that resembles the Alabama State Tax Return 40A. This form is utilized by Alabama taxpayers who have more complex tax situations, such as those with multiple income sources or significant deductions. While Form 40A is for full-year residents with simpler tax profiles, Form 40 accommodates a broader range of tax scenarios, similar to how the federal 1040 form functions in relation to the 1040A and 1040EZ.

The Alabama Form 40V is related to the 40A in that it is used for payment of taxes owed. When taxpayers find that they owe money after completing their 40A, they must submit Form 40V along with their payment. This form ensures that the payment is correctly attributed to the taxpayer's account, paralleling the way that payment options are integrated into federal tax forms, such as the payment vouchers used with the IRS forms.

For those looking to organize their estate planning, a valuable resource is our "comprehensive guide to completing a Last Will and Testament" available at https://lawtemplates.net/last-will-and-testament-form/. This form outlines essential steps in ensuring your final wishes are honored and legally documented.

The IRS Schedule A, used for itemizing deductions, also has similarities with the Alabama State Tax Return 40A. While Form 40A includes a standard deduction, Schedule A allows taxpayers to itemize their deductions on their federal return. Both documents require detailed reporting of expenses, although the 40A is more focused on state-specific deductions and credits, reflecting Alabama's tax laws.

Form 8862, the Information to Claim Certain Refundable Credits After Disallowance, can also be likened to the Alabama State Tax Return 40A. This IRS form is necessary for taxpayers who have previously been denied certain credits and wish to claim them again. Both forms require comprehensive documentation of income and eligibility, ensuring that taxpayers meet the necessary criteria for claiming credits, whether at the state or federal level.

The IRS Form W-2, Wage and Tax Statement, is another document that interacts closely with the Alabama State Tax Return 40A. Employers provide this form to employees, detailing annual wages and taxes withheld. Taxpayers must include W-2 information when filing their state return, as it forms the basis for income reporting on the 40A. This relationship emphasizes the importance of accurate reporting across both state and federal tax documents.

The Alabama Schedule CR, which is used to claim tax credits, is similar to the Alabama State Tax Return 40A in that it is part of the overall tax filing process for Alabama residents. Taxpayers may need to complete this schedule to claim various state credits, which can reduce their tax liability as reported on the 40A. Both documents require careful attention to detail and accurate reporting of financial information.

Lastly, the IRS Form 1099 series, which includes various forms for reporting income other than wages, is relevant to the Alabama State Tax Return 40A. Taxpayers who receive income reported on a 1099 must include this information on their state tax return. Both forms necessitate accurate income reporting and tax calculations, reinforcing the interconnected nature of state and federal tax systems.

00

00