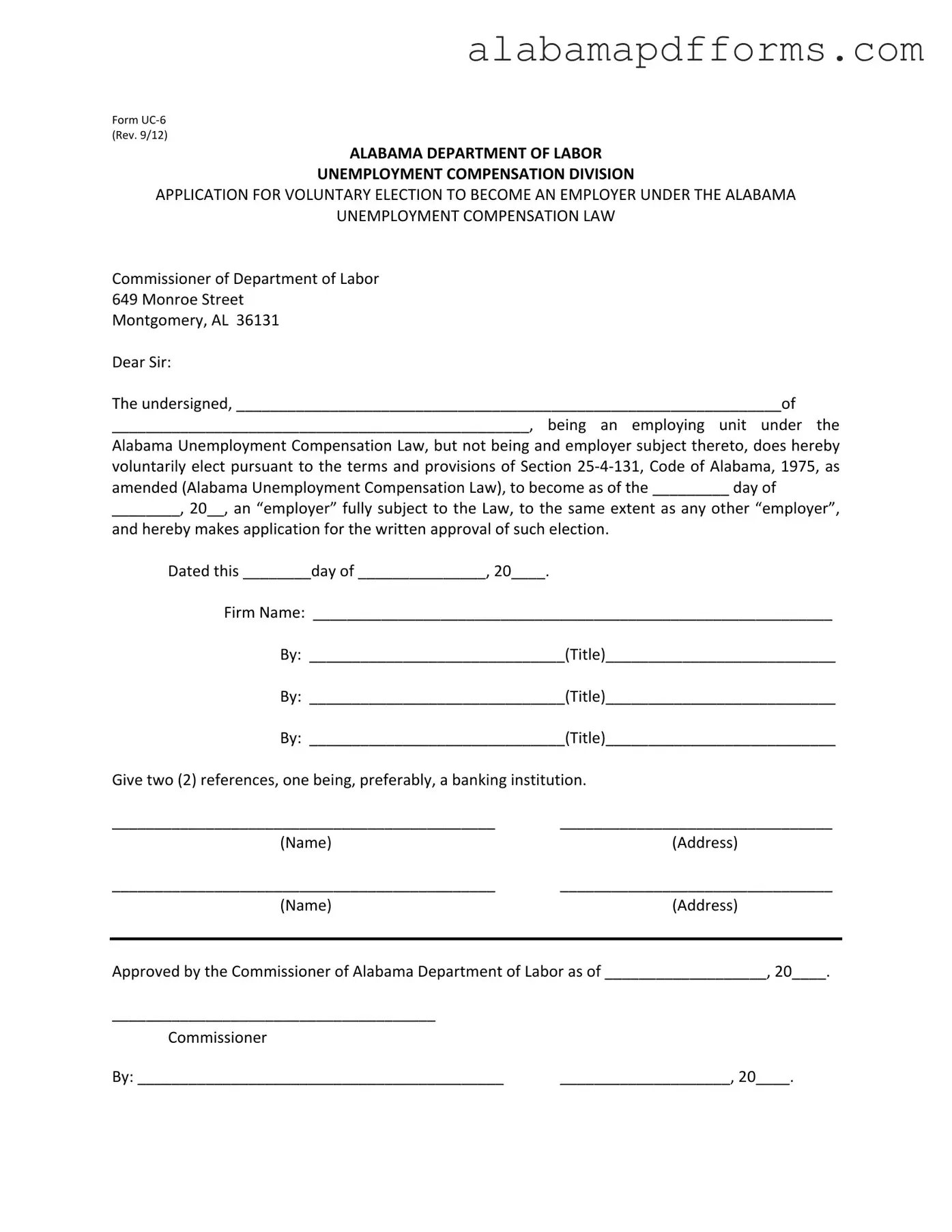

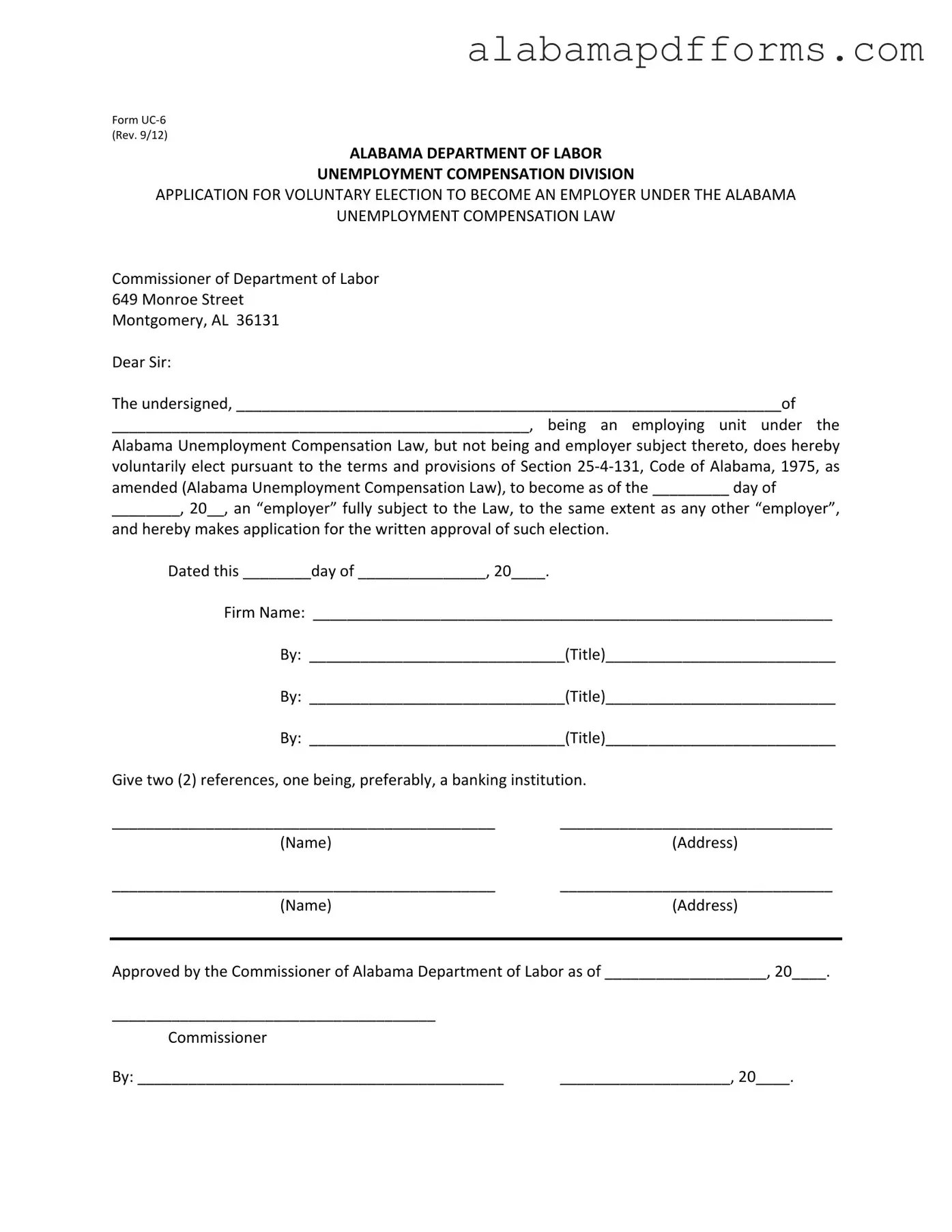

Fill Out a Valid Alabama Uc 6 Form

The Alabama UC-6 form serves as an application for voluntary election to become an employer under the Alabama Unemployment Compensation Law. By completing this form, an employing unit not currently subject to the law can elect to become an employer, thereby gaining the rights and responsibilities that accompany this designation. This process ensures that businesses can choose to participate in the unemployment compensation system, providing essential benefits to their employees.

Fill Out Your Document Online

Fill Out a Valid Alabama Uc 6 Form

Fill Out Your Document Online

Fill Out Your Document Online

or

➤ Alabama Uc 6 PDF Form

Your form is halfway done

Complete and edit Alabama Uc 6 online in minutes, hassle-free.