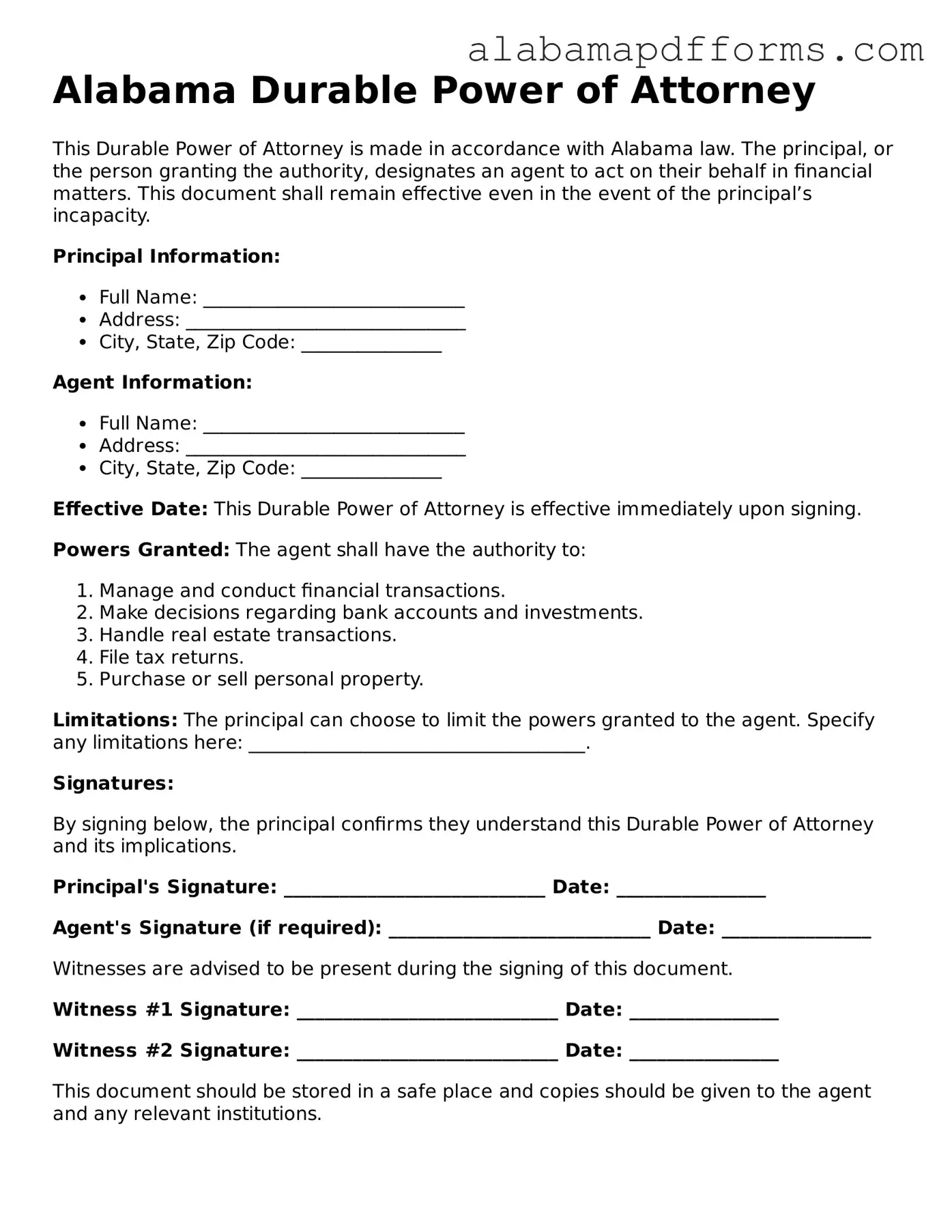

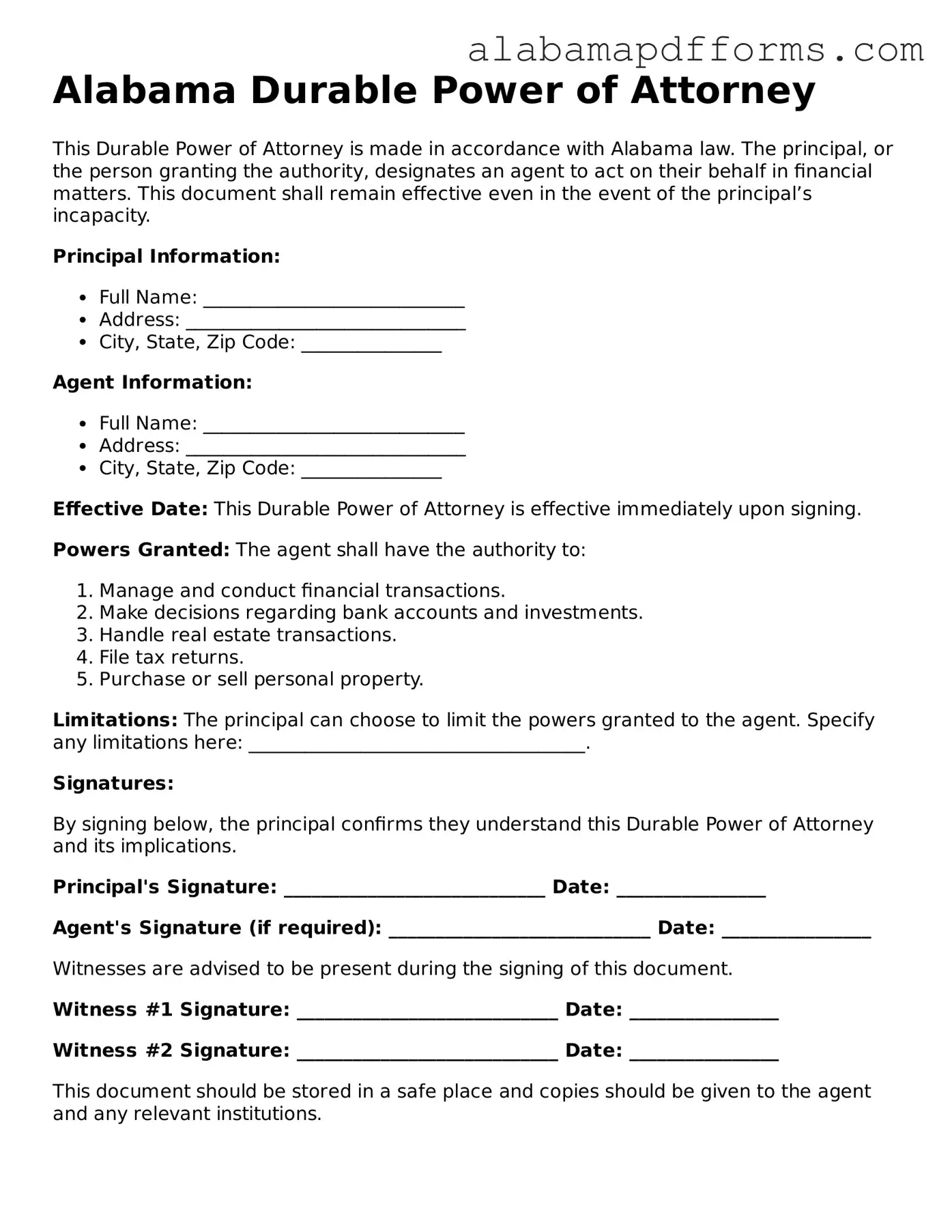

The Alabama Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. The key difference lies in the durability of the powers granted. While a General Power of Attorney becomes void if the principal becomes incapacitated, a Durable Power of Attorney remains effective, ensuring that the agent can continue to act even when the principal is unable to do so.

Another related document is the Medical Power of Attorney. This form specifically grants an agent the authority to make healthcare decisions for the principal. Like the Durable Power of Attorney, it remains in effect even if the principal becomes incapacitated. However, the Medical Power of Attorney focuses solely on health-related matters, while the Durable Power of Attorney can encompass a broader range of financial and legal decisions.

The Limited Power of Attorney is also similar but differs in scope. This document allows the principal to grant specific powers to the agent for a limited time or for particular tasks. For instance, if someone needs assistance with a real estate transaction, they might use a Limited Power of Attorney. In contrast, the Durable Power of Attorney provides ongoing authority until revoked or the principal passes away.

Understanding the various forms of Power of Attorney is crucial for effective estate planning and decision-making during times of incapacity. For instance, the Durable Power of Attorney not only allows for the management of financial affairs but also ensures that appointed agents can make decisions even under challenging circumstances. This underscores its significance alongside other important documents, such as the Medical Power of Attorney and the Living Will. For those seeking specific templates or further guidance on these essential documents, Colorado PDF Forms can be a valuable resource.

The Springing Power of Attorney is another variant. It becomes effective only under certain conditions, typically when the principal becomes incapacitated. This type of document can provide peace of mind, as the agent's authority is not activated until needed. The Durable Power of Attorney, however, is immediately effective unless stated otherwise, allowing the agent to act without delay.

A Trust Agreement is also relevant, as it allows individuals to manage their assets during their lifetime and after their death. While a Durable Power of Attorney can help manage financial matters, a Trust Agreement can provide a more comprehensive plan for asset distribution. Both documents serve to protect the principal's interests, but a Trust Agreement often involves more complex arrangements and can provide additional benefits, such as avoiding probate.

The Living Will is another important document, closely related to the Medical Power of Attorney. It outlines an individual’s preferences regarding medical treatment in case they become unable to communicate their wishes. While the Durable Power of Attorney allows an agent to make decisions, a Living Will specifically details the principal's desires, ensuring that their healthcare preferences are honored.

The Advance Healthcare Directive combines elements of the Medical Power of Attorney and the Living Will. This document allows individuals to appoint an agent for healthcare decisions while also specifying their treatment preferences. Like the Durable Power of Attorney, it ensures that the principal's wishes are respected during times of incapacity, but it focuses exclusively on healthcare matters.

The Guardianship form is another related document, though it serves a different purpose. Guardianship is a legal relationship established by a court when an individual is deemed unable to care for themselves or manage their affairs. While a Durable Power of Attorney allows the principal to choose their agent, a Guardianship is appointed by the court, often after a more extensive legal process. Both serve to protect individuals, but they operate within different frameworks.

Lastly, the Will is a fundamental estate planning document that outlines how a person's assets should be distributed after their death. While a Durable Power of Attorney is active during the principal's lifetime, a Will takes effect upon death. Both documents are crucial for ensuring that an individual’s wishes are carried out, but they serve different purposes in the overall estate planning process.