The IFTA-100-MN form is closely related to the IRP Alabama form. Both documents serve as essential tools for reporting fuel use and taxes related to commercial vehicle operations. The IFTA-100-MN is specifically designed for reporting quarterly fuel use taxes across multiple jurisdictions, while the IRP Alabama form focuses on the registration and licensing of commercial vehicles. Both forms require detailed calculations of miles traveled and fuel consumed, ensuring compliance with state and federal regulations.

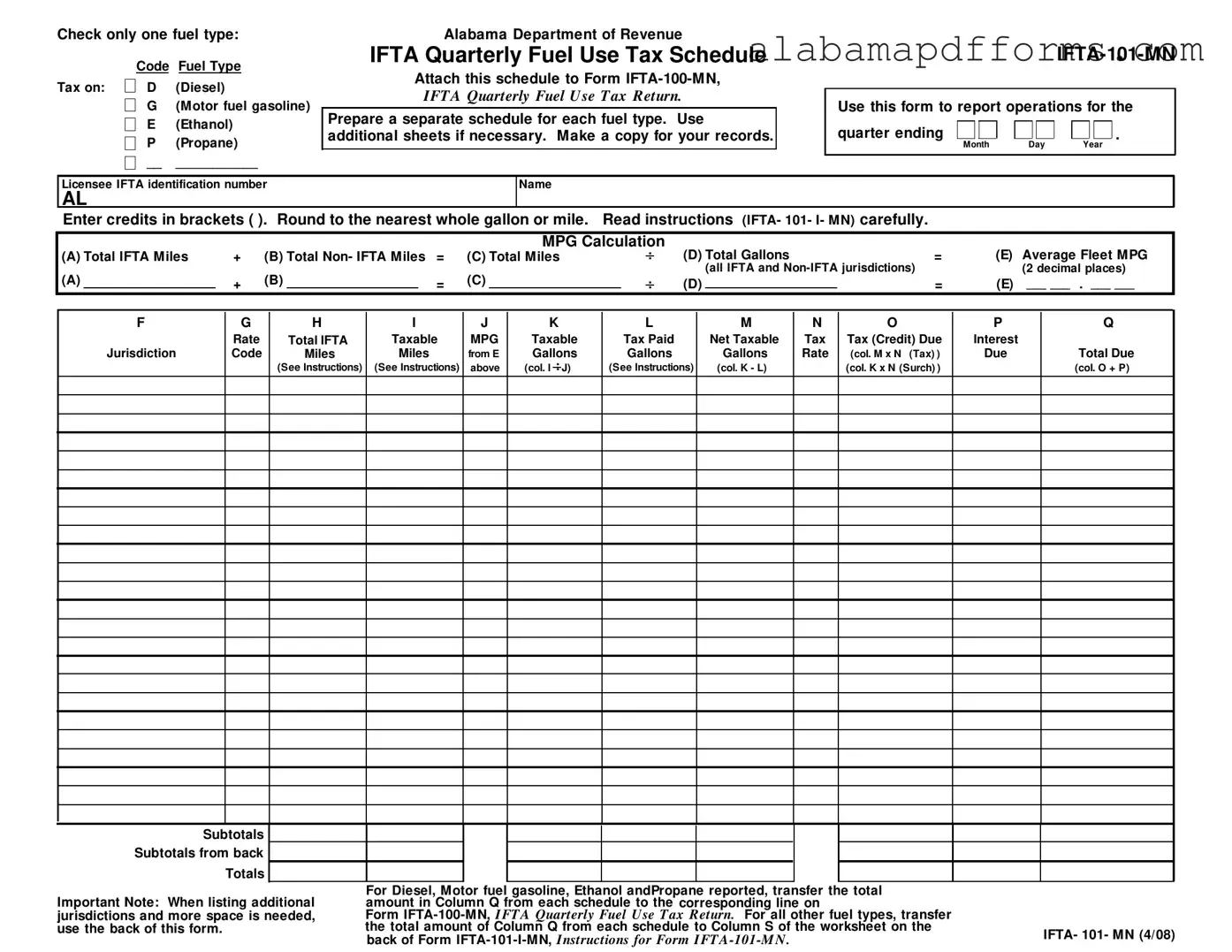

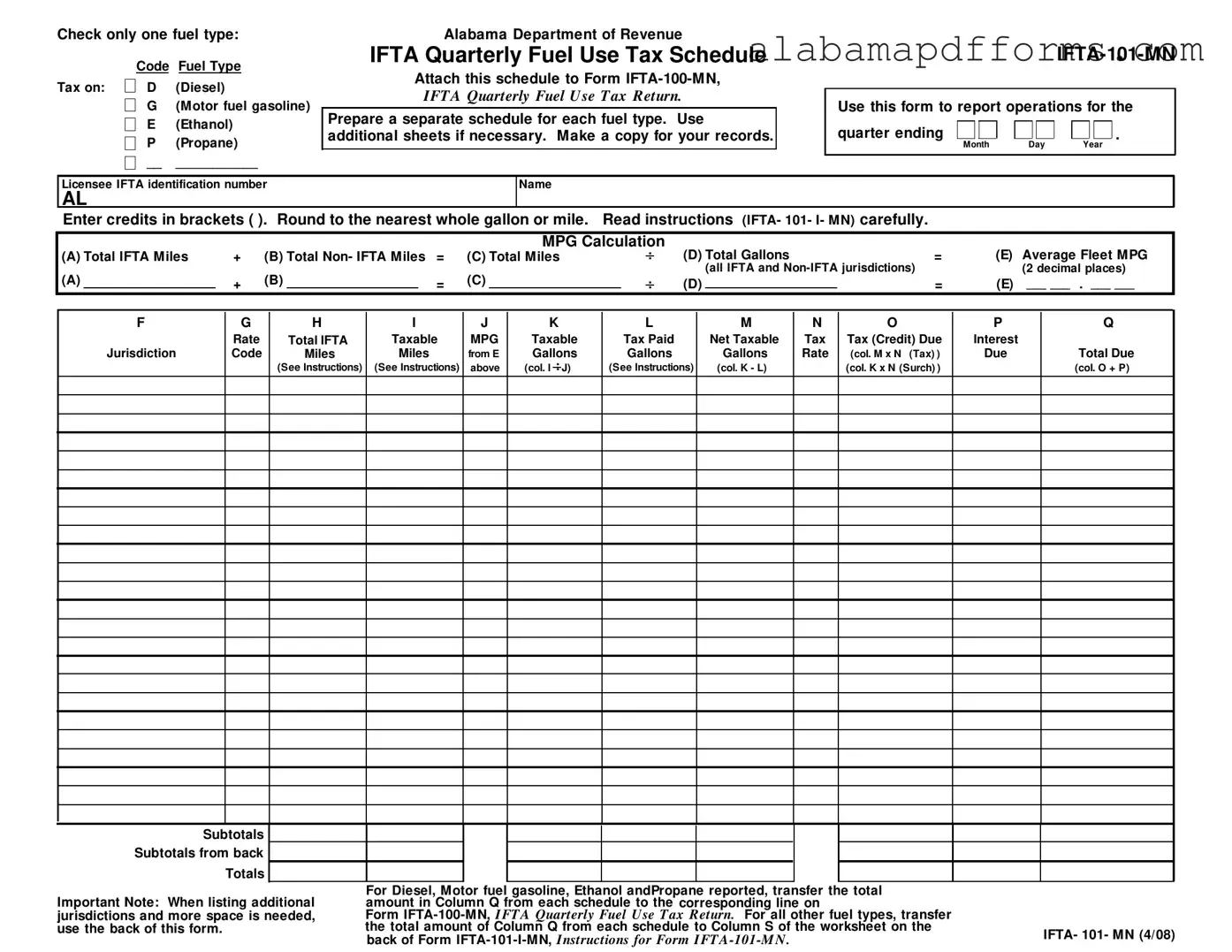

The IFTA-101-MN form is another document similar to the IRP Alabama form. This form is used to provide a breakdown of fuel consumption by type, such as diesel or gasoline. Like the IRP Alabama form, it requires users to report specific data related to their operations. The IFTA-101-MN allows for a more granular view of fuel usage, which is crucial for accurate tax reporting and compliance. Both forms emphasize the importance of maintaining precise records for audits and inspections.

The Schedule C (Form 1040) is also comparable to the IRP Alabama form, especially for individuals who operate businesses using commercial vehicles. Schedule C is used by sole proprietors to report income and expenses, including fuel costs. While the IRP Alabama form focuses on vehicle registration and fuel tax reporting, both documents require meticulous record-keeping and accurate reporting of operational costs. This ensures that all deductions and tax obligations are correctly calculated.

The Form 2290, Heavy Highway Vehicle Use Tax Return, shares similarities with the IRP Alabama form as well. This form is specifically for reporting and paying taxes on heavy vehicles that operate on public highways. Both forms require detailed information about vehicle usage and mileage. While the IRP Alabama form addresses registration and fuel tax, Form 2290 focuses on the tax liability associated with heavy vehicle operations, highlighting the importance of compliance in both areas.

The Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, also relates to the IRP Alabama form in terms of reporting requirements. While Form 940 deals with unemployment taxes for employees, both forms require accurate tracking of operational details and financial information. Businesses must ensure they comply with tax obligations, whether related to fuel use or employee taxes. This underscores the importance of maintaining thorough records across various tax forms.

In addition to these various tax-related documents, individuals and businesses in West Virginia may also need to consider the implications of liability protection when engaging in different activities. For this purpose, a crucial tool is the Hold Harmless Agreement, which helps in mitigating risks by ensuring that one party does not bear the liability for potential damages or losses incurred by another. This agreement plays a significant role in various business transactions and services, safeguarding interests and promoting clarity while navigating legal obligations.

Finally, the Form 941, Employer's Quarterly Federal Tax Return, is similar to the IRP Alabama form in that it requires businesses to report tax information on a regular basis. Form 941 is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the IRP Alabama form, it necessitates accurate record-keeping and timely submissions to avoid penalties. Both forms are integral to ensuring compliance with federal and state tax laws, reinforcing the need for diligent tracking of financial activities.