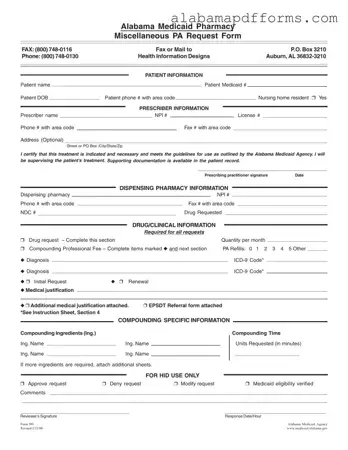

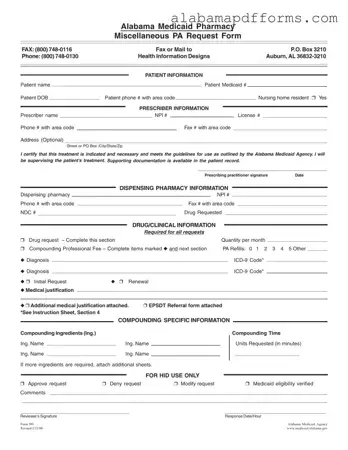

The Alabama 390 form is a request form used for Alabama Medicaid Pharmacy Miscellaneous prior authorization. This form facilitates the approval process for specific medications and treatments, ensuring that patients receive necessary care. It is essential for healthcare providers to...

The Alabama 40 form is the official document used by residents and part-year residents to file their individual income tax returns in Alabama. This form captures essential information such as income, deductions, and tax liabilities for the tax year. Completing...

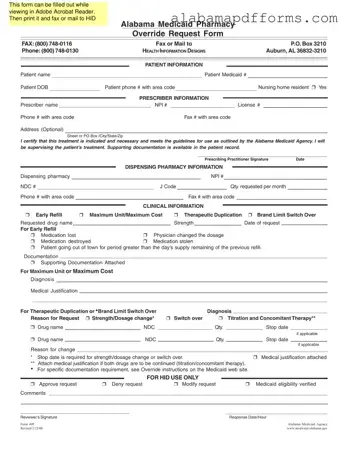

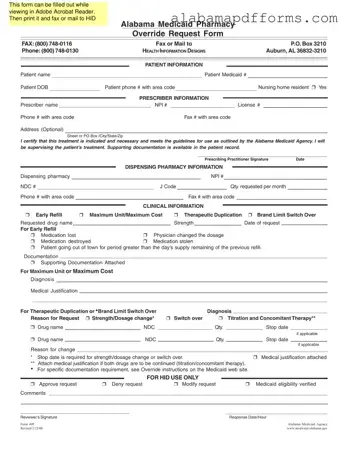

The Alabama 409 form is a request form used for obtaining pharmacy overrides within the Alabama Medicaid system. This form allows healthcare providers to submit necessary information to ensure patients receive the medications they need. Proper completion of the form...

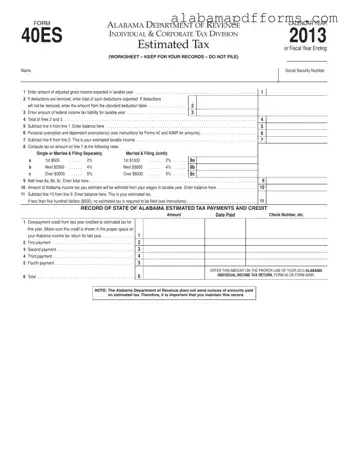

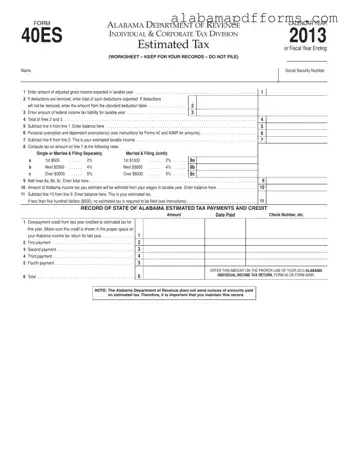

The Alabama 40ES form is a worksheet used by individuals and corporations to estimate their state income tax for the year. This form helps taxpayers calculate their expected tax liability and determine if they need to make estimated tax payments....

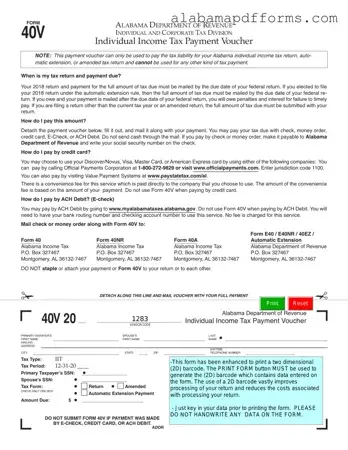

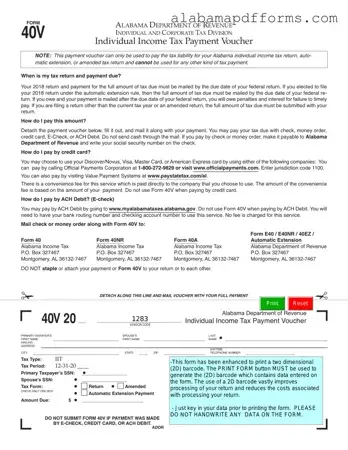

The Alabama 40V form serves as an Individual Income Tax Payment Voucher specifically designed for taxpayers in Alabama. This form is essential for submitting tax payments related to individual income tax returns, automatic extensions, or amended returns. It is important...

The Alabama 40X form serves as the state’s Individual Income Tax Return or Application for Refund. This form is essential for taxpayers who need to amend their previously filed returns or seek a refund for overpaid taxes. Understanding how to...

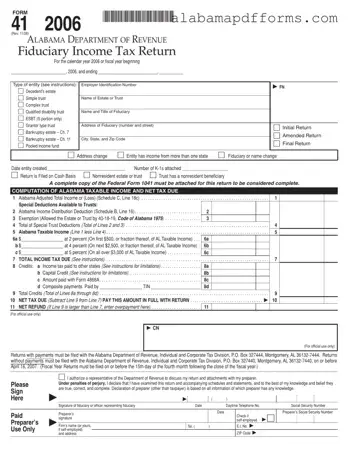

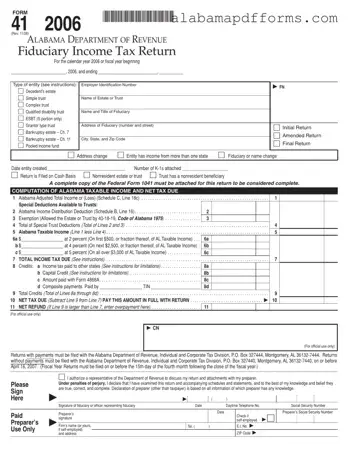

The Alabama 41 form is the Fiduciary Income Tax Return required by the Alabama Department of Revenue for estates and trusts. It is essential for reporting the income generated by these entities for the calendar year 2006 or the corresponding...

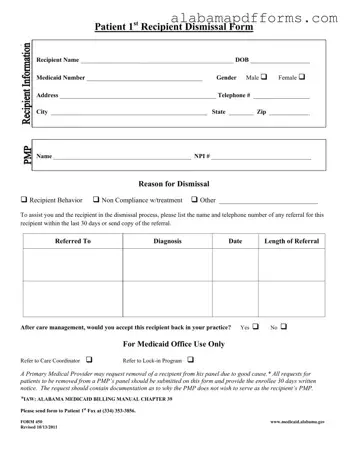

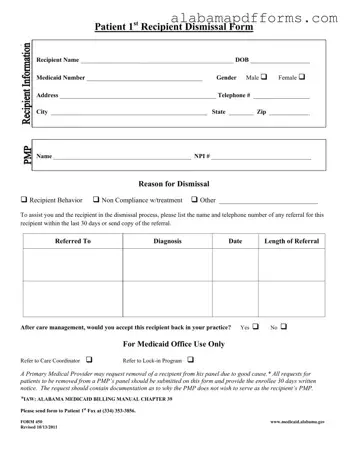

The Alabama 450 form is a Patient 1st Recipient Dismissal Form used by medical providers to request the removal of a Medicaid recipient from their practice panel. This form captures essential details about the recipient, including their name, date of...

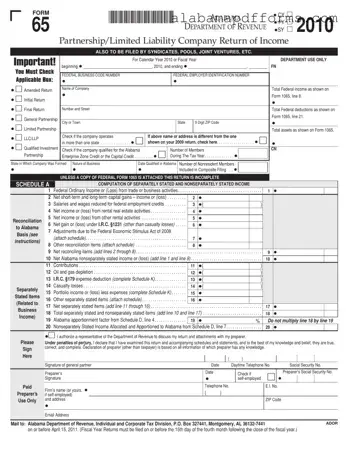

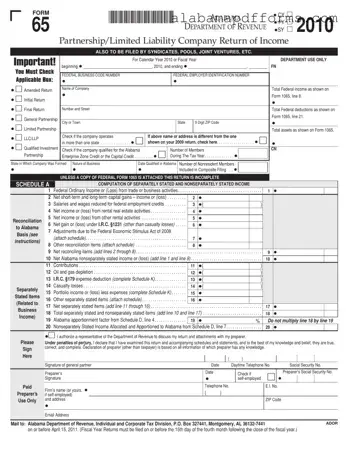

The Alabama 65 form is a tax document specifically designed for partnerships and limited liability companies (LLCs) to report their income to the Alabama Department of Revenue. This form must also be filed by syndicates, pools, joint ventures, and other...

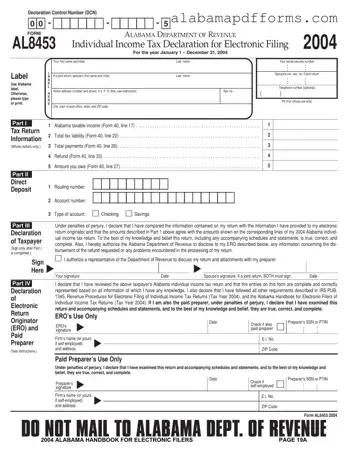

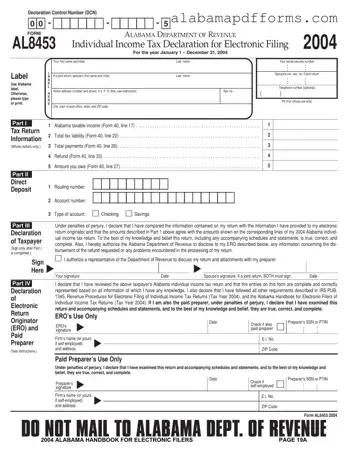

The Alabama 8453 form is a declaration used for electronic filing of individual income tax returns in Alabama. This form ensures that taxpayers confirm the accuracy of their tax return information before submission. By signing the Alabama 8453, individuals authorize...

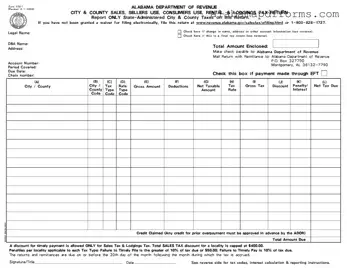

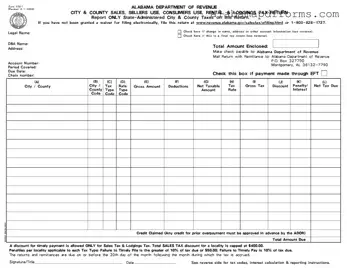

The Alabama 9501 form is a tax return document used to report state-administered city and county sales, sellers use, consumers use, rental, and lodgings taxes. This form is essential for businesses operating in Alabama to ensure compliance with local tax...

The Alabama 96 form is a document used to summarize annual information returns for the Alabama Department of Revenue. This form is essential for individuals and entities making payments of $1,500 or more to taxpayers subject to Alabama income tax....