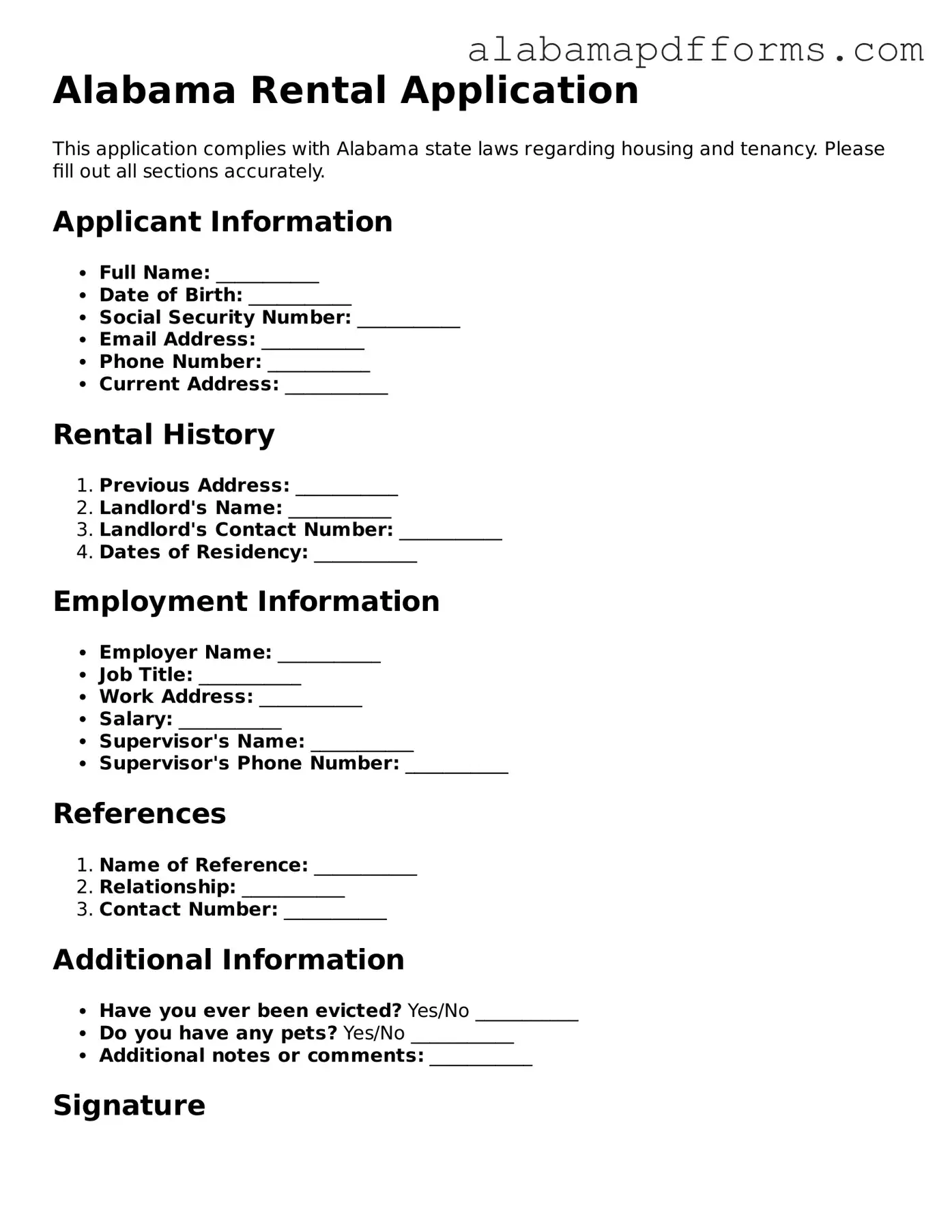

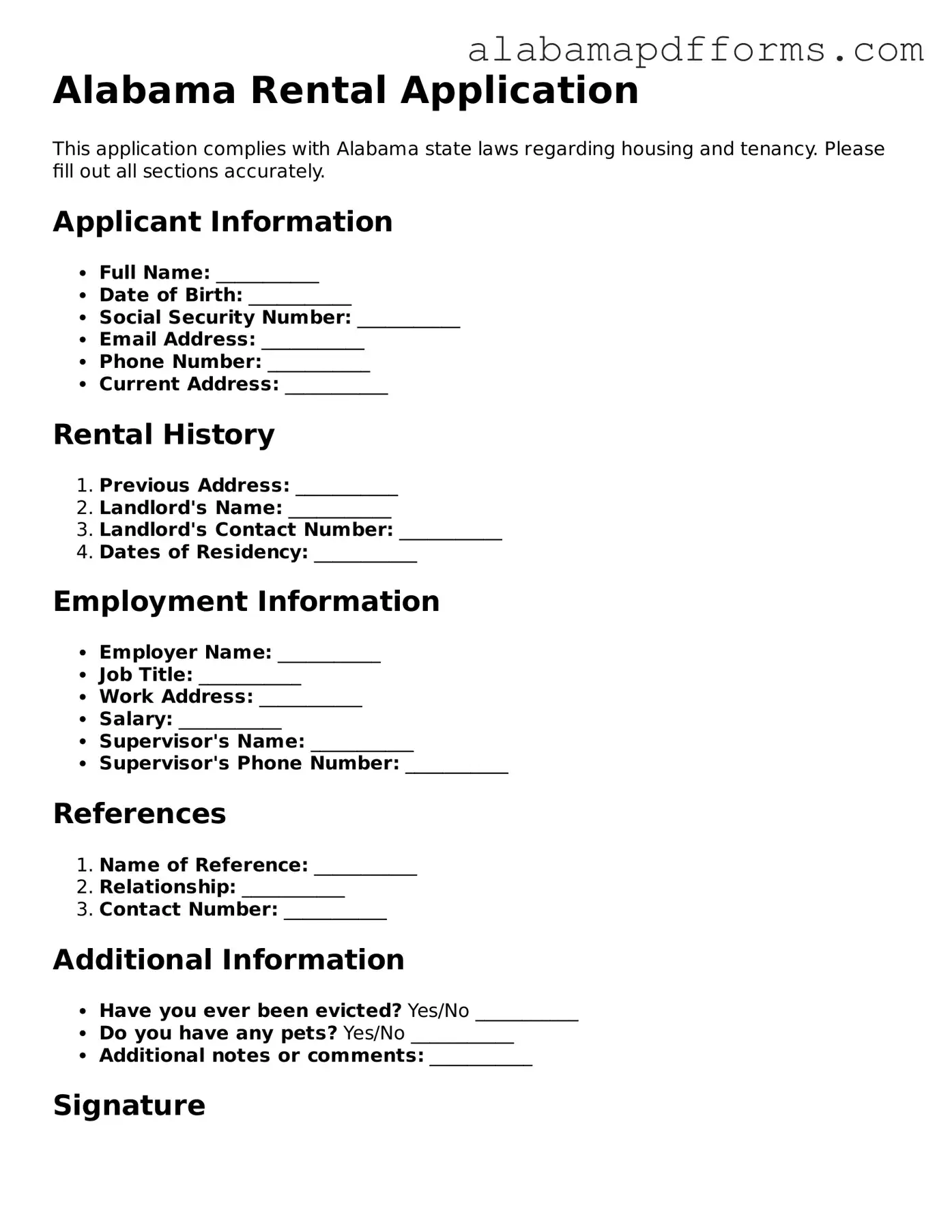

The Alabama Rental Application form shares similarities with the Tenant Screening Form, which landlords often use to assess potential renters. Both documents collect essential information about the applicant, including personal details, rental history, and employment verification. The Tenant Screening Form may also request consent for background checks, similar to the Alabama Rental Application, ensuring that landlords can make informed decisions based on the applicant's reliability and suitability as a tenant.

Another document comparable to the Alabama Rental Application is the Lease Application. This form typically serves a dual purpose: it gathers information necessary for screening and may also outline the terms of the lease agreement. Like the rental application, the Lease Application requires personal details and references, allowing landlords to evaluate the applicant's financial stability and past rental behavior before entering into a formal lease.

The Rental History Verification Form is also akin to the Alabama Rental Application. This document specifically focuses on a tenant's previous rental experiences. It often includes questions about prior landlords, payment history, and any issues that may have arisen during the tenancy. While the Rental History Verification Form is usually filled out by the landlord, it complements the rental application by providing a deeper insight into the applicant's past behaviors as a tenant.

In the landscape of rental documentation, the ADP Pay Stub form is vital, especially for employees who may need to show proof of income when applying for housing. Just like the Alabama Rental Application form, which gathers crucial information for tenant screening, the pay stub provides essential details about one’s financial status. For those interested in templates for such forms, Formaid Org offers valuable resources to streamline the process.

The Employment Verification Form is another related document. This form is used to confirm the applicant's employment status and income level. It typically requires the applicant's employer to provide details about their job title, salary, and duration of employment. Like the Alabama Rental Application, this form aims to ensure that the applicant has the financial means to meet rental obligations, thus helping landlords assess the risk of potential defaults.

The Guarantor Application is similar in purpose to the Alabama Rental Application but is specifically designed for applicants who may need a co-signer or guarantor. This document collects information about the guarantor's financial situation and willingness to take on responsibility for the lease should the primary applicant default. Both forms aim to provide landlords with a comprehensive view of financial reliability, though the Guarantor Application focuses on the additional layer of security offered by a co-signer.

Finally, the Background Check Authorization Form is closely related to the Alabama Rental Application. This document is often included as part of the application process and allows landlords to conduct background checks on potential tenants. It typically requires the applicant's signature to authorize the release of their credit history, criminal background, and other pertinent information. This form complements the rental application by providing landlords with crucial data that can influence their decision-making process regarding tenant selection.