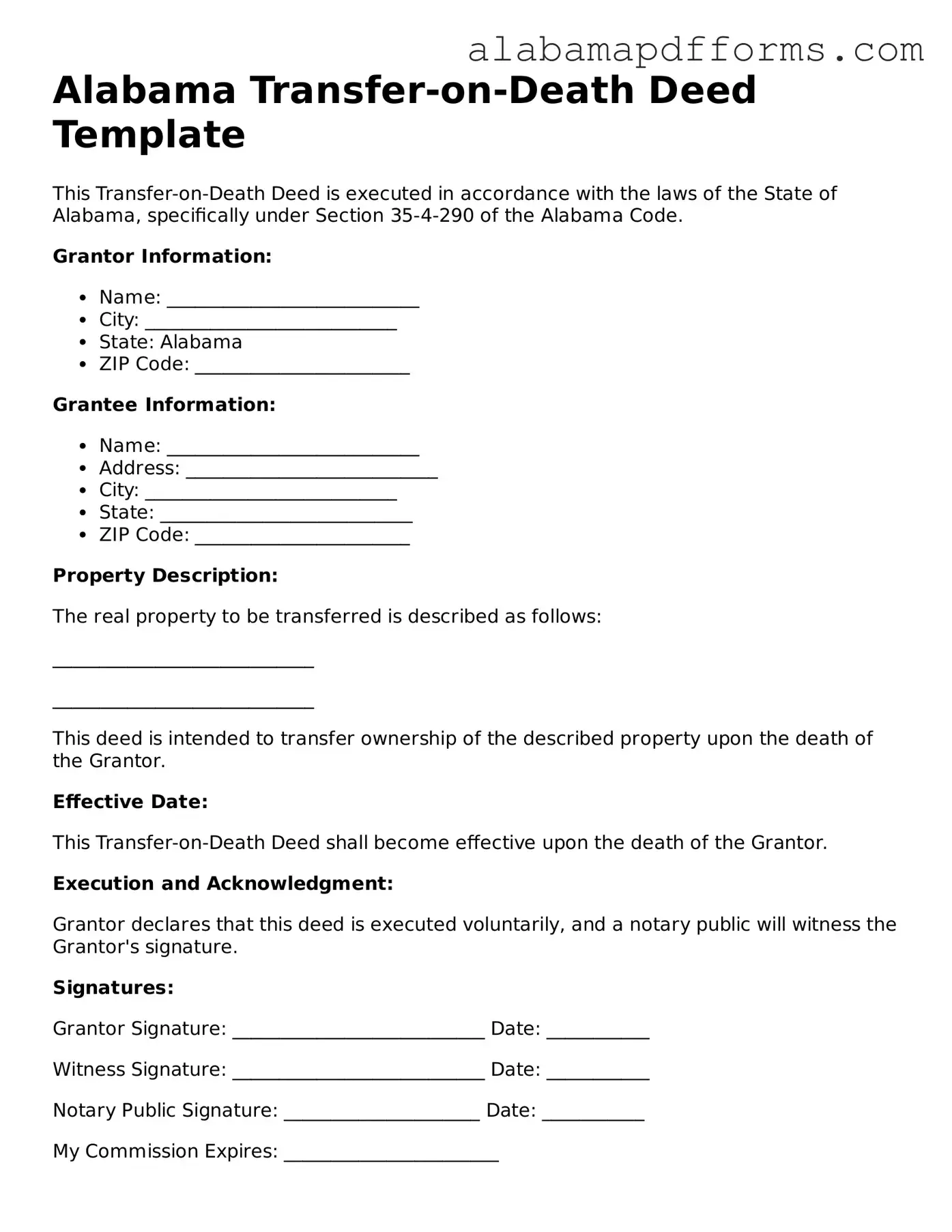

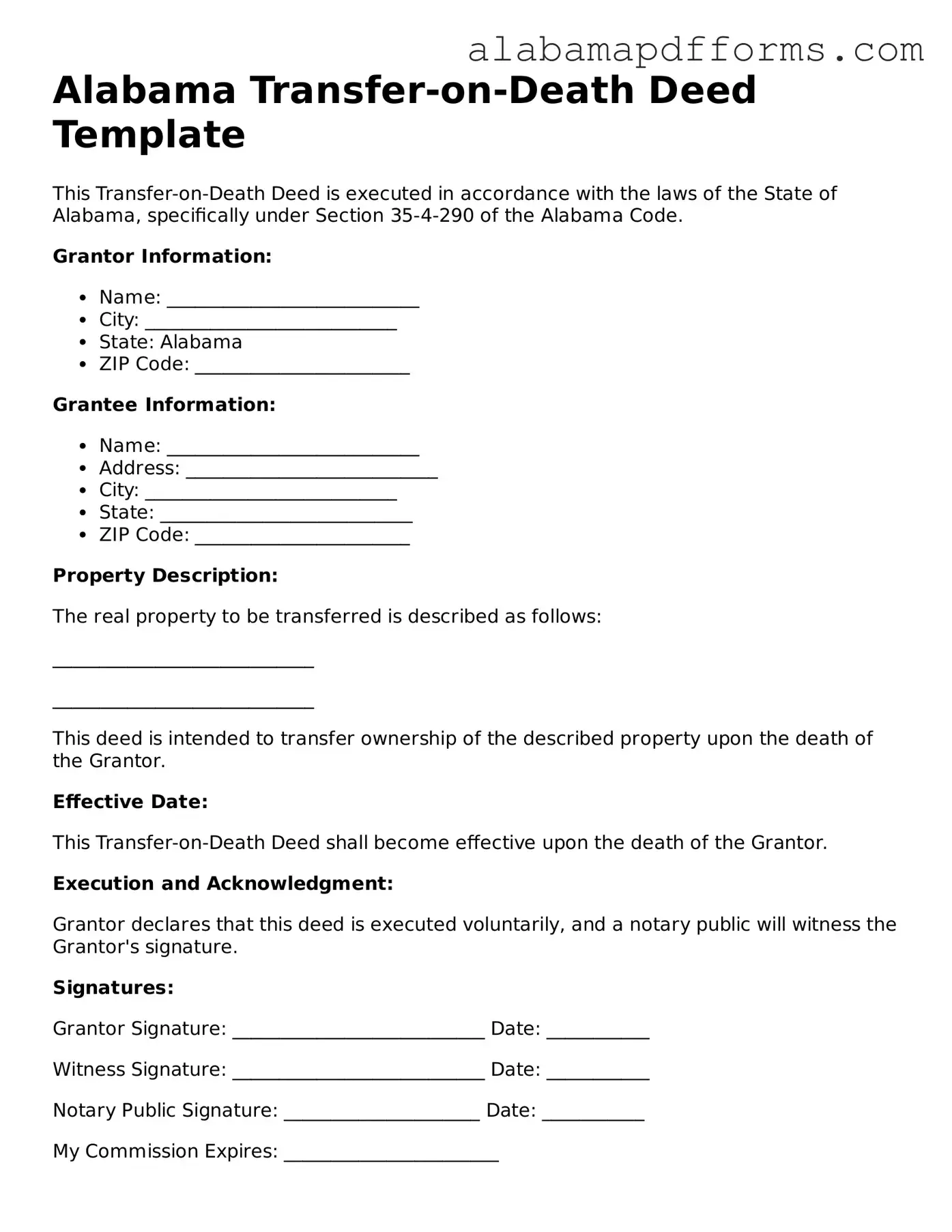

Legal Transfer-on-Death Deed Document for the State of Alabama

The Alabama Transfer-on-Death Deed form allows property owners to transfer real estate to designated beneficiaries upon their death without the need for probate. This legal instrument simplifies the transfer process, ensuring that assets pass directly to heirs. Understanding its implications and requirements is essential for effective estate planning in Alabama.

Fill Out Your Document Online

Legal Transfer-on-Death Deed Document for the State of Alabama

Fill Out Your Document Online

Fill Out Your Document Online

or

➤ Transfer-on-Death Deed PDF Form

Your form is halfway done

Complete and edit Transfer-on-Death Deed online in minutes, hassle-free.